MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

For a limited time, the Citi® / AAdvantage® Platinum Select World Elite™ MasterCard® is offering 60,000 bonus American Airlines miles after spending $3,000 in the first three months. While we don’t know when exactly, according to the Points Guy, this 60k bonus is disappearing soon. 60k is as good as it gets for this card, and while it comes and goes periodically, I’d apply now if you were already interested.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Credit Cards.

In the process of reaching that minimum spending requirement you would earn:

- 60,000 miles for the bonus

- at least another 3,000 miles from the $3,000 in spending it takes to unlock the bonus (you earn 1 mile for every dollar spent on everyday purchases)

- more than 3,000 points if any of that spending is on American Airlines flights, which earns 2 miles for every dollar spent

The card offers other benefits as well, including a free checked bag for you and up to four others on your domestic American Airlines itinerary, and 10% of your redeemed American miles back — up to 10,000 miles each calendar year.

63,000 American Airlines miles is a pretty big stash that you can do a lot of cool things with. Listed below are different ideas for how you could use them.

Awards Originating in the United States

1. Fly two roundtrips between the United States and Mexico, Caribbean, or Central America during the time window of April 27 to May 20 or September 7 to November 14 (Off Peak dates).

How many miles you’ll have leftover: 13k (18k after your 10% rebate on redeemed AAdvantage miles)

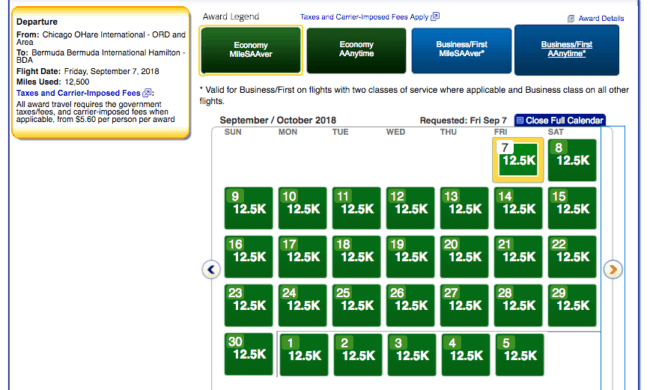

It costs 12,500 American Airlines miles to fly one way between the United States and Mexico, Caribbean, or Central America during Off Peak season. Note that this price applies only to American Airlines flights.

Award space for two travelers is wide open from Chicago to Bermuda this September and October.

2. Fly roundtrip in Business Class to Northern South America.

How many miles you’ll have leftover: 3k (9k after your 10% rebate on redeemed AAdvantage miles)

It costs 60k American Airlines miles to fly roundtrip to Northern South America in Business Class.

American Airlines’ definition of Northern South America, interestingly enough, also includes Manaus, Brazil.

Manaus is the jumping off point for people who want to explore the Brazilian Amazon, so consider that if it’s on your bucket list.

3. Fly roundtrip to Europe.

How many miles you’ll have leftover: 3k (9k after your 10% rebate on redeemed AAdvantage miles)

A roundtrip for one person in economy to Europe costs 60k American Airlines miles.

If you can travel during the Off Peak season (January 10 – March 14 or November 1 – December 14) then you’ll pay only 50k miles for the roundtrip, which is a steal.

Just don’t forget to check the price of cash flights, which you can often find dirt cheap deals on to Europe. Read this post to learn who to follow on Twitter for cheap flight alerts!

4. Fly four roundtrips within the contiguous 48 states and Canada.

How many miles you’ll have left over: 3k (9k after your 10% rebate on redeemed AAdvantage miles)

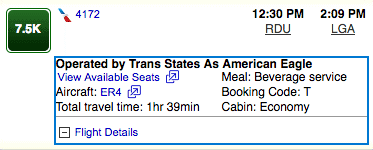

Just make sure the flights are direct and don’t exceed 500 miles each direction, like this 426 mile flight between Raleigh and New York City:

American Airlines now offers a lower award price for direct economy flights that are equal to or less than 500 miles in distance and within the contiguous 48 states and Canada– only 7,500 miles.

The Points Guy wrote an excellent post about the best routes for AA’s New 7,500-Mile Award Level.

5. Fly to Japan in flat bed Business Class on Japan Airlines.

How many miles you’ll have leftover: 3k (9k after your 10% rebate on redeemed AAdvantage miles)

Japan Airlines (JAL) is known for having superb premium products.

For the Business Class flight to Japan, try for one of its newer Dreamliners that feature flat beds in Business Class.

The plane is a new Dreamliner if “SS8″ appears on the search results for the flight on jal.com. SS8 means the new flat beds are installed.

6. Fly to Europe in flat bed American Airlines Business Class.

How many miles you’ll have left over: 5,500 (11,250 after your 10% rebate on redeemed AAdvantage miles)

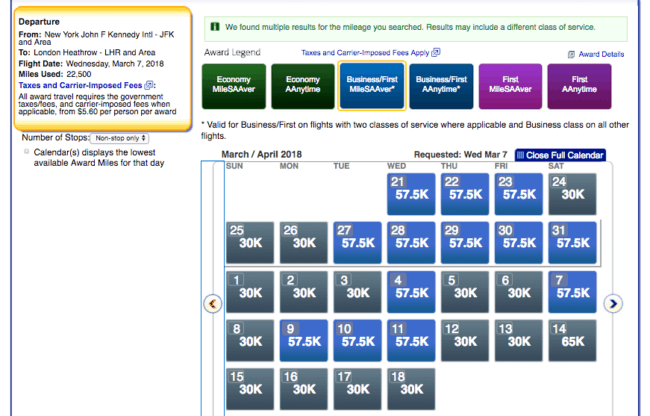

It costs 57,500 American Airlines to fly one way in Business Class to Europe. On January 24th I wrote about a batch of newly released AAdvantage Business Class award space to Europe. It has been picked over since that post, but you can still find lots of seats for a solo traveler.

Above is the calendar for one traveler between New York and London (direct).

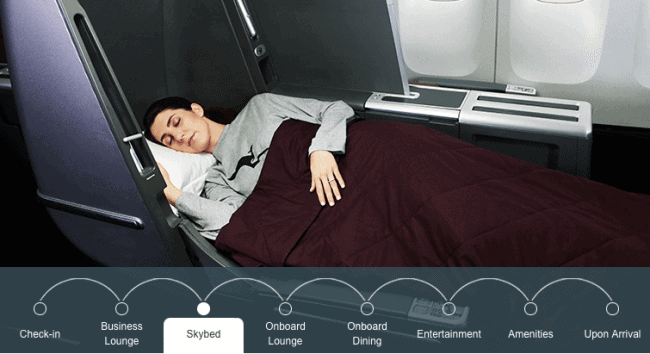

7. Fly to Australia in flat bed Qantas Business Class (almost).

You’ll need to earn 17k extra miles to make this happen since it costs 80k one way in Business Class to the Australia.

Qantas Business Class on the A380 feature flat beds and onboard lounge to hang out in.

Awards That Originate Outside the United States

Think outside the box! Not all awards have to originate in the United States. Use the 65,000 miles from your sign-up bonus to fill in the gaps on your next Around the World trip.

8. Fly from the Middle East to Southeast Asia in Qatar A380 Business or First Class.

How many miles you’ll have left over: 23k if you fly Business , 13k if you fly First Class (27k / 18k after your 10% rebate on redeemed AAdvantage miles)

It costs 40k miles to fly flat bed Qatar Business Class between the Middle East and Southeast Asia, or 50k miles to fly Qatar First Class.

9. Fly Etihad First Class between Europe and the Middle East, Indian Subcontinent, or Maldives.

How many miles you’ll have left over: 500 (6,750 after your 10% rebate on redeemed AAdvantage miles)

It costs 62,500 miles to fly First Class between Europe and the Middle East, Indian Subcontinent, or Maldives.

Etihad First Class on its newest A380 has a couch that seats several people and a separate bed.

Etihad’s fully enclosed suites are the most spacious in the sky, and there’s a shower onboard that you can use in flight.

First Class Award space is generally plentiful on the A380 between London and Abu Dhabi throughout the year.

10. Fly Qantas First Class between London and Dubai.

How many miles you’ll have left over: 500 (6,750 after your 10% rebate on redeemed AAdvantage miles)

It costs 62,500 miles to fly First Class between London and Dubai.

Qantas’ international First Class on the A380 looks fantastic, with fully flat bed and dining space for two at each seat.

11. Fly two people in Business Class from Northern South America to Southern South America.

How many miles you’ll have leftover: 13k (18k after your 10% rebate on redeemed AAdvantage miles)

It costs 50k miles to fly two people one way between Northern and Southern South America in Business Class. Include this award on your next big trip! Email me when you get to Buenos Aires and we can go for a glass of wine.

Bottom Line

For a limited time that appears to be ending soon, the Citi® / AAdvantage® Platinum Select World Elite™ MasterCard® is offering 60,000 bonus American Airlines miles after spending $3,000 in the first three months.

By meeting the $3,000 total spending requirement you’ll earn at least 63,000 American Airlines miles, which you can redeem on a plethora of awesome awards.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Credit Cards.

Another nice compilation. I particularly like the “almost” in number 7. Good for a laugh.

Out of curiosity, why are comments blocked from my pc? I certainly don’t think I’ve ever been profane, and while I may have asked travel questions that were at times uncomfortable to answer, overall I’ve been more toward fawning than disrespectful.

I read the “almost” to mean almost enough miles. But agree the real issue with #7 is the lack of QF J seats SYD-LAX ever being available for AA folks to book even at the 331 day mark. Did see one F seat one day but it was likely not real.

There is a problem with the above information. While you can theoretically use miles to fly business on Qantas. Good luck with that! That is one of the most difficult miles tickets. I suppose they may have some availability out of SFO, but I haven’t seen any from DFW.

[…] By meeting the $5,000 total spending requirement you’ll earn at least 65,000 American Airlines miles. Read about 11 cool things you can do with that sign-up bonus here. […]

Good Post ur still alive which is Good and is better for u ..Got my Marriott 80K points card by Chase today and will B 90K for my trip to KONA for the Marriott King Kam Resort in 2/1/19 ….

CHEERS

The problem I see with this is you have to return home from the trip. You are showing one way fares!

The first four suggestions are for roundtrips. Some awards suggested (that don’t touch the US) are ideas for a portion of a longer, round-the-world trip. The one way suggestions assume that you have either a) more AA miles, or b) another type of point or mile you can use for the return.

I have the impression that the personal AA card is not “the same type” as the AA Business card. In other words, I have two independent counters of 24 months from the last open/close, one for the personal side and another for the business side. Is this correct?

I am out of 24 months for the AA Business card, but am within 24 months for the personal AA. So I applied the business one and got approved. Before I start the spending, I secure-messaged them to confirm my eligibility of 60K sign up bonus. To my surprise, this Citi customer service representative said I am not eligible because of my personal side. I hope she is wrong (and the computer system will award me the 60K eventually). What’s your understanding? Thanks!

That is correct. It is my understanding that personal cards and business cards are separate for the purpose of that Citi rule.

I think the rep you spoke to is incorrect. I would try calling again. If they push back, read them the terms from the CitiBusiness Platinum Select application: “This card is not available if the business already has a CitiBusiness® / AAdvantage® Platinum Select® World Mastercard® card. Bonus miles are not available if you have had any CitiBusiness® / AAdvantage® card opened or closed in the past 24 months.” It specifically refers to the CitiBusiness card negating your eligibility for another bonus. Not the personal card.

Let me know how it goes!

hi Sarah, I called Citi. This time the rep told something that is even more horrible. She said that I am not eligible for the 60K bonus if I opened or closed *ANY* AA card, Citi or other bank, in the last 24 months. She further said this is imposed by AA, not Citi, and politely offered to transfer me to an AA agent to discuss further. I further asked whether it was only her interpretation or if she sees something in my account saying I am not eligible. She read me a list of benefits I have (like first checked bag free…) and said the sign up bonus is not in the list. I can only think the rep does not know what she’s talking about and politely hung up. However through the secured message and this phone call, they both said I am not eligible. I am really hesitating on whether I should go ahead and spend $3K now. (The T&C you quoted contains a slash “/”, which I guess could be interpreted as *ANY* AAdvantage card…)

That is super odd to me. I’m going to look into this more but I haven’t seen any other data points with similar experiences. I 100% understand why you’re hesitating to put $3k spend on the card, I would be confused too. It just goes against everything I know. If I discover anything in my research I’ll let you know.

While both reps said I am not eligible, one good sign from the conversation is that their reasons for my ineligibility are different. Hopefully this means they both don’t really know what they were talking about. While hesitating, I have 3 months to decide what to do. Thanks for all your info and feedback. I’ll keep you posted if I find out anything.

wondering if there is any 5/24 rule for citi since I have various cards of theirs?Also when I shed cards, is there backlash on credit report/score ? thnks!

No, no 5/24 rule for Citi cards, however you are only eligible to earn a sign up bonus if you haven’t opened or closed a card from the same type (brand or co-brand) within the last 24 months. Read that linked post to learn more.

Even when you close a card, it typically stays on your credit report for ~10 years before dropping.

Re: #11 – How exactly are you supposed to use AA miles on Avianca? They aren’t oneworld, and they aren’t listed as an other airline partner.

Blooper! Edited.

We used this bonus last year to fly to two to one of American’s Reduced Mileage Awards Destinations, Monterey, California, and enjoy a week-long couples’ trip exploring the northern California coast from Big Sur to Carmel to San Francisco.

Sounds like a dream!

This is slightly off this page’s topic. I found some CX and JL award availabilities, and wanted to use AA miles to ticket them. However AA reps cannot see them. I then checked qantas.com and the availabilities look real (i.e., not phantom). I called back with 3 other AA reps and they all cannot see the availabilities. Any suggestion?

Sorry I may not have been clear on my question. The way I first found the CX and JL award availabilities is from ba.com, then confirmed from qantas.com. However AA phone reps don’t see the availabilities…

Whenever I have award space that the US AAdvantage office agents can’t see, I try the Australia AAdvantage office instead. That team is typically better at finding it.