MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The current public sign-up bonus offers for the Cit AAdvantage Platinum Select Mastercard, CitiBusiness AAdvantage Platinum Select Mastercard, and the Citi ThankYou Premier Mastercard are 30k, 30k, and 0 (no bonus) respectively.

But you can do much better.

The following links have surfaced with much higher sign-up bonus offers:

- Citi® / AAdvantage® Platinum Select® World MasterCard®

- CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®

- Citi ThankYou® Premier MasterCard®

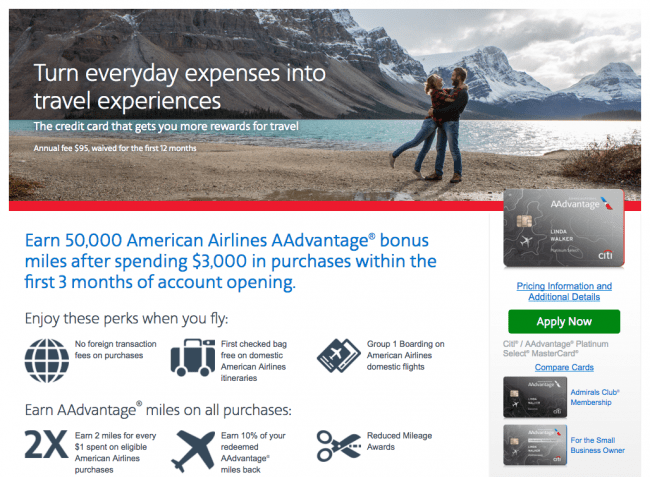

Citi® / AAdvantage® Platinum Select® World MasterCard®

This card’s public sign-up offer is 30,000 American Airlines miles for spending $1,000 within three months of opening the account. This link will take you to a secure application that offers:

- 50,000 American Airlines miles after spending $3,000 within three months of opening the account

- First checked bag free and Group 1 Boarding on domestic American Airlines itineraries

- 2 miles for every $1 spent on eligible American Airlines purchases

- 10% rebate on your redeemed AAdvantage®miles

- Reduced Mileage Awards

- No foreign transaction fees

I value American Airlines miles at 1.8 cents each, so this alternative offer is worth $360 more to me.

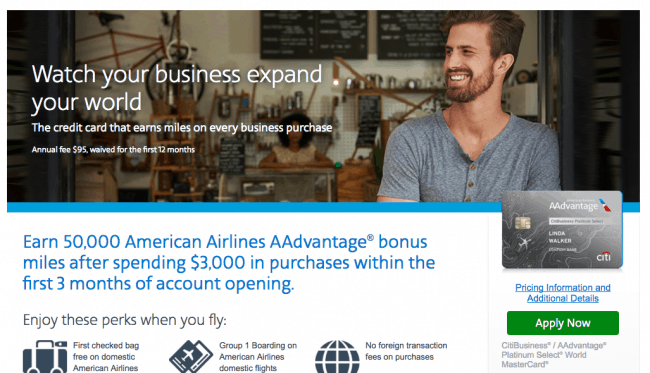

CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®

This card’s public sign-up offer is 30,000 American Airlines miles for spending $1,000 within three months of opening the account. This link will take you to a secure application that offers:

- 50,000 American Airlines miles after spending $3,000 within three months of opening the account

- First checked bag free and Group 1 Boarding on domestic American Airlines itineraries

- 2 miles for every $1 spent on eligible American Airlines purchases

- 2 miles for every $1 spent on select business categories including gas stations

- No foreign transaction fees

I value American Airlines miles at 1.8 cents each, so this alternative offer is worth $360 more to me.

Citi ThankYou® Premier MasterCard®

This card’s public sign-up offer does not include any bonus ThankYou Points whatsoever. That part of the offer was taken away in April of this year, so this non-public link is an especially good find*. This link will take you to a secure application that offers:

- 40,000 ThankYou Points after spending $3,000 within three months of opening the account

- Category Bonuses

- 3x on Travel (gas, airfare, hotels, and travel agencies)

- 2x on Dining and Entertainment

- No foreign transaction fees

I value ThankYou Points at 1.9 cents each, so this alternate offer is worth $760 more to me. This card is one the best cards to pay for airfare with as it earns 3 ThankYou Points per dollar spent on travel.

Bottom Line

If you’ve been thinking about signing up for any of these cards, don’t settle for their public offers. You can reap more American Airlines miles/ThankYou Points by signing up via these links:

In the past, the TYPremier has had a 50k offer, no? I know it’s no longer available. But if you’re prioritizing your apps, it’s good to know what they’ve previously offered because it means there is a decent chance that it goes back up in the future.

Yes. It had a 50k offer recently and was pulled completely in April.

Citi says that you can’t have the AA bonus miles if you had a AA card in the last 24 months. Does that include the Citi AA Executive card as well or having an Executive card doesn’t restrict getting the AA bonus from the Platinum card?

Executive and Platinum cards don’t affect each other. The prohibition is on getting the same card over and over.

the link to the 50k AA Business doesnt have any wording of 50k at all, its just an application. Are you sure its

50k in bonus pts ?

Yes. This primary landing page where you can click to “apply now” (which leads you to the secure application link in this post) says very clearly that you earn 50k AA miles after spending $3,000 in three months.

Sweet, thanks! Any guess how long these offers will last?

Guesses: near constant AA & AA biz 50k offers for foreseeable future, Citi TY Premier at 40k-50k for foreseeable future

Thank you so much for this. We hadn’t gotten the business card and now find ourselves needing multiple flights from Little Rock to Dallas for treatments for our son’s seizure disorder. This will make those much more affordable. Thank you.

That’s probably better flown with British Airways Avios.

Same deal here for applying for the citi cards…? Can apply for one, then wait 8 days before applying for the second card, and finally having to wait 65+ days to apply for the third card? Thanks for your help and great info!

Always the same deal applying for Citi cards