MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Marriott recently announced a lot of big changes for the future of their combined loyalty programs. Starwood Preferred Guest, Marriott, and Ritz-Carlton will merge into one program in August 2018.

Marriott bought SPG many months ago, creating not only the largest hotel portfolio in the world but also the fastest growing. August of this year marks the day the loyalty programs become one (i.e. using one point currency, award chart, elite qualifying system, etc). They will keep their separate names, however, until 2019 when the loyalty program will be given just one (yet to be announced) name.

In brief, this is what’s happening in August

- All SPG points will be automatically converted into Marriott Rewards at a rate of 1:3, which is the current transfer rate. Marriott points will turn into the sole currency for the whole program.

- Elite status between programs will be transitioned to a singular benefits/qualification system with five tiers: Silver, Gold, Platinum, Platinum Premier, and Platinum Premier with Ambassador service.

- Earning Points:

- The rate of points earning from stays at hotels will increase at an average of 20%.

- The rate at which you earn points from credit card spend will decrease significantly for SPG members, and increase for Marriott members.

- Redeeming Points:

- As for redemptions at all SPG, Marriott, and Ritz-Carlton family hotels, there will be one singular award chart, eventually with eight categories and three tiers within each category (standard, off-peak, and peak). Prices are going up for Marriott members and generally down for SPG members.

- As for redemptions as airline miles by transferring points to airline loyalty program parters, the transfer rate across the board will be 3 Marriott points to 1 airline mile (current transfer rate nor the current bonus structure for transferring to airline miles will change).

- Two new credit cards will be introduced: the SPG American Express Luxury Card in August, and the Chase Marriott Rewards Premier Plus Credit Card, in the beginning of May). There will also be changes to already existing SPG or Marriott cards, and the halt of new applications for various legacy cards.

Some Missing Pieces Yet to be Determined

- The name of the program for 2019 and on

- What hotels will be in what category

- The ability to book hotel award nights with a mixture of cash and points awards options will remain, but the pricing under the new singular program is not yet known

- Hotel + Air Packages. Examples should be published soon!

There is a lot of new info to cover here, so to keep it digestible, today I’m going to stick to just elite status, earning points from hotel stays, and redeeming points for hotel stays. I’ll leave earning points through credit card spend, redeeming points as airline miles, and the new credit cards hitting the market in August for the next post (Part II). Although we can all take a deep breath now that we at least know our existing SPG / Marriott points will not be devalued for transferring to airline miles, as the new unified program is pretty much keeping the old SPG’s way of doing things (and actually adding new transfer partners!)

Elite Status: Qualifying, Benefits, and How Status Will Transfer Over

As of August, the new joint program will have five elite status tiers, achieved by staying specific amounts of qualifying* nights per year (and in the case of the top tier, spending enough).

- Silver Elite – 10 to 24 nights/year

- Gold Elite – 25 to 49 nights/year

- Platinum Elite – 50 to 74 nights/year

- Platinum Premier Elite – 75 – 99 nights/year

- Platinum Premier with Ambassador service – 100+ nights a year as well as $20,000 in qualifying spend (Ambassador service is a dedicated reservation agent)

*Note a big change in what kind of nights count towards elite status, as pointed out by Marriott themselves when speaking with View from the Wing… “elite night credits are awarded for stays [only that] elites personally stay and pay for.” Under the current SPG program, you could earn elite night credits for up to three rooms you’re paying for simultaneously. In other words, if you and your family had three rooms booked for two nights, you’d get six elite night credits. Now, you’d only get two (for the two nights in the single room you are staying in).

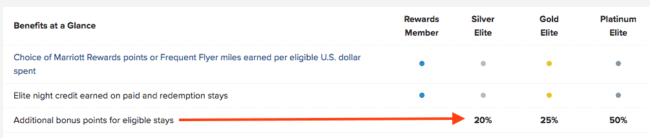

If you want to know the specific benefits enjoyed by each elite level check out Marriott’s chart. As for the heavy weight benefits:

- Room upgrades: Platinum Elite and higher, dependent upon availability, will get upgraded to suites (either standard or select) free of charge.

- Confirmed room upgrades: Despite availability, Platinum Elite members will get five confirmed suite upgrades free of charge. Platinum Elite Premier will get 10.

- Welcome gift (points, breakfast, or amenity): Gold Elite will get points, Platinum Elite and higher will get either points, breakfast, or an amenity, dependent on the brand of hotel. The breakfast benefit is expanding to 23 brands, including Courtyard, AC Hotels by Marriott, Protea and Moxy, as well as resorts.

- Club Lounge access: Available for Platinum Elite and higher.

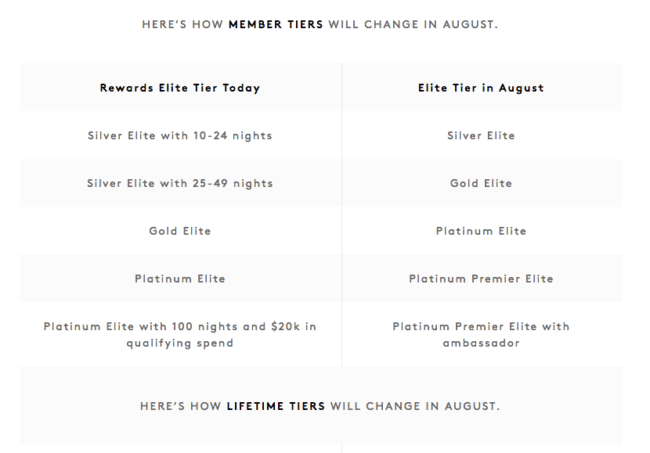

Between August and December of 2018, your status as a Marriott member will be matched in the following way under the unified system:

Or if you have SPG status, it will be matched in the following way:

A particular point of confusion I’ve noticed from comments on other blogs is whether or not SPG members that currently have SPG Gold Preferred Status and chose (or choose) to match it (before August) to Marriott’s Gold Elite Status, which is possible under the current merger rules, will match to Gold Elite or Platinum Elite under the new, unified system in August. In other words, is there a potential workaround here?

- Old SPG Gold Preferred = Gold Elite in new program as of August

- Old Marriott Gold Elite = Platinum Elite in new program as of August

- Old SPG Gold Preferred = Old Marriott Gold Elite under current rules

So can you match Old SPG Gold Preferred to Old Marriott Gold Elite before August to ensure you get Platinum Elite in the new program, which is the tier when all the juicy benefits start like breakfast, suite upgrades, and lounge access?

Sadly I do not think so. The Points Guy interview David Flueck, SVP of Global Loyalty for Marriott International, and around the ten minute mark they discuss elite status matches. Flueck says that only those who earned Marriott Gold Elite status through the old Marriott’s qualification system will match to Platinum Elite. Womp. Amex Platinum cardholders who got Old SPG Gold Preferred status… don’t think you’ll win on this one.

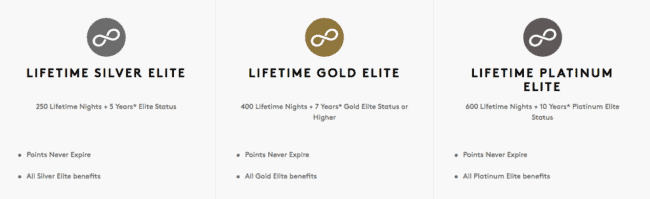

Lifetime Status

Those that have earned Lifetime status will keep it. The following is from Marriott’s announcement:

“You can qualify for Lifetime status based on your combined Rewards and SPG nights and Elite years. If you achieved Elite status in both SPG and Rewards in one year, you’ll receive credit for two Elite years. You can also qualify via the existing criteria through December 31, 2018. When your current Elite status is higher than your Lifetime status, you’ll receive the higher-status benefits for that year.

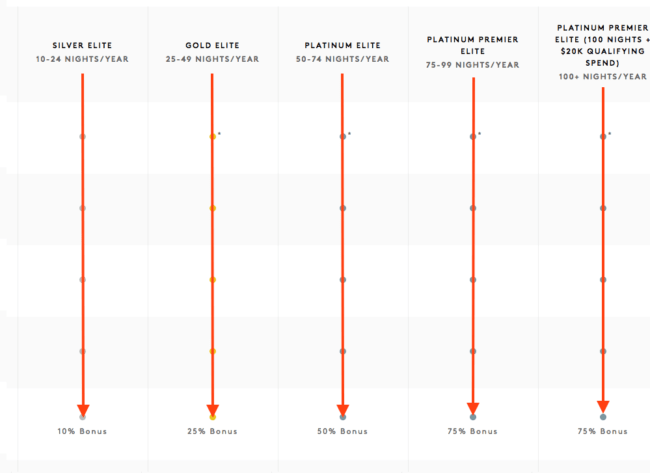

Earning Points Via Hotel Stays

According to Marriott, this is a big perk of the new system. On average all members will increase the rate at which they earn Marriott points via hotel stays at an average of 20%. Here are the new earning rates under the new elite tiers when you factor in elite bonuses.

- Members (no elite status): 10 points/dollar

- Silver Elite: 11 points/dollar

- Gold Elite: 12.5 points/dollar

- Platinum Elite: 15 points/dollar

- Platinum Premier Elite: 17.5 points/dollar

You’ll also be able to earn points on food/drinks and certain incidentals come August, which is new.

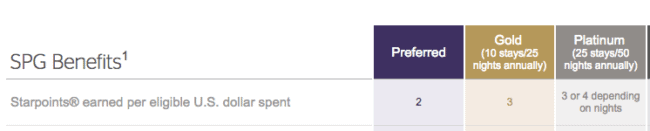

Below are charts of earning rates through the current SPG program and Marriott program.

There’s no doubt that earning points through hotel stays will be easier in the new program. No matter what elite status level you are, you will at least earn the same amount of points and the upper tiers will definitely earn more points under the new structure. The only exception is current Silver Elite members under Marriott’s program that qualified with 10 to 24 elite credit nights whose earning rate will drop to 11 points/dollar instead of 12 under Marriott’s current system.

All of that being said, at least from Marriott members point of view, hotels are getting more expensive in points (more on that below), so you can’t take an increase in earning rate at face value. We’ll see what happens with award availability, but an increase in earning coupled with an increase in price doesn’t necessarily sound like an improvement to a program. I guess one must consider the newfound ability to spend Marriott points at SPG properties, but we still don’t know what categories the SPG hotels will fall into yet. Only time will tell.

Redeeming Points for Free Night Awards

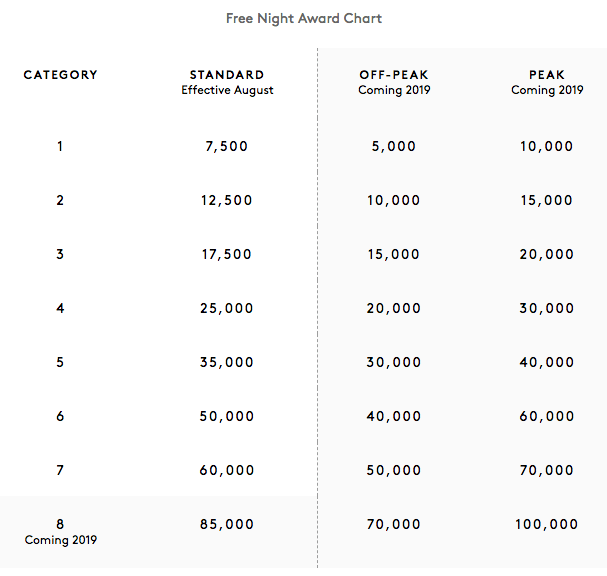

The award chart that kicks in as of August has eight categories total, but only seven will apply through the rest of the year. In 2019, category 8 pricing will kick in, along with two other tiers of pricing in each category for off-peak and peak travel times.

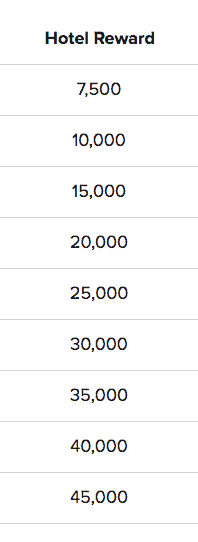

In general, Marriott award nights are getting more expensive compared to their current award chart. The following is the cost of one night, starting at 7,500 points for a Category 1 and topping off at 45,000 points for a Category 9.

…and SPG award nights, compared to their current award chart, seem to be getting cheaper. Especially in the upper categories, and especially between August and December, before Category 8 pricing kicks in! Below I have converted the current cost of SPG points to Marriott points (1:3) to make comparisons easier.

- Category 1

- 6,000 to 9,000 points

- Category 2

- 9,000-12,000 points

- Category 3

- 21,000 points

- Category 4

- 30,000 points

- Category 5

- 36,000 to 48,000 points

- Category 6

- 60,000-75,000 points

- Category 7

- 90,000 to 105,000 points

But we’ll have to wait see what SPG hotels are assigned to what categories and also how off-peak and peak pricing change things in 2019 before knowing how good of deal this chart is. Award charts can be deceiving–the proof is in the pudding.

At least we know the fifth night free on award stays, a feature of the current Marriott Rewards program, is sticking around come August.

Bottom Line

For those that are actually interested in redeeming points for hotel award nights and elite status (not me), it totally depends on which status your currently have and in which program you have it whether you win or lose.

To look at the new program basically, the future, singular program of Marriott/Ritz Carlton/SPG will be the most convenient hotel loyalty program to utilize as the mammoth organization has the largest footprint in the world. And getting 10 elite credit nights for the first tier of status will be easier than before as stays at both SPG and Marriott hotels will count.

To look at the new program more closely, it seems as though current SPG Gold Preferred members will suffer on the benefits side of things with this transition. SPG Gold Preferred will translate to Gold Elite in the new program, which does not really give access to the valuable benefits as Gold Preferred (they’ll lose 4 pm checkouts and upgrades). But the new Platinum Elite level is at least equally attainable as before by SPG members for the future (50 nights), and now will be easier for Marriott members to reach.

And it seems like everyone will have more access to top tier SPG properties that cost an insane amount of points on the currents charts but an accessible amount of points the new unified chart. That dream could be busted, however, by whatever the realities of Category 8, peak pricing, and award availability have in store for us.

Only time will tell.

What do you think of these changes? Angry? Excited?

Time to up my SPG spending to stockpile now that I won’t get the low SPG redemption rates on lower Cat hotels and the 3x the points Marriott conversion when August comes. After that, it’s not worth it anymore to use my spending there.

Thanks for the helpful info, but this is a lot to digest and I’m still confused about the lifetime status tiers and how to achieve them. I earned Marriott Platinum Elite through credit card spend and that got me the SPG Platinum status match as well (I was SPG Gold before that). I have about 690 Marriott Lifetime nights and 1,500,000 lifetime points, so am I understanding it correctly that I will be grandfathered into the lifetime platinum premier level if I attain the 750 nights/2 million points required by the end of 2018? How do my SPG lifetime nights and points factor into the equation? Will these be added together when the programs are integrated in August and help me reach my goal? I’m doing my best to ensure I achieve the Marriott Lifetime Platinum Premier status by December since it appears there will be no way to achieve this level beyond 2018? Any expert opinions would be greatly appreciated! All of this is dizzying! ????

Sarah, I think the person with tons of Marriott points loses the most in all this. If a hotel goes from 40K to 60K or more is a huge hit. I spent my life travelling and away from my wife and kids and earned these points. The saving grace was the ability to use these points in retirement. Now, Marriott, whom I have been loyal too, will devalue my points by 30% to 50% in those locations we would like to go. I would gladly pay for a breakfast vs. having my points devalued so badly. This is much worse than not getting a free breakfast or lounge access.

That is a valid perspective I wasn’t thinking about upon writing this post, John. That does really suck for people like you/in your position. I guess the one small silver lining is that you’ll be able to book top tier SPG properties for less points…properties that weren’t available to book with Marriott points before the merger, period. That being said, SPG’s footprint is drastically smaller than Marriott’s, so that’s probably not a significant perk when it comes the the actual likelihood of you booking one of those properties.

Thanks for pointing that out.

Great post, thank you! Can you clarify my understanding: 3 SPG points convert to 1 Marriott point: then it takes 3 Marriott points to gain one airline point when transferring to a partner airline? That would suggest 9 SPG points will be worth 1 airline point after Aug 1.

It’s the other way around, 3 Marriott points = 1 SPG points. The way I had it written before did make it seem like 3 SPG points = Marriott points–edited.

I’ll be writing a more thorough follow-up in the beginning of the week covering the changes as they relate to earning through credit card spend and for redemption as airline miles, which should clear up any lingering questions you may have, so keep an eye out for it.

How sad. I’m in the same boat and I’m sure many others are as well. Many bloggers have posted that the best use of points is to burn, burn, burn. I was leery when the merger was announced. Loyalty has no value

Thank you for clarifying all these points! For me (relative newcomer) the feeling that the carrot keeps getting move is unsettling. Just got the biz and personal SPG amex card. it would have been pretty easy to achieve Gold status (stay 5 more times) and get worthwhile benefits. Now that gold status will not get the benefits (and they wont let you combine the nights, either from 2 cards). So just became out of reach for someone who doesn’t stay in hotels that much. I found most strange their thinking on the people who are BUYING 2-3 hotel rooms at a pop (for family or such) and will now only getting ‘credit’ for their room – what the heck???!!! Hope anyone in that situation rents a multi-room apartment on airbnb for a fraction of the cost and the hotel loses 3 paid nights x length of the stay they would have had.

Looking forward to part 2 – as SO many bloggers mis-reported the information you clarified above!