MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Huge Hat Tip to reader Daniel for emailing me about this deal. Email me your tips!

Today the AAdvantage eShopping portal tripled the earning rate on magazines.com to 60 American Airlines miles per dollar through November 30, 2013.

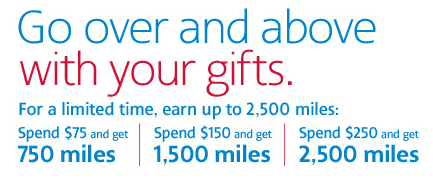

Stacked with the ongoing promotion that is awarding up to 2,500 miles for $250 in purchases through the portal (and fewer bonus miles for smaller purchases), you can buy up to 17,500 American Airlines miles for 1.43 cents each until the magazines.com promotion ends. And you even get some magazines thrown in for free. 😉

Stacked with the ongoing promotion that is awarding up to 2,500 miles for $250 in purchases through the portal (and fewer bonus miles for smaller purchases), you can buy up to 17,500 American Airlines miles for 1.43 cents each until the magazines.com promotion ends. And you even get some magazines thrown in for free. 😉

If you actually want a magazine subscription than the cost of “buying” miles through the AA portal is even lower.

If you actually want a magazine subscription than the cost of “buying” miles through the AA portal is even lower.

What is the lowest price you can buy miles from the American Airlines portal for? Should you buy miles speculatively?

To figure out the price at which you are buying miles, subtract the value you place on the magazine from its subscription price.

For instance 28 issues of Sports Illustrated is $26. If you would value those 28 issues at $10, then we’ll imagine that you are paying $10 for the magazines and $16 for the miles.

Divide the extra amount you are paying above what you value the magazine by the miles you will earn to get the price you are paying for the miles.

In this case $26 * 60 miles is 1,560 miles earned from Sports Illustrated at a cost of $16, or 1.03 cents per mile.

The lowest cents per mile will be achieved if you spend $75, $150, or $250 to unlock the next tier of bonus from the tiered promotion.

Buying any of those amounts from magazines.com through the AA portal will result in manufacturing miles for 1.43 cents even if you value the magazines at zero. Buying $250 will earn 15,000 miles at the 60 miles/$ rate plus 2,500 bonus miles from the tiered promotion. That means 17,500 miles can be had for $250.

Buy Speculatively?

I would not buy American Airlines miles right now for 1.43 cents without an award in mind that I was nearly ready to book.

I expect a devaluation is the next few months during the American Airlines/US Airways merger, so I am not interested in buying either type of miles speculatively.

Getting Your Miles

If you go through with this deal at the AAdvantage eShopping portal, make sure you read Frequent Miler’s “How to ensure your portal points” post to make sure you get the miles to which you are entitled.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Donate the mag subscriptions to charity and deduct.

[…] 60 Miles per Dollar at magazines.com: How to Buy American Airlines Miles for 1.43 Cents or Less Unti… […]

“Today the AAdvantage eShopping portal tripled the earning rate on magazines.com to 60 American Airlines miles per dollar through November 20, 2013.”

Should say November 30, 2013. You do have it correct in the title though 😀

Thanks