MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

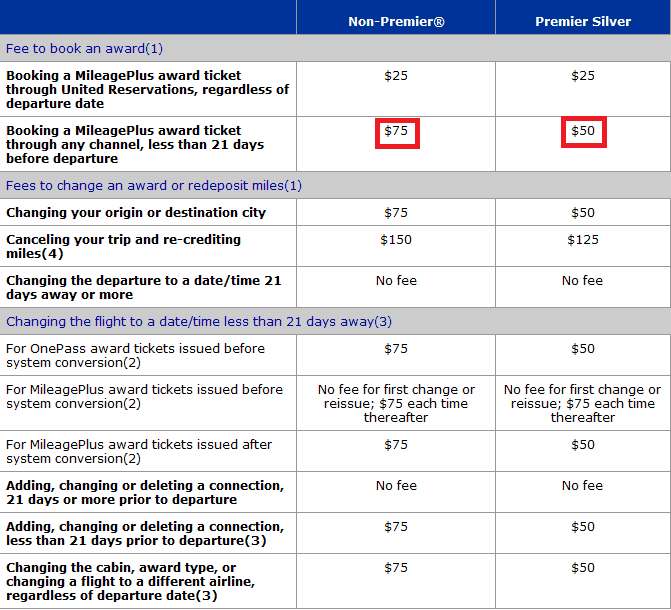

Anyone without United status is charged a hefty $75 fee to book an award within 21 days of departure. There are two tricks to reduce or eliminate this fee.

Trick 1- Transfer your Ultimate Rewards to a Status-ful spouse’s United account

Ultimate Rewards can be transferred to your United account or your spouse’s. If your spouse has status, transfer there.

If you transfer your Ultimate Rewards to a spouse’s account who has Premier Platinum or higher status and book from his account, the $75 fee will be waived.

As a bonus, future change and cancellation fees will be waived too, so you don’t need to worry about yesterday’s tricks for reducing or eliminating those.

Trick 2- Book an award 22+ days out and change it to your real award — perhaps

If you don’t have Ultimate Rewards or a friend with Platinum+ status, I might at least be able to save you $25, using one of yesterday’s tricks.

Take a look at United’s award fee chart:

Ordinarily non-elites are charged $75 for booking an award ticket within 21 days of departure. Non-elites are charged the same $75 if they try to change an award within 21 days of departure.

Ordinarily non-elites are charged $75 for booking an award ticket within 21 days of departure. Non-elites are charged the same $75 if they try to change an award within 21 days of departure.

Theoretically that means that there is no advantage to booking a dummy award and changing it to your real award if you want to make a last-minute booking. But I think doing just that might save non-elites $25.

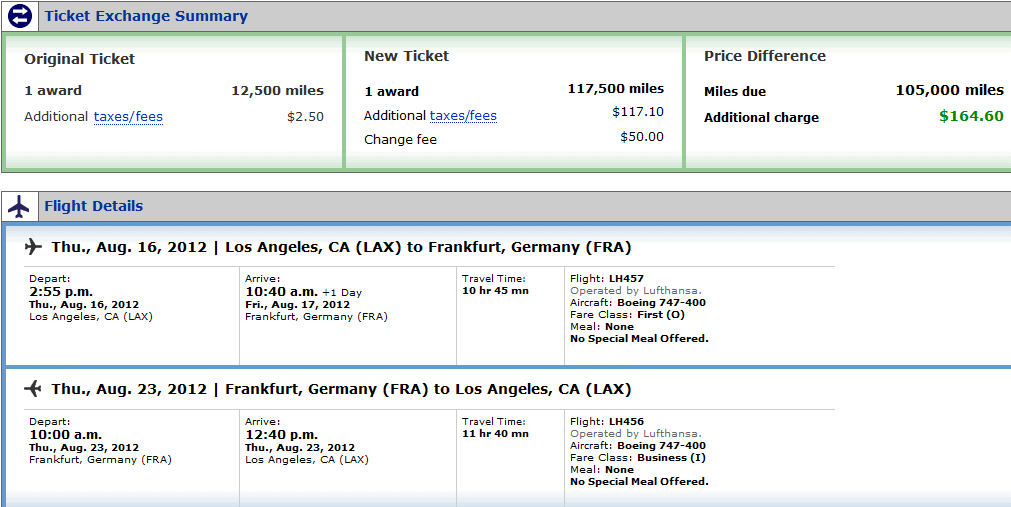

Here’s my reasoning. Look at this award change:

This is a within-21 day change, so there should be a $75 fee. That fee is not listed where it would be in a normal award search, under the taxes/fees link. Instead, we just see the $50 “Change Fee” listed where it was yesterday when we were basically cancelling itineraries.

This is a within-21 day change, so there should be a $75 fee. That fee is not listed where it would be in a normal award search, under the taxes/fees link. Instead, we just see the $50 “Change Fee” listed where it was yesterday when we were basically cancelling itineraries.

I have Silver status with United, so that’s what I should be charged to make a within-21 day change: $50. This possible trick doesn’t save me anything.

But I think it might save non-elites $25 to book within-21 day itineraries this way. The reason is that the $50 charge listed in the screen shot above is exactly the same $50 fee that was charged to non-elites yesterday when they should have been charged $75.

Unfortunately, I don’t have access to a non-elite United account, so I can’t check whether this trick works and saves $25 for close in bookings. But if you can check, let us know.

Either way, the next time you want to make a within-21 day booking on United without status, it can’t hurt to make a dummy booking then immediately try to make the change to your desired award. At worst, you’ll break even. At best you’ll save $25. (Don’t forget if you try to make a change, and the award space you wanted has disappeared, you can cancel a United award within 24 hours of booking it for free.)

Recap

Save $75 per ticket on last minute bookings by transferring your Ultimate Rewards to a friend with high-level United status and having him book.

If you don’t have Ultimate Rewards or friends, you can try my as-yet-unproven second trick to save $25 on a last minute booking by booking a distant-future dummy award and replacing it with your real desired award.

Scott, if you have the United Club card or the old Continental Presidential Plus card, you won’t be charged the $75 close-in fee, either. So that will give you one more option to consider, when thinking about whom to transfer your Chase UR points to.

That’s a great reminder. Thanks

“If you don’t have Ultimate Rewards or friends, you can try my as-yet-unproven second trick…”

I agree! if you have enough Ultimate Rewards, you don’t need any friends!

If you have Ultimate Rewards, you don’t need to make friends. Friends will make you.

[…] damage waiver but little else). His posts this week on saving on United award cancel fees and last minute award bookings are just what I needed, with a bonus post on United Miles and Avios in […]