MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Now is a special time to earn American Airlines miles.

- The personal American Airlines credit card is offering 50,000 bonus miles after spending $3,000 in the first three months.

- The business American Airlines credit card is offering another 50,000 bonus miles after spending $3,000 in the first three months.

The personal deal has been the official offer since late October and the business deal since late November, so they’ve been around for three and two months respectively.

How much longer can we expect these amazing deals to last?

First, a quick word on why the deals are so amazing: American Airlines has a much better award chart than its competitors. If United or Delta are publicly offering 50,000 mile bonuses on their cards, that’s great, but not as good as these American Airlines offers.

Delta and United both jacked up the number of miles needed for premium-cabin awards in 2014. American hasn’t touched their award chart in years, so it’s like you can pay the last-generation miles price for premium-cabin awards with American Airlines miles. I gave an example the other day in my post about using AA miles to East and Southeast Asia:

- American charges 55,000 miles one way to Southeast Asia in Business Class and 67,500 miles in First Class.

- Delta charges 70,000 miles in Business Class. Delta miles cannot be used to book international First Class.

- United charges 80,000 miles one way in partner Business Class and 130,000 miles in partner First Class.

These massive savings on premium-cabin awards compared to its competitors run throughout the American Airlines award chart.

Even on economy awards, Delta and United only bumped a few award prices up, but American still has by far the best economy award prices because it offers “off peak” awards in economy for much of the year to much of the world. For example:

- American charges 17,500 miles one way in economy to Hawaii for much of the year and 20,000 miles to Brazil and Argentina for much of the year.

- Delta and United charge 22,500 miles to Hawaii all year and 30,000 miles to Brazil and Argentina all year.

So 50,000 American Airlines miles does not equal 50,000 Delta or United miles. The American Airlines miles are worth more.

How long can we earn 50,000 bonus American Airlines miles on one card?

I don’t have any inside info, so I’ll look to clues from what competitors have done and what American Airlines is up to.

United publicly offered 50,000 bonus miles online on its basic personal card for one month last year. Delta also ran a few very short-term 50,000 mile public, online offers.

These American Airlines offers have been around for 2-3 months, so that’s not a good sign.

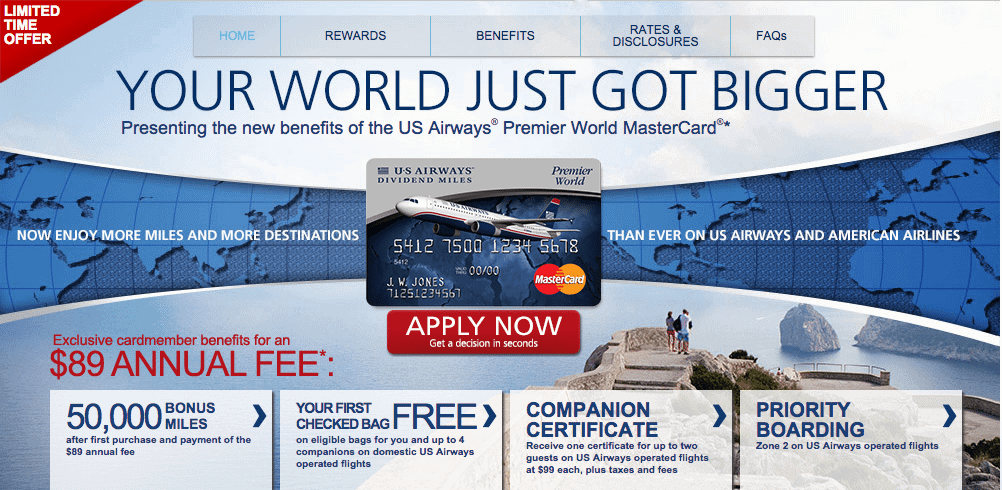

What is a good sign is that the US Airways credit card has been offering 50,000 bonus miles for the last two months.

While American Airlines and US Airways are the same company, the American Airlines credit card and US Airways credit card are competitors. The cards are issued by two different banks.

Barclaycard, which issues the US Airways card, will lose its ability to issue new US Airways cards when the US Airways Dividend Miles program disappears, some time before the end of June. Barclaycard will retain the right to service those accounts, and will convert them to American Airlines cards.

That means Barclaycard has a strong incentive to sign up as many new customers as possible right now, which probably explains the prolonged 50,000 mile sign up bonus.

Right now I consider American Airlines miles and US Airways miles to be nearly identical. There are differences, but some time in the next few months, they will both be American Airlines miles, so the easiest way for me to think about them is 1:1 equals.

Since the main competitor of the American Airlines card is offering 50,000 bonus miles, that puts pressure on Citi to offer 50,000 bonus miles on the AA card.

I am cautiously optimistic that the US Airways card and American Airlines cards will both offer 50,000 bonus miles until the AAdvantage and Dividend Miles programs combine, some time between April 1 and June 30, 2015 according to the airlines. The offers could disappear at any time, but this is my best guess from competing banks.

I don’t mind putting my guesses out there and being proven right or wrong. Feel free to put your guess publicly in the comments. The range of guesses will be interesting, and we’ll see who gets it right.

Getting the Miles

American Airlines miles are super easy to get.

Some credit card offers in this post have expired, but they might come back. If they do they will appear –> Click here for the top current credit card sign up bonuses.

Right now the Citi® / AAdvantage® Platinum Select® MasterCard® comes with 50,000 bonus miles after spending $3,000 in the first three months. The card also comes with other awesome benefits like a 10% rebate on miles used for award bookings.

The business version, the CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®, also comes with 50,000 bonus miles after spending $3,000 in the first three months. This card comes with 2x miles on select business purchases and a 5% miles bonus on renewal. One person can have both cards.

We also know that The US Airways® Premier World MasterCard® will no longer be offered to new applicants as soon as the US Airways and American Airlines frequent flyer programs integrate, some time by June 2015. That means that the chance to earn 50,000 bonus miles after first purchase on this card will disappear soon.

All US Airways miles not redeemed on the US Airways chart by the time of integration will become American Airlines miles, and American Airlines has committed to not devaluing its award chart at the time of combination. The two types of miles are roughly equal in value. Getting all three cards now and meeting their spending requirements means you will have at least 156,000 American Airlines miles by June.

Can you get the signup reward for the citi platinum if you had the citi gold?

Can we apply for AA personal and business card on the same day? The current Citi policy for existing AA personal card holders is a straight denial. Right?