MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

When you’re shut out from the majority of Chase cards, you loose access to tons of rewards and reward earning opportunities due to what everyone calls the Chase 5/24 rule. If you’ve opened more than five credit cards from any bank (with the exception of most business cards) in the last 24 months, then Chase will deny you for almost all of their cards (with the exception of these). That’s where the name 5/24 comes from.

Perhaps the harshest angle of being shut out to Chase cards is the inability to earn United miles from credit card sign up bonuses since Ultimate Rewards are the only transferrable point currency that transfers directly 1:1 to United and the only United co-branded credit card is issued by Chase.

In case you weren’t already aware, there are a handful more United miles available to scrape off the bottom even if you are shut out by 5/24.

The Marriott Rewards Premier Business Card

One of the Chase cards that the 5/24 rule doesn’t apply to is the Chase Marriott Rewards Premier Business Card. It comes with a bonus of 80,000 Marriott Rewards after spending $3,000 on the card within three months of opening it. If you’re unsure of whether or not you’re eligible for a business credit card, read How to Get Approved for Business Cards.

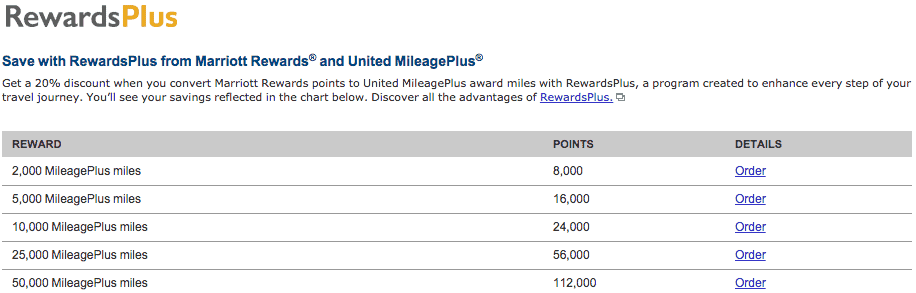

Marriott has a special relationship with United which allows you to convert specific amounts of Marriott points to United miles:

So with 56,000 Marriott points, you could buy 25k United miles (and still have 27k Marriott points leftover).

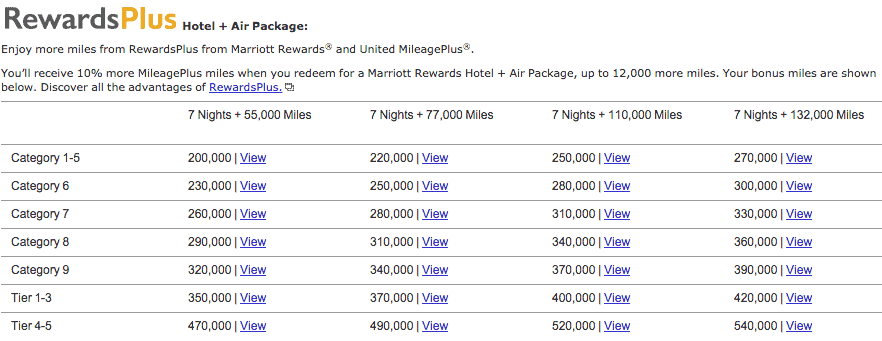

And while just the bonus from the Marriott Business card won’t get you enough, don’t forget Marriott’s hotel + air packages with United.

If you’re just scraping the bottom for a different type of mile, don’t forget that Marriott points can also be transferred to SPG points.

The SPG & Marriott Angle

Starwood Preferred Guest and Marriott merged last year, resulting in many advantageous opportunities for both SPG members as well as Marriott Rewards members. One such opportunity is the ability to link accounts and transfer from Marriott to SPG at a 3:1 ratio or the other way at a 1:3 ratio. The 83,000 Marriott points (minimum, not accounting for category bonuses) you’d earn from reaching the minimum spending requirement for the bonus translates to over 27,000 SPG points.

SPG has a massive amount of airline transfer partners, and most of the good partners transfer 1:1. On the left is the loyalty program, and on the right is the transfer rate.

| Aegean Airlines | 1:1 |

| Aeromexico Club Premier | 1:1 |

| Aeroplan/Air Canada | 1:1 |

| Air Berlin | 1:1 |

| Air China Companion | 1:1 |

| Air New Zealand Airpoints | 65:1 |

| Alaska Airlines Mileage Plan | 1:1 |

| Alitalia MileMiglia | 1:1 |

| All Nippon Airways (ANA) Mileage Club | 1:1 |

| American Airlines AAdvantage | 1:1 |

| Asia Miles | 1:1 |

| Asiana Airlines | 1:1 |

| British Airways Executive Club | 1:1 |

| China Eastern Airlines | 1:1 |

| China Southern Airlines Sky Pearl Club | 1:1 |

| Delta Air Lines SkyMiles | 1:1 |

| Emirates Skywards | 1:1 |

| Etihad Airways | 1:1 |

| Flying Blue | 1:1 |

| Gol Smiles | 2:1 |

| Hainan Airlines | 1:1 |

| Hawaiian Airlines | 1:1 |

| Iberia Plus | 1:1 |

| Japan Airlines (JAL) Mileage Bank | 1:1 |

| Jet Airways | 1:1 |

| Korean Air | 1:1 |

| LATAM Airlines LATAM Pass | 1:1.5 |

| LifeMiles® of Avianca | 1:1 |

| Miles and More | 1:1 |

| Qatar Airways | 1:1 |

| Saudi Arabian Airlines | 1:1 |

| Singapore Airlines KrisFlyer | 1:1 |

| Thai Airways International Royal Orchid Plus | 1:1 |

| United Mileage Plus | 2:1 |

| Virgin Atlantic Flying Club | 1:1 |

| Virgin Australia | 1:1 |

Unfortunately the transfer rate to United is pitiful. But, as I’ve already gone over, that doesn’t matter in this circumstance as you should transfer your Marriott points directly to United instead.

Bottom Line

If you’re grasping at straws for more rewards, don’t forget about the Chase Marriott Rewards Premier Business Card. The 5/24 rule typically does not apply and, as you can see, Marriott points afford much opportunity.

[…] Marriott Rewards Premier Business Card, which the 5/24 rule is known not to apply to. Thanks to the Marriott and United’s relationship, you can purchase 25k United miles for 56,000 Marriott […]