MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

American Express Membership Rewards transfers to British Airways will come with an automatic 20% transfer bonus from now through December 31, 2013.

It’s transfer bonus season with Membership Rewards. Yesterday I detailed how the 30% Transfer Bonus to Virgin Atlantic Means 14k Point Awards to Europe and 35k Roundtrips to Argentina.

Is this British Airways transfer bonus a good deal? Should you take advantage of the 20% transfer bonus?

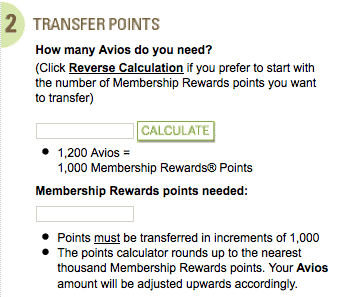

Until December 31, 2013, you can transfer increments of 1,000 AMEX points to 1,200 Avios automatically at membershiprewards.com.

That might sound like a good deal, but I am skipping this transfer bonus for two reasons:

- 1.2 Avios per dollar is not the fastest way to earn Avios. You earn 1.25 Avios per dollar on all spending on the British Airways Signature Visa.

- This is the smallest transfer bonus I’ve seen between Membership Rewards and Avios.

It’s really easy to get a ton of Avios. (See The Best Cards to Earn United, American, Delta, US Airways, Alaska, Southwest, and British Airways Miles.)

You can get them on the British Airways card or you can transfer Ultimate Rewards or Membership Rewards instantly to British Airways.

Not as Good as 1.25 Avios on All Spending

Because there are options, we should choose the best one for earning Avios. Earning 1 Membership Reward per dollar on spending and then transferring those to Avios with a 20% bonus is not the best option. That’s only 1.2 Avios per dollar. The British Airways Signature Visa offers 1.25 Avios per dollar on all spending.

Of course you don’t always have to earn your Membership Rewards one at a time. For instance the Premier Rewards Gold Card earns 3x Membership Rewards with airlines and 2x at gas stations and grocery stores.

But there’s still something that holds me back about a 20% bonus when all spending on the British Airways card has a “25% bonus.”

Low Transfer Bonus Compared to Others

There are frequent Membership Rewards transfer bonuses to Avios. The last one ended in June and was for 35%. Or last December, there was a 30% bonus.

If you’re thinking of transferring speculatively, wait. A better bonus will probably come along in the next six months.

Avios Are Great

I’m not high on this transfer bonus, but I am high on Avios. There are some incredible values on direct flights with Avios. I booked two Avios awards in Europe this summer to see the British Airways A380 and 787 in business class. And I am flying next week on an Avios award to Hawaii for only 12,500 Avios and $2.50–an unbeatable price.

If you really need Avios and have Membership Rewards, this is an OK deal–certainly better than transferring Ultimate Rewards 1:1.

But don’t transfer a ton of Membership Rewards over without a specific award in mind.