MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This post is for people who haven’t yet joined the miles movement–like people who clicked over from today’s New York Times article. If you’re already a regular reader, forward this post to all your friends who are jealous of your travel to get them involved.m

Travel is my single favorite hobby. It expands my mind, brightens my mood, and brings me in contact with new people and experiences. My love of travel comes down to novelty. Going to the grocery store down the street is an errand; going to the grocery store in Kampala, Uganda is an adventure.

But travel is expensive. When I got back from six weeks in East Africa and all I could talk about was the month I’d be spending in Eastern Europe watching the Euro Cup, my friends all reacted the same way.

“I would love to travel as much as you do, but I don’t have the money.”

Admit it: you’ve told yourself you can’t afford a trip you’d like to take. This is especially true if you have kids.

But here’s what I pay for travel: can you afford $100 tickets?

The cheapest roundtrip from Los Angeles to Melbourne, Australia that I could find for New Year’s 2013 was $1,759. But I went to New Zealand and Australia around New Year’s to see the Australian Open, scuba dive the Great Barrier Reef, and Bungee Jump from 440 feet for only about $100 with both directions on flat beds in the front of the plane.

Another example: the cheapest roundtrip flight I can find from Los Angeles to Poland next summer is $1,006. But I went to Poland and Ukraine last summer for about $100 with both ways on flat beds in business class.

I saved 90% on my flight bills by using frequent flyer miles. I didn’t know much about them two years ago, but in the last two years, I’ve earned and redeemed millions of miles to fly first class for free to every inhabited continent. Now I’m trying to show as many people as possible how replicable what I’ve done is.

It’s easy to earn frequent flyer miles. Banks give them away–50,000 or more at a time–just for signing up for a single credit card. And there are tons of credit cards you can sign up for.

I just talked my girlfriend into getting two Citi cards in November, and she now has 105,000 miles in her American Airlines account. Or at least she did before she booked a roundtrip to Buenos Aires for 40,000 miles and $80. And she still has enough miles left for a roundtrip to Europe or Asia. That’s two international trips–all for signing up for two cards at once.

If this all sounds too good to be true, you’ve probably heard one of the two major myths that people use as an excuse not to get involved with miles.

Myth #1: Applying for credit cards will destroy your credit score.

If you’ve heard any semblance of a personal-finance talk, alarm bells are probably going off in your head. You’re probably thinking, “Won’t this hurt my credit score?” No, it absolutely will not hurt your credit score in the medium or long term. The facts are all online.

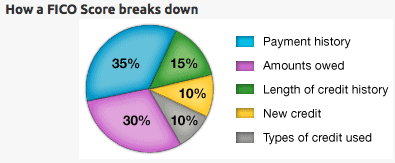

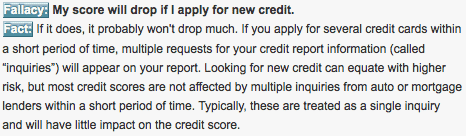

FICO is the most widely-used credit scoring model in the US, and FICO’s official website lists “My score will drop if I apply for new credit” as a fallacy.

Only 10% of your credit score is based on inquiries derived from applying for new credit like credit cards. That 10% is swamped by other factors, all of which are helped by getting more credit cards!

Only 10% of your credit score is based on inquiries derived from applying for new credit like credit cards. That 10% is swamped by other factors, all of which are helped by getting more credit cards!

Specifically, a big part of the 30% listed as “Amounts owed” is percentage of credit utilized. A new credit card will come with a new credit line, say $5,000. If your monthly spending on that card is just $500, then your credit utilization is only 10%. This will make you look like a good credit risk, causing your score to rise.

The extra credit lines from new cards, the payment histories you generate, and the relationships you establish with banks will all help your credit score over time.

If you monitor your credit score closely–and you should whether you get involved with miles or not–you will notice a decline in your credit score from each new credit card application. I see my score fall 2-5 points when I apply for a card. Then you will see your score rise slowly over time until you are at or above where you started.

I’ve gotten more than a dozen cards in the last year, and my credit score is higher now than ever. Other people with longer histories of even more extreme credit card “churning” as we call it have similar stories of maintaining extremely high credit. Here’s a documented example of someone applying for 11 cards in a year and seeing his score rise.

Myth #2: Frequent flyer miles are impossible to redeem.

Finding a seat with miles is not always simple. Award seats are capacity controlled, so if you want to go to Rio over Carnival or some other ultra-peak destination, you may be out of luck. But I’ve managed to score some incredible peak awards like Europe in the summer, Hawaii over Christmas, Australia over New Year’s, Argentina over its summer with planning and flexibility.

Redeeming miles is simple if you know the tricks–tricks we publish here. But if you don’t want to learn them, you don’t have to.

You can outsource the work of finding a ticket to a paid award booking service for $125. If you hire a booking service, you’ll still be paying way less than people who are buying their tickets with cash.

Once you are familiar with miles, you’ll realize that not only are they not hard to use, but they are way better than cash in a lot of ways. For instance on cash tickets, it’s often difficult to cheaply build in stopovers to see multiple destinations on one trip. With some awards, it’s easy to build in one or more stopovers.

With cash, good luck flying in style; international first class tickets can cost $10,000. With awards, the miles needed to fly in first class on a bed with stewardesses filling your glass with champagne can be obtained from opening one or two credit cards. All my international trips in the last two years have been in business or first class, just by signing up for a few credit cards.

There are two situations in which you shouldn’t follow my advice to start getting mile-earning credit cards.

1. You have an upcoming major loan application like a mortgage. Your score does drop slightly and briefly when you open new cards; those effects disappear in 24 months. Don’t open up new credit cards if you want to get a mortgage in the next 24 months.

2. If you are in debt or can’t control your spending on credit cards, don’t apply for new ones. If you run a balance on your credit cards, the interest will cost you more than the miles are worth. Only open new cards if you can pay off their balances every month, so you don’t pay interest.

Hopefully I’ve got your attention, and you’re ready to start traveling better than you thought possible for cheaper than you thought possible. If so, subscribe to this blog on the bottom of the page to wake up to emails with my latest post(s).

If you aren’t going on the vacation of your dreams, it’s not money that’s stopping you!

Nice work on the NYT piece Scott. Well done! – René

shared your article. it’s good sometimes to go back to the beginning to recruit new readers. I hope this helps some of my friends understand how I can afford to fly a family of 4, two to three times a year to international destinations!

Yes, the only reason I can think not be involved is because you haven’t heard of this stuff, so I am trying to correct that.

Nice citation! I would add that finagling tickets for a family of 4 together can be a lot of work, even for the most seasoned of bookers.

That’s where a $99 per person award booking service can come in. Some routes have better availability for people looking for 4+ seats.

Keep in mind the destination isn’t free. Australia and New Zealand are expensive countries.

I’ve got tips on that too all over the blog–couchsurfing, hostels, pricelining, hotel points, and more.

Scott, Great to see you getting some publicity. You’re doing good things here, keep up the good work.

Just to give an example in support of Scott’s credit score comments. I’ve been monitoring my credit score through Credit Sesame. I had a score of 840, and then applied and received the United Explorer Card for 50,000 miles and the Marriott Chase Card for 50,000 Marriott points back in early December. My score only dropped to 832.

Watch it rise in the next few months.

I will see what I can come up with. I have tried a few cards but never got many miles for travel. I am ready to get all I can from the Credit Card companies.

I’m looking to go from Boston to Thailand sometime in the distant future. When I search at aa.com with awards travel, it keeps coming up “There are currently no awards travel.” How can one determine when AA will accept miles for its flights. I can’t imagine I have to keep trying different dates until I find one aa will take miles for.

The airlines websites are not perfect. The AA website doesn’t show award availability for Cathay Pacific or Japan Airlines, the two most likely options when trying to get to Thailand. Try searching britishairways.com for award space. Then when you find it, write down all the info and call American to book using your AA miles. Also, how far into the “distant future” are you talking? They only book 11 months out.

AA.com only displays some of its partners, and not Cathay Pacific, which is most likely the partner you’d want to fly. Either search for Cathay space on BA.com, ask an AA phone agent to search for it or contact my Award Booking Service.

This post sounds like an infomercial. As I was reading I was waiting for the $$, then it came: $99/pp for Award Booking service.

It’s an infomercial, but it’s not for the award booking service. It’s an infomercial for miles. I mentioned the award booking service because some people might never want to learn how to redeem miles, and I want them to know it’s still beneficial to get involved even if you don’t learn how.

Re: “There are two situations in which you shouldn’t follow my advice to start getting mile-earning credit cards.”

Actually, there are more than 2, but I won’t belabor the point. 🙂

Inspirational, like a recruitment poster for frequent flyers. I like how you explained the myth of hurting your credit score in detail, with official information and graphics. That’s the No. 1 fear I hear when I talk about the points game to people who don’t do it.

[…] A Call To Join The Frequent Flyer Movement Submitted by Marcus • about 1 min ago Website: milevalue.com […]

I don’t understand why you don’t like Capital One. It’s MORE versatile, in that you can use the rewards for any trip on any airline, or hotel, or rental car. Plus, you don’t have to plan ahead – you can get reimbursed up to 90 days after travel. And 2% is twice as good as 1%. Why are miles that only work on one specific carrier better?

Capital One is bad. Why get 2% only good on travel (Capital One)? If you want cash back, get a 2% cash back card (many providers). Cash is better than cash only good for travel, right?

Plus, you are misunderstanding my advice. I don’t consider 1 mile better than 2 cents. I am not recommending piling up spending on 1 mile/$ cards. I am recommending signing up for huge 50k sign up bonuses! That’s how to get big miles. Also in many way, miles tickets are better than cash tickets. (Free stopovers, open jaws, premium cabins are affordable.)

[…] credit score will GO UP as a result of getting new cards. First of all, Scott at MileValue has a great post (see: Myth #1) about how this is a myth that is easily debunked by reading information available at […]

[…] The first was a post about why we collect miles with some recent personal success stories of my own, Travel for Pennies with Miles. […]

Welp. You didn’t say that one shouldn’t sign-up if they have bad credit. And for that reason, I’m signing up right now. Looking forward to learning from you. Thanks

[…] Yesterday I talked about why newbies should dip their toes in the credit card pool–the rewards are enough to travel for pennies in first class. In this post, I’ll give you an overly detailed explanation of how I would start today if I were new. […]

[…] Travel for Pennies with Miles […]

Hi man!

All this sounds super great! I love to travel, been travelling around the world since a kid, and only this year I’ve been in 13 countries.

Anyhow, I’d like to ask you do you know is this possible in Europe (especially in Finland) or is this just a thing in US?

Love what you’re doing to other people, hopefully they’ll get inspired and will travel more and see the world!

BR, Miikka

Getting the credit cards is only for Americans. The redemption tips are for everybody.

hey man are the 2 citi cards for 100,000 miles still avail? If so which 2 are they. I see bunches of em but most have 25 or 30 miles. is there anything that keeps u from signing up for like 5 citi aa cards lol? nice site man

You won’t be approved for more than one personal. You can get one business a few days later. The business card link is located at the best business cards tab. The personal card link is http://www.aa.com/pubcontent/en_US/disclaimers/BP-PLATHV.jsp

hey man let me ask you if I sign up for the us air world mastercard and get 40000 us air miles and then sign up for chase united and get 30000 united miles, can I combine them for 70000 on any star alliance flight because they are both star alliance? thanks again

No –> https://milevalu.wpengine.com/two-foundational-questions-in-miles-collecting/

I recommend the free credit card consultation –> milevalue.com/free-credit-card-consultation

excellent tips on that link thanks so much scott sorry i didnt see that link anywhere

How does cancelling credit cards hurt your credit? A lot of these credit cards have yearly fees. What are the negative side effects of cancelling various cards?

[…] of the blogs I follow, Milevalue, explains why you should get into the miles earning business better than I can. Once you’re convinced this is worth your time, you’ll need to figure […]

very driven re accumulating award points for travelling ,

as i reside in Australia not the USA , is your blog

advantages to me in my quest for achieving my aims .

Not really. Written from an American perspective.