MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

I only cover hotel promotions when one is so good that with a little time and money, you can unlock stays that are worth several times your effort.

IHG Rewards Club’s new Accelerate promo for stays from January 1 to April 30, 2016 is mattress-run-worthy for some people.

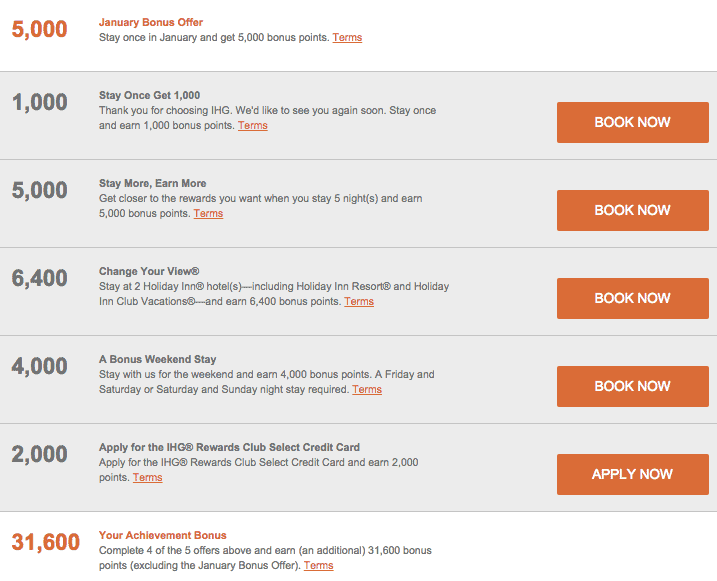

Sign into your account here to see your targeted offer. My offer is:

If I don’t apply for the IHG credit card from Chase, I’d need to make:

- two stays

- at Holiday Inns

- for five total nights

- one of which includes either Friday/Saturday or Saturday/Sunday night stays

- one of which is in January

That would net me 53,000 bonus IHG points in addition to the points I’d earn from the stays themselves. I could probably knock this out for $500. If the stays had no value for me, that would be like buying IHG points for 1 cent each, which is a bad deal because they are worth 0.5 cents and because you can always buy them for 0.7 cents each.

If I needed the stays and valued them at full price, then I’d be getting $265 worth of IHG points for free.

I have registered, and I will look at my 2016 stays to see if the promo makes sense for me. If I had gotten an easier bonus, I would definitely be involved. One Mile at a Time got this offer:

- January Bonus Offer — 5,000 bonus points (stay once in January)

- Stay Once Get 5,000 — 5,000 bonus points (stay once during the promotion period)

- Stay More, Earn More — 10,000 bonus points (stay five nights during the promotion period)

- Earn More, Faster — 2,000 bonus points (book a bonus points package during the promotion period)

- Spend On Your IHG Rewards Club Credit Card — 15,000 bonus points (pay for a stay with your co-branded credit card)

- Your Achievement Bonus — 31,500 bonus points (complete three of the four offers — excluding the January Bonus Offer — and earn this bonus)

That means he “could book a stay at the Candlewood Suites Clearwater with a 1,000 point bonus package for $81.99 for one night… and therefore unlock the achievement bonus.”

That’s paying under $90 for over 50,000 IHG points, a no brainer.

By contrast, some on FlyerTalk are being required to stay 40 nights or stay at hotels in four foreign countries to unlock all their bonuses.

Should You Participate

Simple math: is the value of participating greater than or less than the cost?

For the value, add up your bonus points, the regular points from stays, and the value of your stays.

For the cost, add up the cost of the stays and the cost of your time going to mattress runs (zero value stays you make only for the promo).

Only participate if the value exceeds the cost.

Bonus

You still have time to participate in this amazing IHG promotion to earn 47,000+ IHG points for $56 from home. Read the comments to see actual experiences of people participating.

My targeted offer is 53,000 points after staying EIGHTEEN nights! Seems like a ton

My targeted offer is 53,000 points after staying EIGHTEEN nights! Seems like a ton

[…] Check your IHG Accelerate Promo, which may be an easy 50,000 IHG Points. […]

[…] Check your IHG Accelerate Promo, which may be an easy 50,000 IHG Points. […]