MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

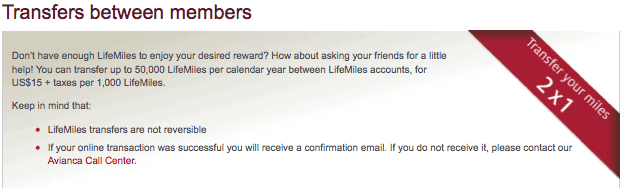

Avianca/TACA LifeMiles, a member of the Star Alliance, is offering a 100% bonus on miles transferred between accounts through March 17, 2014.

During the promotion, the cost to transfer each mile is 1.5 cents. For every mile taken out of your account, the transferee receives 2 miles.

Example:

- I pay $150 to transfer 10k miles to my friend.

- My account loses 10k miles. His account gains 20k miles.

- The net gain of 10k miles cost $150 or 1.5 cents per mile.

Is it a good deal? Should you transfer LifeMiles? Why should everyone pay attention to LifeMiles?

Transfers must be made in 1k mile increments between 1k and 50k miles. Fifty thousand miles is also the yearly limit to transfer.

LifeMiles runs a 100% bonus on purchased miles about every other month, which also results in the chance to buy miles for 1.5 cents.

LifeMiles awards never have any fuel surcharges, one way awards cost half the price of roundtrips, and they have access to all the same Star Alliance award space that United does.

LifeMiles also has mis-coded a few airports, so that it prices them as being in the wrong region. I wrote about one such mistake in $200 Flight to Japan with Hidden City Ticketing on LifeMiles Awards. Guam (GUM) prices as if it were part of the mainland US, which makes a ton of awards available for cheap.

The big problem with LifeMiles is the inability to redeem for mixed cabin awards, so you can’t combine domestic economy with international business.

As with most mileage purchase opportunities, my advice is do not buy LifeMiles speculatively. If you have an award that you are ready to book and award space appears at lifemiles.com, buy the miles. Otherwise wait. There are plenty of options to buy LifeMiles for 1.5 cents, and the LifeMiles program has a history of no-notice devaluations.

PS– One other option to get LifeMiles? LifeMiles Visa Signature Offers 40,000 Mile Signup Bonus

I am back in the US after enjoying Guam for a week for 25,000 Lifemiles from Miami, with a 9 hour stopover in Narita, Japan, on the way back to Houston. We had a great time and it wouldn´t had been possilbe without reading your article. Thanks a lot!

Excellent! Glad you enjoyed!