MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This card keeps getting better and better.

The Barclaycard AAdvantage Aviator Red World Elite MasterCard has increased its sign up bonus from 50,000 American Airlines miles to 60,000 American Airlines miles and has no minimum spending requirement. It started with a bonus of just 40k back when I signed up for it. In June the bonus rose to 50k, and now it’s at a whopping 60k for putting just one purchase on the card!

You’ll receive the bonus after buying one thing with your card (of any value) and paying the annual fee of $95.

That means you’d effectively be paying $95 (or .15 cents a mile) and a hard credit pull for 60,000 American Airlines miles.

Quick Facts

- Sign Up Bonus: 60,000 American Airlines miles after your first purchase

- Category Bonus: 2 American Airlines miles for every dollar spent on American Airlines purchases

- First checked bag is free on domestic American Airlines flights for the cardholder and four others on the same reservation

- Preferred Boarding on American Airlines flights

- 25% off of in-flight food, beverages, and headsets purchased on the card

- 10% rebate of redeemed American Airlines miles (maximum of 10,000 miles returned each calendar year)

- $100 American Airlines Flight Discount each year that you spend $30k on the card

- Access to American Airlines’s Reduced Mileage Awards

- No foreign transaction fees

- Annual fee: $95, not waived the first year

You can read a full breakdown of the benefits here.

Getting Real About AAdvantage

American Airlines have a nasty reputation for lack of SAAver Level award space on American Airlines, and for good reason. Beware that you probably won’t find tons of options on the exact dates you want to travel when redeeming AAdvantage miles on American Airlines flights, especially domestically. That doesn’t, however, mean they’re useless. American has tons of partners you can redeem their miles on–anyone in the oneworld alliance–and even valuable non-allied partners like Etihad.

I myself have a healthy balance of American Airlines miles (I do actually put my money where my mouth is) and find them useful for travel between the United States and South America, as well as occasionally within South America on LATAM flights.

Whenever American Airlines Business Class award space opens up to popular destinations like Europe we try to cover it as quickly as possible here on the blog, so keep an eye out for notice.

What You Can Do with the 60k Sign Up Bonus

- Fly one way to or from Europe in American Airlines Business Class for 57,500 miles + taxes only (if you redeem on British Airways you’ll incur high fuel surcharges, stick to AA)

- Fly one way to or from Southern South America (Brazil, Argentina, Uruguay, Chile, Paraguay) for 57,500 miles + taxes only

- Fly one way to or from Asia 1 in Japan Airlines Business Class (Japan, South Korea) for 60,000 miles + taxes only

- Fly roundtrip in American Airlines or LATAM Business Class for 60,000 + taxes only

- There are many sweet spots awards that don’t touch the United States on American’s chart flying premium partner products like Etihad, JAL, Qatar, Cathay Pacific and more… read Sweet Spots on New Devalued American Airlines Award Chart to learn more.

Think you already have this card?

Typically with cards issued by Barclaycard, you can’t have two of the same card open at the same time. Note that this AAdvantage Aviator Red World Elite MasterCard is a separate product from the AAdvantage Aviator Red MasterCard, also issued by Barclaycard, which is what most of you who used to have the U.S. Airways card were converted to back in early 2015. So if you have the AAdvantage Aviator Red MasterCard, you should still be eligible for the this card. I can personally attest to this fact because I still have the old Barclaycard AAdvantage Aviator Red MasterCard that was a product change from the old U.S. Airways card, and also opened and received the bonus on this new AAdvantage Aviator Red World Elite MasterCard earlier this year.

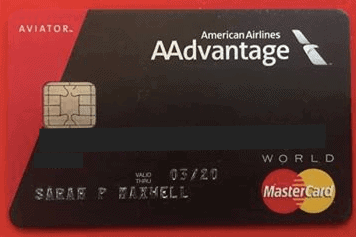

Here’s what the old product looks like…

…and here’s the new one.

Of course, this is also a separate product from the Citi / AAdvantage cards, so you can have those and this card at the same time.

Bottom Line

We value American Airlines miles at 1.5 cents, which makes a 60k bonus worth roughly $900. That is the biggest sign up bonus I’ve ever seen for the tiny effort it takes to unlock it.

It’s never wise to collect miles you don’t have a plan for since all miles depreciate over time. But if you have a trip in mind, the bonus from the AAdvantage Barclaycard is super easy to earn and burn. If you want more American miles fast and also value American elite status/lounge access, the Citi / AAdvantage Executive World Elite MasterCard is now offering a whopping 75,000 bonus American Airlines miles for spending $7,500 within three months of opening the card.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards. We do get commissions when you sign up for some cards, but not the AAdvantage Barclaycard. We just want you to be aware of the best deals.

Hat tip Frequent Miler

How many days / months you should wait between 2 barclay applications? I have applied and approved for Barclay Arrival+ about a month ago. I also have old Barclay card (AAdvantage Aviator Red MasterCard) for about 2.5 years.

Six months is the recommended wait time between Barlcaycard applications.

Sarah,

I received 40K on the Aviator card in April. Will Barclay match the new 50K offer and give me an extra 10K miles?

I’d like to know this, too.

Not sure…have read data points in both directions. Definitely worth a shot! Let us know how it goes!

NO, according to the response I got from Customer Care when asking this exact question: “We wish to kindly explain that when your account was opened you received offer to earn 40,000 bonus miles and the miles will be issued within 1 to 2 billing cycles. Although we are currently offering the 50,000 welcome bonus miles, only accounts opened on or after May 1, 2017 can be reviewed for the eligibility to receive the additional bonus miles. As your account was opened on April 5, 2017, we are unable to issue the additional welcome bonus miles and we apologize for any inconvenience this may cause.”

[…] increased from 40k to 50k!) by opening, making one purchase, and paying the $95 annual for the new Barclaycard AAdvantage Aviator Red World Elite MasterCard. It’s benefits package is very similar to the Citi / AAdvantage Platinum Select’s […]

Hi Sarah,

In a previous post I seem to remember that you or someone else mentioned that since they had the “old” card they needed to call recon and gave the reason for wanting the new card as better benefits. I have not yet closed my old AAviator (USAir) card but would like to apply for this “new” one. Any advice on “talking points” should I go to pending and have to call recon?

PS I also was approved for the Arrival + in Feb. this year. Think that this will be a problem?

Hello! To be on the conservatively safe side if you’re worried about a hard credit pull in vain, I’d wait six months from when you opened the Arrival Plus. As for talking points, whenever I’m put in that situation, I just say I want it to organize a different set of expenses. I can’t remember off the top of my head their exact benefits comparatively but yes, having a benefit handpicked from the new card’s package that the old one doesn’t have would also be smart.

I still have the old Barclay AAdvantage card and will definitely try to get this card as well. My understanding from the US Air-AA merger was basically that Citi bank “won” the right to issue the new (post-merger) AAdvantage credit cards. Am I remembering correctly that there was a period of time when Barclay didn’t have an AAdvantage credit card product, only Citi did? Did they somehow manage to renegotiate so they they could issue AAdvantage cards again? Was just curious because I thought I recalled that Barclay couldn’t issue new cards at some point…

Sarah, just out of curiosity, how many other Barclays cards did you hold when you applied for your new Aviator Red card other than your old Aviator Red card converted from the US Airways card. I was just approved for the Arrival + card for the second time (closed the first one two years ago) June 1st. Some people say two Barclays cards are max others say three max. So this question is similar to Jaz’s question. The original Aviator card has $27,500 credit limit. Would you just cancel the card or just reduce credit limit?

I had an Arrival + and the old converted Aviator Red card. If I was in your shoes though and had had another Arrival+ open previously, I think I would have canceled my old Aviator Red before applying for the new Aviator.

Looks like I missed out on the chance to get the second card since I’ve now been “upgraded” to the new card automatically.

“We’ve upgraded your AAdvantage® Aviator™ Mastercard® to the AAdvantage® Aviator™ Red World Elite MasterCard®, with added benefits you’re sure to like.”

How long to wait after closing Barclays Arrival Plus before applying? 800+ credit score but churned all last year. no new cards pulled last 3 months. Consistently used Arrival+ for 10 months that I had it

I have the RED Aviator card converted from the US Airways master card. I think I have this card for 4-5 years now (including the US Airways years).

However, my RED Aviator card looks exactly like the one you showed above “new” card look.

Mine doesn’t look like the “old” you showed.

They Barclay upgraded again?

Will I still be eligible for this new card bonus??

Thank you

[…] The sign-up bonus on the Barclay Aviator Red has been increased to 60,000 American Airlines miles. The minimum spend requirement is one purchase of any amount! The card does come with a $95 annual fee NOT waived the first year. If you have the Aviator Red that was transmuted from the old U.S. Airways card, you are still eligible for this bonus since it’s considered a different product. For more details, check out MileValue’s report on the bonus increase here. […]

[…] The Barclaycard AAdvantage Aviator Red World Elite Mastercard offers 60,000 bonus American Airlines miles after making just one purchases and paying the annual fee of $95 within the first 3 months of opening the card. Read more about it here. […]

My wife and I sent Barclay a note asking if our account could be upgraded to the 60K offer. We are approved for the cards, but have not received them even though they show on the account page. Barclay said they would forward our claim for this to an appropriate office and would let us know in 7-10 days.

Bryon

Call double check MAKE sure it’s in their data (notes) .Got Citi P card for 50K then 3 weeks later they upped it to 75K CALLED got the 75K offer upgrade . Got the Aviator card last nite TEN MINUTES LATER it was with my 2 other cards online . Wait the 10 days but stay on top of this it is $$$$$$$$$$$$$$$$$$$$..

CHEERs

Looking for data points on how long did it take for bonus miles to post for people who had or currently have the “old” Aviator card(US Air conversion) and applied for the “new” card. Language in the terms does say something like 6-8 weeks. My son applied for the new card in June, paid the yearly fee and made several purchases but hasn’t seen any bonus miles yet. My previous experience with other Barclay cards was that the miles posted almost immediately. Hoping to hear back from others before the other family members (4 of us) apply for the “new” card, pay the fees and then might not get the bonuses!

I bet (CALL) it’s the next statement after he pays the $95 but i will find out .They must b insane like most banks to have an offer like this . This is my 3rd card over 3 years never spent any money and they gave me another ????????????

CHEERs

Update: bonus posted 2 days after the second statement. His old Aviator card was already closed. Now going to apply for myself (old aviator card still open) and hope that it works.