MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Barclaycard Arrival Plus comes with 50,000 bonus Arrival miles after spending $3,000 on purchases in the first 90 days. The card earns 2 miles per dollar on all purchases. You can redeem the miles on to offset any travel expense greater than $100 (one mile = 1 cent when redeeming on travel expenses specifically) inside your Barclaycard account within 120 days of the purchase. Here is How to Redeem Arrival Miles. Read Barclaycard Arrival Plus: 2% Back Card with $500 Sign Up Bonus to learn all details about the card.

The requirement to redeem at least $100 worth of Arrival miles at a time on travel expenses means you must redeem at least 10,000 miles at a time. You need to strategize which charges you are going to redeem miles for so you aren’t left with an amount below 10k. If you don’t, you could be left with orphaned Arrival miles.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

I’ll show you what I mean by with a series of Arrival miles redemptions made by a friend recently.

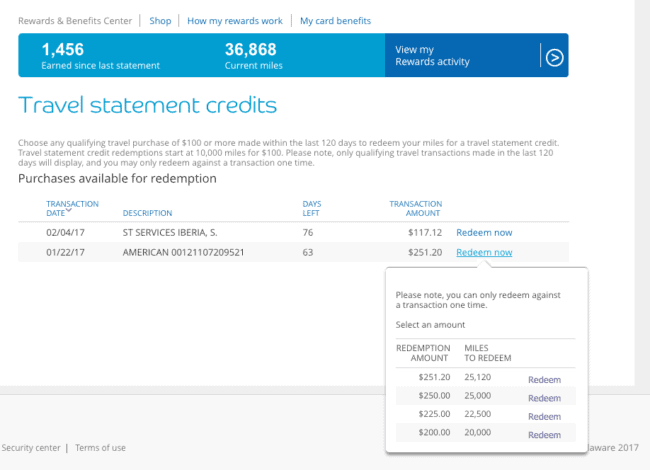

Here is an Arrival Plus account with 36,868 miles in it. That’s the equivalent of $368.68 in travel statement credits. If you don’t know how to get to this section of your account and need help navigating, read How to Redeem Arrival Miles.

There are two charges that, out of all of this person’s expenses, qualified as travel expenses.

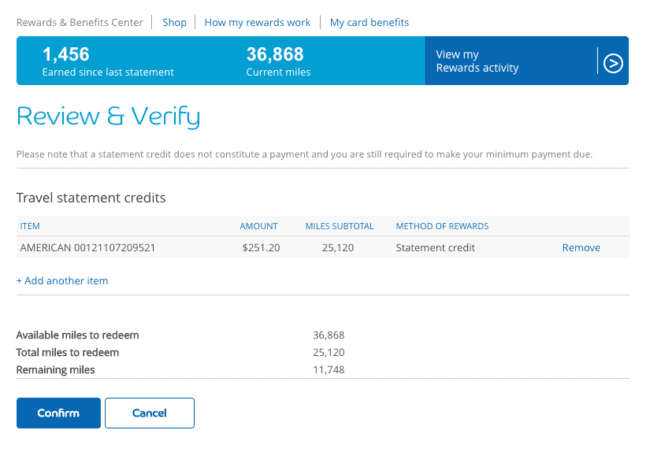

Clicking the Redeem now link next the American Airlines charge shows redemption options. If desired, they could redeem 25,120 Arrival miles to offset the entire charge of $251.20. Which is what they did by click Redeem next to the 25,120 amount.

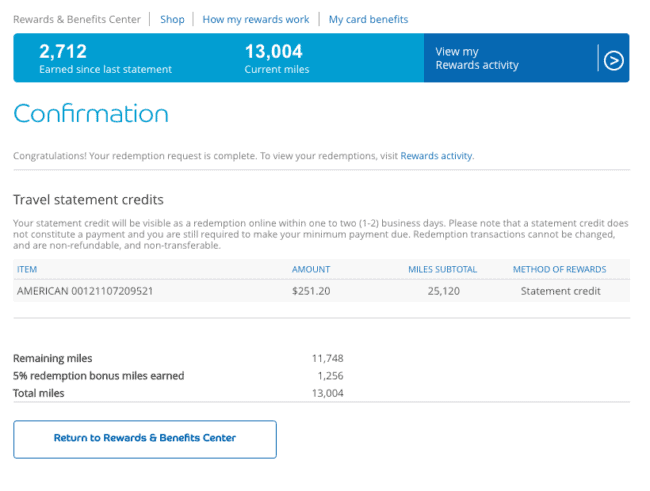

After clicking Confirm, the following page accounts for the 5% rebate they received and the updated balance of Arrival miles post redemption and post rebate.

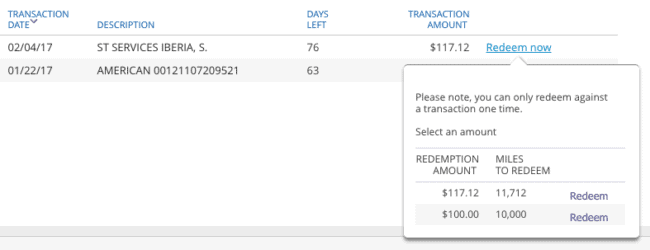

With 13,004 Arrival miles left, they had enough leftover to go back and redeem for that $117.12 charge, which would take 11,712 Arrival miles to totally offset the cost of.

With 13,004 Arrival miles left, they had enough leftover to go back and redeem for that $117.12 charge, which would take 11,712 Arrival miles to totally offset the cost of.

But doing so (13,004 – 11,712) would have left them with 1,292 Arrival miles (+ the 5% rebate, so actually 1,877 miles).

As I knew my friend had already (just) bought another plane ticket on their Arrival Plus that cost over $200, I advised them to wait until that charge posted in their account so they could redeem ALL of their remaining Arrival miles instead of leaving a lonely 1.3k in the account, which you can’t do much with since the minimum redemption for travel expenses is 10k. You could redeem 1.3k Arrival miles in other ways, on merchandise and whatnot, but you won’t get 1 cent of value per point and it’s not worth it.

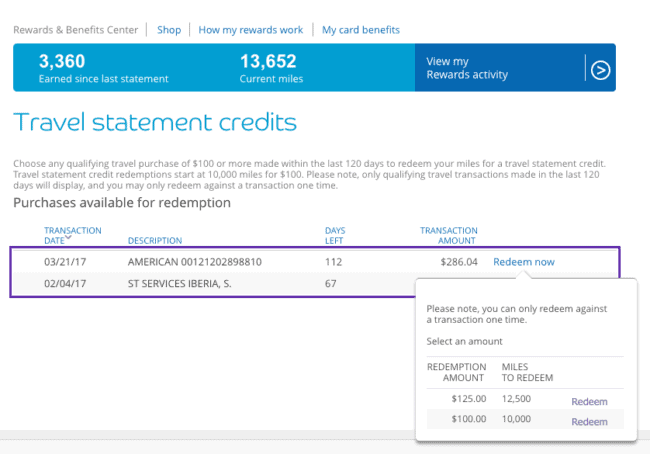

Here is what the account looked like once the new ticket charge posted…

…notice anything strange? The maximum amount it says they can redeem is 12,500 miles. Yet their account has 13,652 miles in it. I knew that, unless the terms & conditions of the Arrival miles had changed without my knowing, that wasn’t correct. They should have been given the option to redeem all the remaining miles in their account, 13,652, since the charge was for more than $125.

They called Barclaycard customer service and after getting a manager on the phone who was able to look into their account and see what was happening (or rather, what the site wasn’t properly allowing them to do), a redemption of 13,652 Arrival miles was done by hand by the manager. This meant all possible Arrival miles were redeemed. Post 5% rebate, my friend was left with 682 Arrival miles.

Dealing with Large Amounts of Leftover Arrival Miles

Didn’t redeem so wisely? Have 6,000 Arrival miles leftover and don’t want to spend another $2,000 on the card to get to 10,000? You can earn Arrival Mile by posting short travel tips + a photo on the Barclaycard Travel Community.

The Barclaycard Travel Community is an aggregator of travel stories. Users share short stories about trips with at least once picture each, and some have added details like recommendations for hotels, restaurants, etc. Users are incentivized to share their experience by earning participation miles, which can be translated to Arrival miles if you have Arrival Plus or Arrival card.

You’ll earn

- 150 participation miles for each story you write (minimum of 100 words each)

- 10 participation miles for every detail you add

- 10 participation miles for every kudo you receive

Register here to join the community and you can start earning extra Arrival miles too!

Bottom Line

Of course, no matter how efficiently you redeem Arrival miles for travel expenses, you’ll always be left with a balance due to the 5% rebate. I’m sure the rebate is there for that exact reason–an incentive to keep you spending on the card. But if you’re careful with the way you redeem for travel expenses rather than redeeming without rhyme or reason, you can certainly end up with less orphaned miles.

I don’t remember how it happened but I have -1,143 miles. Since it is the Arrival card, not the Plus it is in the sock drawer.

Same thing happened to me a couple of weeks ago (not being able to redeem my full balance for a $125 travel purchase). I called, was put on hold for a long time, then was told it was not possible because the system would not let them do it. It seemed so absurd that later I sent a secure message to Barclay & got the same reply. Now I’ve got over 1,000 Arrival miles that will go to waste (since I’m definitely not using the card now). Grrrr. I wish I would have seen this article a couple weeks ago–hopefully it will help someone else out! Thanks.

I had the Barclay once before when they didn’t have the 10k requirement so when I got this card again this past year, I didn’t look closely at the terms and conditions and just chalked it up to a system change. I have orphaned miles now and was trying to build up to the 10k requirement again. Good to know this. Just to clarify – you mean that if you redemption amount is greater than all the points value in your account you SHOULD be allowed to redeem all of them, but will just have to get a manager on the phone?

[…] expenses specifically) inside your Barclaycard account within 120 days of the purchase. Read How to Avoid Orphaned Arrival Miles to learn the ins and outs of efficiently redeeming your Arrival miles so you’re not forced to […]

I use this card for putting some travel on it and then doing the necessary spend to cover that cost. I have found this card great for things you just cannot get coverage with other cards. Such as, parking garage while on a cruise, cruise fees, odd flights in Europe.

The fact that you have 120 days to come up with the points, is even greater. This card should be in everyone’s arsenal and used specifically to cover those odd costs.

Put things in perspective, 1000 orphan points is only worth $10. There are bigger things to worry about.

While the redemption benefit is not as good as it once was, it is still covers the things that sting a bit.