MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

In case you’re joining us for the first time, or missed a prior post in this series, please check out the index below:

- Credit Card Reward Programs for Travelers: An Introduction

- The Basics of American Express Membership Rewards

- The Basics of Chase Ultimate Rewards

- The Basics of Capital One Rewards (this post)

- The Basics of Marriott Bonvoy

- The Basics of Citi ThankYou Points

Today we’ll take a look at an underrated player in the points and miles world: Capital One.

Capital One offers cards desirable to travelers, including those which earn transferable points as well as cards offering cash back. And of course, there are both personal and business cards. Capital One does not have a name for their rewards program, so most refer to it as Capital One “points” or “miles.”

Capital One Airline and Hotel Partners

There are upsides and downsides to Capital One’s travel partners.

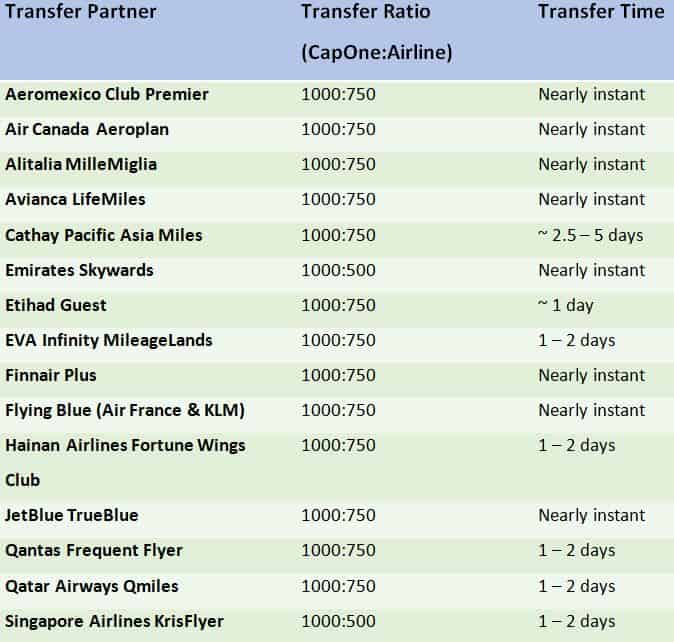

On the upside, you have the ability to transfer to 15 airline programs and two exclusive hotel programs.

On the downside, the transfer ratios are not an even 1:1. And arguably a couple of the airline partners offer lackluster redemption options.

Nonetheless, the airline partners span all three major alliances–Star Alliance, oneworld, and SkyTeam–as well as airlines with individual alliances. You can find great value and flexibility.

About half of the travel partners feature nearly instant transfer times. Most of the rest transfer within a day or two. Again, rely on real world data points for transfer times, such as from Award Wallet and One Mile at a Time. Keep in mind award space availability can change while you’re waiting for the points to transfer.

The following four Capital One credit cards have the ability to transfer points to travel partners:

- Venture Rewards

- VentureOne Rewards

- Spark Miles for Business

- Spark Miles Select for Business

Airline Partners

Capital One has 15 airline partners (note the transfer ratios which differ from the 1:1 of Chase and American Express):

Remember: When you transfer your points to an airline or hotel, the points then become subject to that program’s terms and expiration. Capital One points in your credit card account do not expire as long as your card is open and in good standing. Points once transferred to many airline and hotel programs do have an expiration date. Check each program for the details.

K2 Breaking News: A new partnership has just been announced between Air Canada (Aeroplan) and Etihad (Guest). You can now book the renowned Etihad First Class Apartment using Air Canada Aeroplan miles (a transfer partner of Capital One and American Express). This is even bookable online, for very reasonable mileage rates, and no surcharges at that! Dave Grossman at Miles Talk has a great write up on why this partnership is fantastic news.

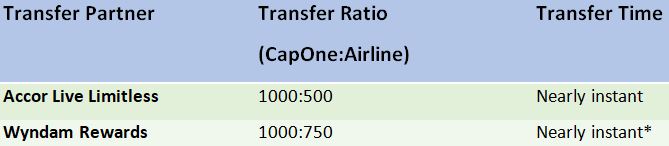

Hotel Partners

Capital One has two exclusive hotel partners, not available with any other credit card program:

Both of these hotel groups have properites worldwide. Accor Live Limitless has a particular focus throughout Europe. Both offer decent redemption value. As always you should compare the value and perks of booking in cash vs. transferring points.

Transfer Bonuses

Though Capital One’s transfer partners are relatively new (they added the first 12 partners only at the end of 2018), they have offered quite a few transfer bonuses. Seven transfer bonuses in 2019 across five different airline programs, to be exact. One such transfer bonus even brought the transfer ratio to 1:1 with Emirates Skywards program. Be sure to read and follow the details here on MileValue as written by Sarah Page.

K2 Top Tip: Do remember that transfers to airline and hotel partners are final! It will not be possible to transfer those points back into your Capital One account, even in the event of cancellation. It is generally recommended to only transfer when you have an imminent plan in mind to use the points.

Tremendous Value Via Transfer Partners

Capital One’s airline partners overlap with some of those from Chase and American Express. So you could book one of the high value Singapore Airlines options we shared previously, for example.

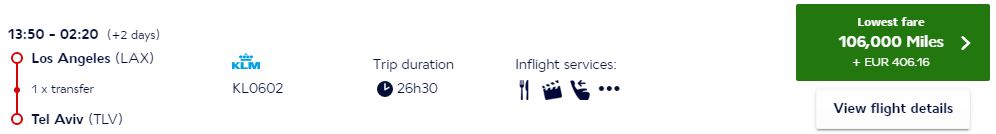

Recently for one of our clients via the MileValue Award Booking Service, we found an excellent redemption via Flying Blue. One sweet spot of the Flying Blue program is that Israel is included in the European region. This means between the US and Israel, you can find business class for just 53,000 miles per person.

Searching for two people around the holidays and New Year’s, there were a few dates available at this rate:

The taxes are a little more than some other programs would charge, but 53k miles per person is absolutely fantastic. Flights were available on Air France or KLM. The wonderful Spencer Howard is a big fan of KLM business class, especially the KLM Delft Blue houses which are given to business class passengers on international flights.

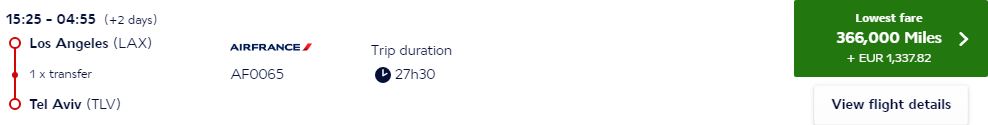

At the time of writing, there were a couple dates available in December – February for six passengers in business class at 53k points per person. Yes, SIX business class award seats available on the same flight:

And there were more dates available for six passengers at 61k points per person:

K2 Insider Info: Though the Flying Blue search results are still showing flights on the Airbus A380, Air France has recently stated they are immediately retiring all of their A380 aircraft. The A380 is loved by passengers and crew in general, but when it comes to business class on Air France A380s, it will not be missed. Air France featured archaic angle-flat business class seats on their A380s. It is expected the Air France A380s will be replaced by A350s and Boeing 787s, with true lie-flat business class.

We’ve written about the Flying Blue program, so be sure to read that article for more details and insights. Greg The Frequent Miler names Flying Blue as one of the five most promiscuous programs, as it is a transfer partner of all the major credit card programs. Even if you do not have enough Capital One points, you can transfer in points from other credit card programs such as Chase Ultimate Rewards or American Express Membership Rewards.

If you would like a guiding hand or prefer to leave all the complexities to an expert, we are here to help at MileValue’s Award Booking Service. We know the routes, transfer rules, and all the little details to help you extract maximum value for your trip. Award travel can be booked as far out as 11 months ahead of time, so you can start planning your future vacation well in advance.

Capital One Travel Rewards Center and Purchase Eraser

Card holders have the option to use their points via the rewards center or to erase purchases. Using your points for either of those two options will always yield a value of 1 cent per point.

With the Purchase Eraser, any travel expense is eligible. As we mentioned with Chase cards, if the purchase codes as travel, then it is eligible. This can cover a wide range of purchases, from airfares to tolls to rideshare and much more. For example, you could charge a baggage fee to your Capital One card for $50. Later, you can erase it from your statement using 5,000 points.

You can also redeem for travel through Capital One Travel at a value of 1 cent per point. Turning your Capital One points into gift cards can be done at a value of 1 cent per point. And there are other options, such as using your points towards Amazon purchases (0.8 cents per point) and statement credit (0.5 cents per point).

Generally speaking, these options are not recommended because you can easily attain better value through transferring your points to travel partners. In other words, you can get more than 1 cent per point value by transferring to airline or hotel partners.

In our example with the flights from Los Angeles to Tel Aviv, the cash fare would set you back almost $3,000 per person:

Using 53,000 credit card points per person means we are getting a value of 5.2 cents per point. That is over five times more value than using the Purchase Eraser, redeeming for gift cards, or using for travel through Capital One.

And it’s not just business class flights where you can get great value. K2 have redeemed many flights in economy class with a redemption value of five cents or more. When cash prices are high or the mileage cost is low, you can find great value. As Sarah Page noted, always compare your options to see where the best value can be found.

For an in-depth look at Capital One’s redemption options, check out this article by Ethan Steinberg at The Points Guy.

Pandemic Bonuses

Through September 30, 2020, you have the option to redeem Capital One points for streaming services, takeout, and delivery. When doing so, each point is worth 1 cent. Sarah Page has recently written about similar offerings from Chase, Amex, and Citi.

Spend Categories

Capital One may have a smaller credit card portfolio than Chase or American Express, but it definitely should not be overlooked. You can match the areas where you commonly spend money with a credit card that earns bonus points in those areas. And for those areas not covered by a particular bonus category, you can still maximize your earnings.

Capital One’s premier travel card is the Venture card. It earns a solid two miles per dollar on every purchase. It doesn’t matter if it’s groceries or department stores or online, you don’t need to adhere to special categories with this card. That makes it a great option for purchases where you would not earn a bonus using other cards.

The SavorOne card offers unlimited 3% cash back on dining and entertainment, and 2% at grocery stores. Entertainment is a category which not many credit cards offer as a bonus, so this may be a good option for some to maximize return in that area. The card has no annual fee. Or for a $95 annual fee, you can earn 4% cash back on dining and entertainment with the Savor card.

For business cards, Capital One has cash back earning cards (the Spark 2% Cash and the Spark 1.5% Cash Select) as well as transferable points earning cards (the Spark 2X Miles and the Spark 1.5X Miles Select). The cards earning 2% cash back or 2X miles have a $95 annual fee starting the second year. The 1.5% Cash and 1.5X Miles cards have a $0 annual fee. Naturally, the Cash cards are for purely cash back. The Mile cards earn transferable points which can be transferred to Capital One’s travel partners.

Special Earnings for Business Cards

If you have the Spark Miles or the Spark Miles Select, you can earn five points per dollar on hotel and rental car bookings. These bookings must be made through Capital One Travel in order to earn the bonus.

K2 Top Tip: Capital One allows you to transfer your points to other accounts. It doesn’t even have to be a family member. Points can be transferred between the Venture, VentureOne, Spark Miles for Business, and Spark Miles Select for Business. If you are planning on closing a Capital One credit card, keep this in mind to transfer your points to another eligible rewards account. Josh Patoka has a great write up on this topic.

Sarah Page, the owner of MileValue, is an expert in the credit card arena. She offers a free personalized credit card consultation service where she’ll look at your portfolio, needs, and future trip desires in order to plan out the best credit card strategy for you. She will also help you navigate the credit card application rules.

Final Approach

Chase Ultimate Rewards and American Express Membership Rewards get most of the attention. But with 17 travel partners, Capital One should certainly not be overlooked. Their cards can offer a nice balance in a credit card portfolio to help you maximize your earnings, and often come with big and valuable sign up bonuses. Not to mention, the ability to transfer your points to any Capital One eligible account is a huge perk.

With the new partnership between Air Canada and Etihad opening up incredible booking opportunities and Emirates drastically reducing their award fees, Capital One should be a consideration.

Keep in mind the transfer ratios (and transfer bonuses) to travel partners. With over a dozen possibilities, Capital One points can be a great way to help you book or top off an airline account. Plus, the two hotel partners are exclusive to Capital One, so you can have even more options at your disposal.

Have you made an airline or travel redemption using Capital One rewards? Please share in the comments below!

Cheers and transfer on.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.