MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Each day we edge closer to the end of the year, which is significant if earning elite status is on your radar. You’ve got just under two months to meet elite qualifying requirements if you want status in 2017.

And the American Express Delta credit cards have limited time, enhanced sign up offers that end day after tomorrow–November 9. Along with a 70k redeemable mile bonus, the platinum version also offers a boost of MQMs for meeting the $5,000 minimum spending requirement, which could be crucial if you need to top off your MQM balance and don’t have time nor want to spend the money on earning butt-in-seat miles.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

Today I will go over the basics of qualifying/re-qualifying for Delta elite status in their Medallion program. To be completely clear, none of the different types of “miles” I will discuss in this post are redeemable, unless I expressly say redeemable beforehand. They are instead separate metrics of spending/flying with Delta/partners one must reach in a calendar year in order to qualify for Medallion status the following year.

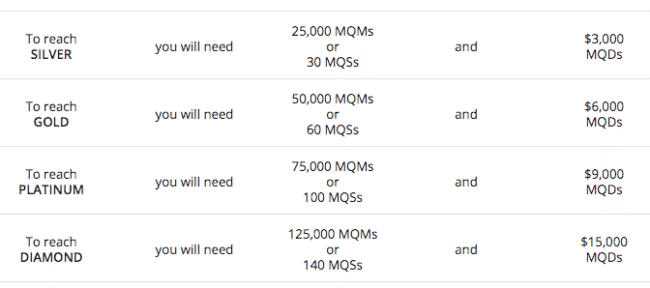

Requirements For Earning Delta Medallion Status

Key Terms

Key Terms

- MQM = Medallion Qualifying Mile

- MQS = Medallion Qualifying Segment

- MQD = Medallion Qualifying Dollar

You have to meet either the MQM or MQS threshold, whichever you hit first, as well as the MQD threshold for each respective tier to earn the benefits associated with that tier. You must meet these thresholds in the current calendar year (January 1 – December 31) to qualify for Medallion status in the following calendar year.

You earn Medallion Qualifying Miles by flying them. When you buy a cash ticket flying Delta and/or Skyteam partners, the amount of MQMs you’ll earn is based on the cabin and distance you fly.

You also earn Medallion Qualifying Segments by flying them. A segment is considered one takeoff and one landing.

Medallion Qualifying Dollars are “the sum total of the SkyMiles member’s spend on Delta-marketed flights (flight numbers that include the “DL” airline code), inclusive of the base fare and carrier-imposed surcharges, but exclusive of government-imposed taxes and fees” taken from Delta.com). If the flight is marketed and ticketed by a partner airline, you’ll earn MQDs based on a percentage of distance flown as determined by the fare class paid.

Checking Your Status Counting Balances

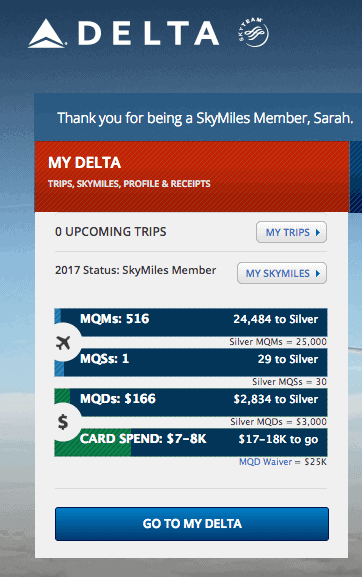

You can check all the metrics outlined above by logging into your Delta account on delta.com. The home page of your account will have MQM, MQS, and MQD balances–and if you have one, the amount you’ve spent on your Delta co-branded credit card–all listed in a box on the left side of the screen.

Here’s what mine looks like. You can tell that I’m not chasing Delta status.

Look at Your Upcoming Fights

This seems obvious, but if you’re checking how close you are to qualifying for 2017, don’t forget to consider what MQMs/MQSs/MQDs you have scheduled to earn for upcoming booked flights on Delta before the end of the year. Here’s how to judge what you’ll earn.

MQMs

By logging into your Delta account and clicking My Trips, you should be able to see the amount of miles you’ll fly on upcoming trips. You could also plug in the routing of your upcoming flights into Great Circle Mapper to find the same number, which should be roughly equal to MQMs earned if you’re flying economy. If you’re flying any cabin other than economy than that you’ll need to adjust for the bonus you get for doing so.

You can check bonuses when earning MQMs on Delta flights here on delta.com.

You can check bonuses when earning MQMs on partner airlines here on delta.com

MQSs

To see how many MQSs you’ll earn, just count those by hand. One take-off/one landing = one segment.

MQDs

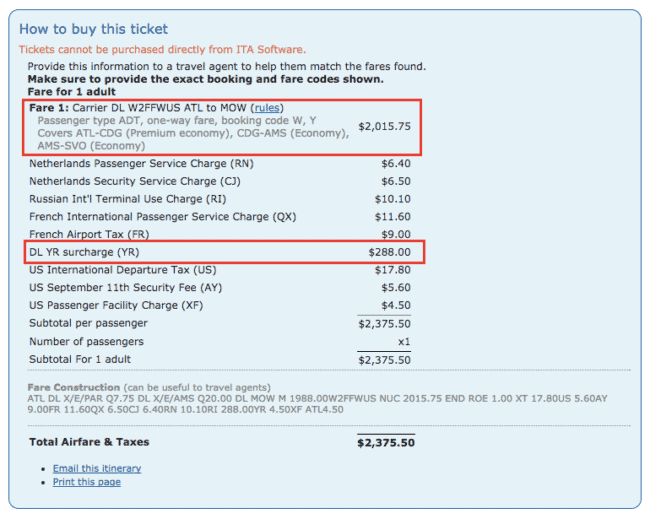

For figuring out how many MQDs you’ll earn on Delta marketed flights, search for the flight on ITA Matrix to see the price breakdown. In the itinerary details, the base fare is apparent (it will be labeled fare) and the carrier-imposed surcharges are labeled either (YR) or (YQ).

For figuring out how many MQDs you’ll earn on partner flights, check the distance flown either in your Delta account online or at Great Circle Mapper, and then adjust by using the percentages listed on delta.com for earning MQDs via partner airlines (click on each partner to view percentages based off of cabin flown).

Extra MQMs Roll Over Into the Next Calendar Year

If you earn more MQMs than is necessary in a calendar year to qualify for a Medallion status tier (and you also meet that tier’s MQD requirement), then any extra MQMs beyond that threshold will roll over to the next year.

For example, let’s say you earned 45,000 MQMs and 3,000 MQDs this year (2016), which more than qualifies you for Silver status for next year (2017). The extra 20,000 MQMs earned in 2016 will roll over to 2017, so you’d only have to earn an additional 25,000 MQMs (in addition to the 3,000 MQD requirement) in 2017 to re-qualify for Silver status in 2018.

MQD Waiver Via Credit Card Spend

All of the Delta Amex cards–Gold, Platinum, and Reserve–come with the perk of a waiver of the MQD requirement for any status tier if you spend $25,000 on the card within the calendar year.

It’s most likely too late to take advantage of this perk of the Delta cards to qualify for Medallion status for 2017 (unless you can put 25k of spend on the card in the next two months!!), but the MQD waiver is important nonetheless for future consideration.

Topping Off Your MQM Balance Via Credit Card Spend

It is not too late to take advantage of the sign up offers from the Delta Platinum or Reserve card to top off your MQM balance for this year.

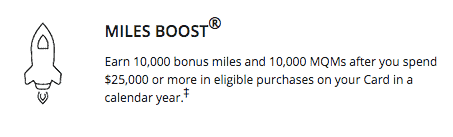

The Platinum Delta SkyMiles Amex offers 10,000 MQMs (along with the 70k redeemable miles and other valuable perks, at least through November 9) for spending $5,000 within three months of opening the account. There’s also incentive for longterm spending on the Platinum card:

The Delta Reserve Amex will give you 10,000 MQMs (along with 10k redeemable miles and other valuable perks) after your first purchase on the card. This card comes with incentive for longterm spending as well:

Both cards have annual fees of $450.

Source for Delta Mileage Run Deals

Renes Points has some of the most up to date info about flights that are economic and efficient for earning MQMs and MQDs if you’re trying to top off your balances before the end of December.

Bottom Line

If you’re reaching to achieve Delta status in 2017, now’s the time to count your elite-qualifying balances in case moves need to be made.

Among other perks, the Platinum Delta SkyMiles Amex is offering 70,000 bonus miles, 10,000 MQMs, and a $100 statement credit after you spend $5,000 in your first three months. The enhanced sign up offer ends in two days.

The Delta Reserve Amex is another way to beef up on MQMs for the year fast, as you get 10,000 of them after your first purchase. I don’t recommend signing up for this card unless you’re looking at the longterm angle, because the sign up bonus of redeemable miles (while it only requires one purchase) is a meager 10k compared to the Delta Platinum card’s 70k when both cards have the same $450 annual fee. But over time, the Delta Reserve offers more MQM bonuses than the Delta Platinum if you have the spending capacity.