MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

This is the second post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flyer miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go.

In just a few days, you’ll be earning hundreds of thousands of frequent flyer miles, and you need a place to put and track them. Below are the bare minimum airline and hotel programs that Americans should be members of, and as you get more involved with the miles game, you’ll probably sign up for more.

By signing up for these programs, you’ll be able to take advantage of most major miles promotions and credit card offers, and you’ll be able to fly domestically and internationally for pennies.

Each program should just take a moment to sign up for, so don’t skip any even if you’ve never flown the airline. Trust me that they all have a lot of value. For instance, you might not expect that British Airways is often the best program for domestic flights within the United States, and that its miles are also very easy for an American to amass..

If you already have an account with a listed airline, then try to sign into it, so you can figure out your account number and password. Write down your user name or number and passwords all in one place because you’ll add them into your new Award Wallet account today.

- What airlines and hotel programs should you join today?

- What is Award Wallet and why should you join it?

The Programs

If you fly any other carriers like Virgin America or JetBlue, you should also sign up for their programs, but if you don’t fly them, you can stick to the seven listed airlines. If you’re an avid couchsurfer, you can skip signing up for the hotels.

Airlines

Hotels

Award Wallet

I keep track of my miles and points with Award Wallet.

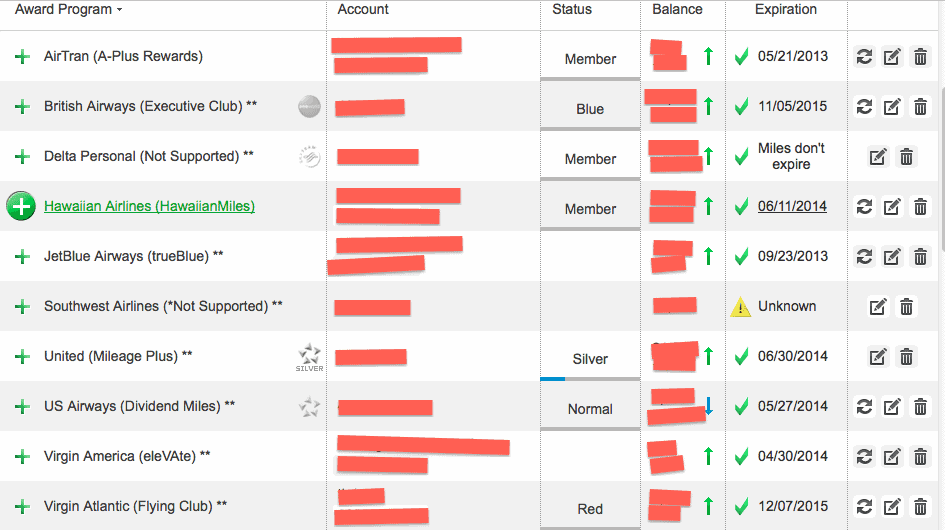

Award Wallet is a free service that tracks your balance, status, user name, and password in nearly every airline, hotel, credit card, rental car, and loyalty program in one place.

The three big exceptions are United, Delta, and Southwest which have blocked Award Wallet from accessing your account information.

I still use Award Wallet because it tracks other airlines, my transferable points, and my hotel points. All told, it tracks 32 of my accounts.

Not only are your balances now listed in one place, but you can click the Update All button to see them all updated in a fraction of the time it would take to go to every program’s site.

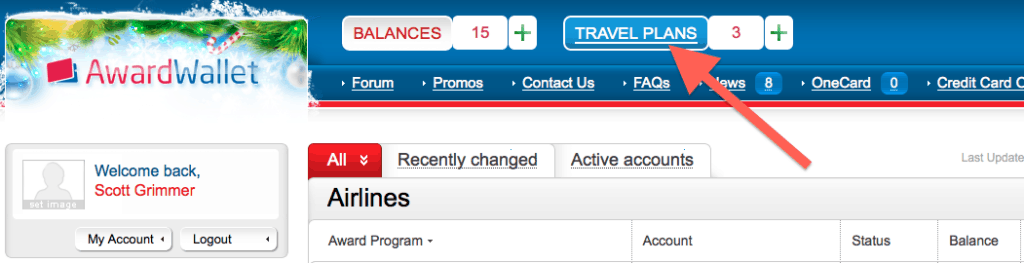

Another great feature of Award Wallet is that it automatically enters your programs and finds your upcoming travel plans and puts them in one place, the Travel Plans tab.

Award Wallet is a fantastic resource that I use every day to keep track of almost all my balances in one place.

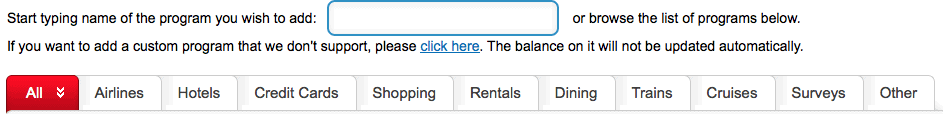

Open your free Award Wallet account now. Populate it with the accounts you set up in this post by clicking the Add a Program Link, then searching for its name or finding it listed alphabetically by category.

By doing this, you can forget about memorizing account numbers and passwords; they are all stored by Award Wallet. You can also substantially cut down on the number of programs you have to log into to see your award balances.

Unfortunately the free version of Award Wallet only shows expiration dates for three programs’ miles. I have some free codes to upgrade, which will cause Award Wallet to display all your expiration dates. First 30 come, first 30 served:

If all the codes are used, but I frequently announce the giveaway of new codes on Twitter. Follow @milevalue.

Invite-55486-IXLOZ – use coupon

Invite-55486-LNCAQ – use coupon

Invite-55486-QOGAT – use coupon

Invite-55486-STHWY – use coupon

Invite-55486-XMNPO – use coupon

Invite-55486-AVHKK – use coupon

Invite-55486-APNBT – use coupon

Invite-55486-BIIMK – use coupon

Invite-55486-CMPTP – use coupon

Invite-55486-DFWTH – use coupon

Invite-55486-DZTQO – use coupon

Invite-55486-ECBSQ – use coupon

Invite-55486-FBVYA – use coupon

Invite-55486-FQKEG – use coupon

Invite-55486-FTSDL – use coupon

Invite-55486-GSYCL – use coupon

Invite-55486-IDPBT – use coupon

Invite-55486-IGOXO – use coupon

Invite-55486-JNPZM – use coupon

Invite-55486-JTDVW – use coupon

Invite-55486-JVTYP – use coupon

Invite-55486-KHUOD – use coupon

Invite-55486-LWGJZ – use coupon

Invite-55486-METGV – use coupon

Invite-55486-MMLCM – use coupon

Invite-55486-MRCTG – use coupon

Invite-55486-OXOIL – use coupon

Invite-55486-PIGPH – use coupon

Invite-55486-QGYSZ – use coupon

Invite-55486-QPLZC – use coupon

Don’t forget, AwardWallet also has a free Mobile App, which definitely comes in handy!

Don’t forget, AwardWallet also has a free Mobile App, which definitely comes in handy!

I use Miles Wallet, it’s free

I use Miles Wallet, it’s free

[…] useful. Sign up now for the many future deals when you will want to transfer between the two, and put your log in information in your Award Wallet account, so you have it for the next […]

[…] useful. Sign up now for the many future deals when you will want to transfer between the two, and put your log in information in your Award Wallet account, so you have it for the next […]