MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Last month, I used 145,000 Hilton points to book a four night stay at the Hilton Hawaiian Village in Waikiki. (This was a 55,000 point discount because I booked an AXON award.)

When I booked, the only room available was one king bed. My traveling party wanted two beds, but I wasn’t worried because I knew that would be an easy change at check in. My other big plan for check in was to use the Twenty Dollar Trick, which I first learned about from thetwentydollartrick.com.

The website is a repository of data points for people trying the Twenty Dollar Trick in Las Vegas. Here’s how the trick is described:

“The twenty dollar bill trick is sweeping the travel industry and becoming extremely popular, especially in Las Vegas. When you check into a hotel you simply slip the front desk clerk a $20 bill with your credit card, while asking, ‘Do you have any complimentary upgrades available?’ The general rule of thumb is that the front desk clerk will check for upgrades and if they cannot find anything they will return the $20 tip, making it risk free!”

I’ve known about the trick for years, but I haven’t tried it in Vegas. Last month my friend tried it at the Cosmopolitan and got upgraded from a standard room to an incredible suite with a bathroom with windows onto the strip and a bar for the weekend. For $20.

I was eager to try to the trick at the Hilton Hawaiian Village.

The Conversation

As I walked up to the check in desk, I made a stack. At the top was my Hilton Gold card. Below that was my driver’s license. Under that was a folded $20 bill. At the bottom was my credit card.

By chance our agent was a guy in his twenties. I thought that was a good sign, but who knows.

I think the wording of the trick is so awkward. “Do you have any complimentary upgrades available (while I bribe you)?” So I reworded it slightly to include my other request for two beds.

I handed the agent my stack and said, “Do you have any complimentary upgrades to a room with two beds available?”

He noticed the $20 bill and threw it behind his keyboard where no one could see it. I knew that was a good sign. He said, “I’ll see what we have available.”

He said that there was an ocean front room available in the Ali’i Tower. That sounded good. He also said he could get us free breakfast. That sounded good too.

We took the keys and went to the room, and we immediately realized how much that $20 had bought us. We were on the second highest floor of the Ali’i Tower looking straight out at the ocean. The view on the background of my twitter account (@MileValue) was our view from the room.

Beyond the view, the Ali’i Tower had several benefits. We had access to a private pool for tower members only, which was much less crowded than the resorts other pools. The pool had incredible beach views.

Beyond the view, the Ali’i Tower had several benefits. We had access to a private pool for tower members only, which was much less crowded than the resorts other pools. The pool had incredible beach views.

The tower had a DVD and Playstation 3 game kiosk where tower members could borrow a disk at a time for free. This should have been a nice benefit, but we borrowed The Campaign, which is awful.

The tower had a DVD and Playstation 3 game kiosk where tower members could borrow a disk at a time for free. This should have been a nice benefit, but we borrowed The Campaign, which is awful.

The tower had free tea and coffee in the room, which was a nice morning benefit.

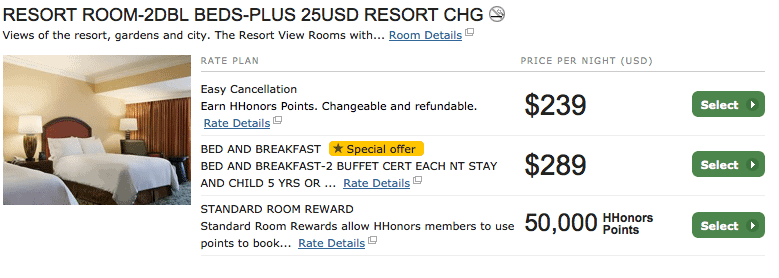

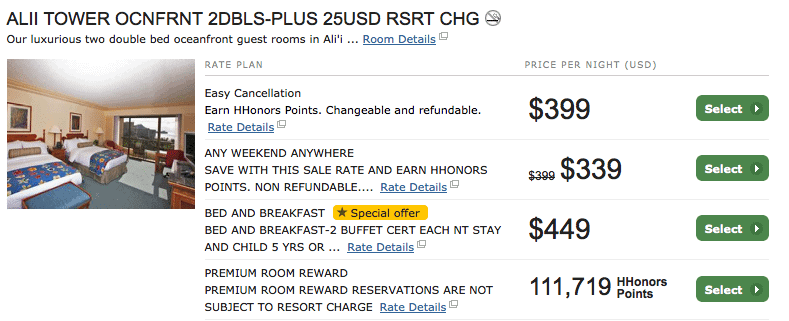

For a random weekday in October, Hilton Hawaiian Village is charging $239 for the base room that we would have gotten and $449 for the room we did get with free breakfast. Over four nights, that’s an $840 upgrade for $20.

Or I could have redeemed 111,719 points for one night in the room. I got four nights for 145,000 points and $20.

Or I could have redeemed 111,719 points for one night in the room. I got four nights for 145,000 points and $20.

I’m not saying that I got $840 in value from the $20 trick. I slept through breakfast, though my friends liked it, and the view was not worth $160 per day. But I did get far more than $20 worth of value.

Is it Repeatable?

Yes. Here’s the data from Las Vegas. 84.4% of reports are of a success. Of course, success is relative. Some upgrades are minor, and some are major. But even a minor upgrade is worth $20, especially if you are staying several nights. And I also imagine there is a self-selection bias whereby people are more likely to report successes. However it’s clear the $20 trick works in Las Vegas and beyond.

Is it Ethical?

It does look like the guest and employee are circumventing the hotel’s ability to profit from its best rooms. But on the other hand, hotels give their check-in agent huge discretion over where to put you.

I can’t tell you whether the Twenty Dollar Trick is ethical, but I welcome civil debate in the comments (and will mercilessly delete unconstructive negativity toward any person.)

Recap

Slip the person at the front desk a $20 sandwich, and you may find your next hotel stay vastly improved.

I thought Hilton Gold gets you free breakfast.

I thought Hilton Gold gets you free breakfast.

In any activity where someone immediately hides the $20 behind the keyboard, it’s probably not ethical.

In any activity where someone immediately hides the $20 behind the keyboard, it’s probably not ethical.

But is it ethical for the hotel owner to underpay it’s employee so much that they will take such a bribe?

Don’t blame the boss nor the rich it means the person WANTED the $20 more then the person’s job . Walmart cans a zillion people stealing exactly $100 because $100 was worth it if they got caught which they do ALL the time .

I’ve read about the $20 trick but I haven’t had the guts to try it yet. Glad to see it worked for you.

I’ve read about the $20 trick but I haven’t had the guts to try it yet. Glad to see it worked for you.

Hi, it’s me, the guy who checked you in. I just got fired today. Thanks!

I’m pretty sure if the hotel finds out about it, the desk clerk will be looking for a new job. If the IRS finds out about it, he’ll be in bigger trouble than that. I thought there were cameras everywhere in Las Vegas. I prefer your posts on getting best value out of air mileage redemptions. Leave the sleazy stuff to others.

[…] writes about tipping $20 at checkin at the Hilton Hawaiian Village. He got an ocean front Ali’i Tower room with free […]

I do it in Vegas all the time. The front desk clerk even leaves the $20 on the counter while typing. It’s essentially expected for any sort of upgrade. Not really worth it as most Vegas roons are suites(at least at the Venetian/Palazzo) and who cares about an upgade at Circus/Circus?

I would imagine YMMV but going from a regular room to a Villa(ala ‘The Hangover’) for $20 is rare.

Your HH Gold status would got you free breakfast anyway.

Getting a tip is part of compensation (and livelihood) for hospitality workers. So I don’t understand why would he get fired as he upgraded a HH Gold status guest. As for the IRS, they will have to audit him after he files his income tax return at the end of the year to see if he declared that $20 bill as part of his income … not likely they will spend that much money/energy to go after a little fish (FD clerk).

I am staying in that exact hotel tomorrow night. I have Hilton Gold status. You think it’s worth it to try this trick? I don’t know if I have the guts though.

Let us know if you do try!

I don’t think I’d have the guts to try it outside Vegas, but I could see it working in touristy destinations. It’s possible your room would have gone empty for your stay, but instead, you got an upgrade the staff got some extra cash and you’ve just posted a rave review about the property. I don’t think this is a lose situation for the hotel.

I agree in this situation everyone won because I would never have paid for an upgrade, and they did get some good free press here. But hotels would not like it if people who would pay for an upgrade stopped doing so because they knew they could use the $20 trick.

If hotel owners didn’t want to give front desk clerks the discretion of where to put guests, they easily could take it away by implementing the software to make it difficult or impossible for the clerk to make that change. In my experience, hotels will be able to upgrade you if there is plenty of room, and won’t if there isn’t. So why not ask?

Despite their grooming and attire, the front desk clerk is often a low-wage job. I am happy to offer them a tip for service that enables me to enjoy my trip more. However, I do think it is a little cheesy to rescind the tip if they can’t offer an upgrade. If you only want to tip in exchange for an upgrade, why not try to assess ahead of time how full the hotel is (based on going room rates for that night, how crowded the lobby is, etc.) before you decide to offer the sandwich.

This seems to work especially well in Las Vegas because of its culture of tipping. My wife and I stayed at the Mark Hopkins in San Francisco, which recognizes priority club status, and we were upgraded to a suite on the top floor since it was my wife’s birthday. The clerk tried to return my tip but I insisted he keep my $10. On the other hand, I tried it in Paris and the clerk looked at me like I was nuts. So it really depends a lot on where you are and what the culture is with respect to tipping.

You never ask for the return of the tip. They just hand it back usually if they can’t help according to the website.

I never do this. I just simply ask and always get it.. not only in Vegas but other places.

LoL.. fools

I would love to hear from one of the front desk clerks. Have they ever been asked by their bosses about why they gave XYZ such a nice room? Is the “tipping” practice implicitly accepted by the front desk manager? Do tell!

Tipping is common in hotels. Desk clerks have discretion to give free upgrades. Honestly, I don’t see this as a big issue. If the desk clerk gave a free upgrade and you tipped $20 to say thanks that wouldn’t be unethical. My ethics meter falls on “is this hurting anyone.” Not you. Not the clerk. I don’t even see this as hurting the hotel because at this point (check in) the nice room will go unsold. My only problem with this post is your bash of “The Campaign.” I thought that movie was really funny!

Oh man, Lucky liked The Campaign also according to a recent trip report. I thought it was too scatter shot. It didn’t know what joke it wanted to make. A rare movie that we all decided to turn off.

I’m a Vegas regular and tip at every check-in. Now, I also tip everyone, every time while in Vegas, so I treat any bump as a bonus. My results have ranged from a high floor, better view to a 1,000+ sq ft suite w/270 view. I’ve had some clerks take the money and set it aside, and others hand it back to me immediately, but regardless of the “result” I always give them the tip. I read about some folks taking back the dough if the clerk cannot help them. I think that’s bogus.

It’s Vegas…everything runs on tips. From the dealers to the cocktail servers to the doormen, you’ll have more fun in Vegas if you allocate a trip cost for tipping. Everyone’s happier and service is better… win-win.

Lastly, you might check your Klout score. Palms is one casino that has admitted giving people bumps based on their Klout in hopes of positive social media feedback. Interesting.

Lots of meat on this comment. What service do you get by tipping the door man? Faster taxi? My biggest Vegas-buff friend is also a tip-everyone-in-sight traveler in Vegas, so that may be the way to go.

Anybody try this at a Hyatt before? A suite upgrade for $20 doesn’t sound too bad. I’ll be at Hyatt Regency Waikiki.

is the AXON rates only for AMEX HHonors card members or any AMEX card

I thought it was only AMEX HHonors holders, but when I called up she said I could pay with any AMEX card, so I think anyone with an AMEX might be eligible.

Money given at the completion of a transaction is a tip; money given at the beginning of a transaction is a bribe. A bribe is not ethical, but YEMV.

All things are negiotiable in life! Thx for sharing, I love it, even though it has nothing to do with miles (but it does offer value). I just shared this with a friend who is heading to Vegas tomorrow.

I think it’s brilliant. Thanks for sharing! I am staying in Hiltons in Anchorage and in Vancouver this summer and I wonder if I could try this to upgrade my family to a suite. One is not a high-traffic hotel, and the other one is Canadian. I hope they are not insulted by this ‘tip’.

[…] Home › Hotel Rewards › How to Get a Hotel Upgrade with “The Twenty Dollar Trick” […]

[…] see this interesting post or try something similar at this property? https://milevalu.wpengine.com/twenty-dollar-t…hotel-upgrade/ __________________ My Open […]

I personally think your upgrade had much more to do with your Gold status than the $20 trick. I have been Gold for many years based purely on credit card spend but because HHonors is not my top hotel loyalty program, my Hilton family stays are few and far between. However, by booking the basic room category, I have received suite or significant upgrades at the Conrads in Hong Kong and Chicago, the Trafalgar in London, the Beverly Hilton, etc. Never tried the $20 trick at a Hilton property.

I can’t obviously prove it and I’ve never stayed at the Hilton Hawaiian Village, but I bet you would have received the same upgrade just by asking since you are Gold.

I can verify the $20 trick has worked well for me in Vegas though.

And Golds do get breakfast at most Hilton properties, including the Hilton Hawaiian Village.

I will try this 3x in the next 2 months Cruise,2 Vegas .I’m a Cheap Slut so anything gos as long as its legal ..

Bless you Scott your my kind of traveler !!

Daytona 500 (9) times

Cj

@Dom, +1! And when a bribe is expected by the recipient, it is extortion. Think of the street person who offers to “watch your parked car” or the maitre’d at a Las Vegas show who only gives you a good seat if there is a nice tip.

A good test for ethics is whether people are happy for their names to be associated with the deal. If not, then it is probably a form of corruption that they want hidden from view.

your free breakfasts came from the Gold Hilton, you should know that Scott.

Mariana – I live in Alaska and stay at the Hilton every now and then..I have been been able to show my Hilton card and ask for an upgrade to the club floor for free. Often we just use priceline though and get the Hilton or Sheraton for $50 a night.

Vegas Hotels and ethics? Talk about the ultimate oxymoron! When has a Vegas Hotel worried about ethics? Can anyone say “Resort Fee?” Or how about outrageous Wi Fi charges? And let’s not forget the jacked-up prices for rooms if you ever want to stay over a holiday weekend. The list goes on and on. So, I say take the hotels for all you can! Whenever you can. They’d do the same to you in a heartbeat!

A friend’s wife works as a hotel event planner. She’s far more brazen than that when they travel. He said she basically walks up to the counter and offers half price to start and negotiates from there. I had a hotel manager last summer pretty much bargain with himself into giving me a ridiculous deal including all of their specialty packages – all I did was ask why one package didn’t include something from the other package. I wasn’t even being pushy. I think it’s pretty much part of the culture, at least here in the States.

Some of these comments are brilliant. Not quite as bad as when Daraius explained how to bypass the longer security line, though!

I love the tip – I’ll try it in Hawaii in a few weeks.

It’s common practice in hotels, even ones that aren’t in the United States (I’ve tried it, successfully, in Paris, Berlin, Prague, Dublin, and London). Customers like it because they get a better room. Front desk people like it because they get extra $$$. Hotels like it because it allows them to continue to pay low wages to people who survive off tips and it gets a better word of mouth about their product.

At the vast majority of hotels this is well known, and it is NOT something you would lose your job over. This is especially true in Las Vegas. As you can imagine, it works better on non-holiday stays, which is the only time I’ve had it not work.

[…] the last trick he lays out is the Twenty Dollar Trick. His wording is slightly different than the one I used successfully in […]

I would be willing to try this in “touristy” areas. As it was said before…gambling establishments are notorious for paying their employees low and so the tipping game is the way to grease the wheels. The best upgrades available are also located in these locations as well. Vegas, Reno, Atlantic City, and big resorts pretty much reward big tippers or people who gamble a lot.

I checked in today a few hours ago at Hilton Waikiki Village and handed my Gold status card and just asked for a free upgrade and received an ocean view room double bed at the Rainbow Towers. I am happy to report that I did not need to hand over any money.

That’s great! The Ali’i Tower is worth an extra $5 per night to me over the Rainbow Tower but Ocean View is pretty sweet in Waikiki.

I’ve gotten some very impressive rooms only with Gold status so I’m not sure about tipping although it probably doesn’t hurt. I do agree with some others that I doubt hotels like their employees taking bribes for better rooms and the more it is publicized the more it will occur and they will crack down on it.

Obviously being nice never hurts and catching someone in a good mood is always a plus.

Has anyone tried the $20 trick in Canada?

I’ve got reservations here next month as a Hilton Gold.

Very curious about the free breakfast. Was it indeed supposed to included free as a gold member? A cold continental breakfast? A hot buffet? or???

Also, am thinking of requesting the lagoon tower because of proximity to the newer water slide area for the kids. Any insight on rooms there?

Thanks.

Great article! And great to hear that the sandwich works out of Vegas. As the guys at Roll Like Boss mention – it’s essentially a risk free transaction – always worth giving it a shot!

[…] got upgraded to the lounge floor where we had access to free breakfast, snacks, and drinks thanks to the $20 trick. Money well […]

Not only is it ethical, it’s not even against policy at many (MANY) properties. As a front desk agent I can upgrade you for basically any reason I want to, and tipping is a good way to make that happen. Even if you can’t get an upgrade I will help you get the best room of the type you’ve reserved – the one with the bigger shower or nicer view. Plus, if you ask me for a late checkout after spotting me some cash you better believe I will make it happen.