MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Transferable points are points you earn from a credit card that you can transfer to many different types of airline miles or other points. They are valuable because they give you so much flexibility. Each airline program has strengths and weaknesses in terms of the number of miles you need and the availability from point A to point B. Collecting transferable points ensures that no matter where you decide to go, you can always transfer your points to the type of airline miles that is best for the award you want.

Since award space can be a scarce resource, it is important to note that not all transferrable points transfer to their partners instantaneously.

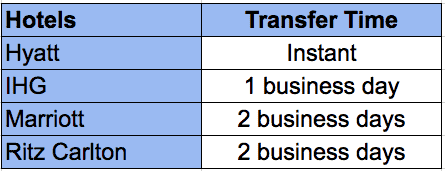

This is the first post of a four part series going over how long it takes each type of transferrable point to transfer to its partners. Today’s post is about the transfer times between Ultimate Rewards and each of its seven airline partners and four hotel partners.

- How Long Does it Take Ultimate Rewards to Transfer? (this post)

- How Long Does it Take Membership Rewards to Transfer?

- How Long Does it Take ThankYou Points to Transfer?

- How Long Does it Take SPG Points to Transfer?

Ultimate Rewards Transfer Times

Ultimate Rewards transfer to almost all the airline partners instantaneously except for Singapore. People report different spans of time for how long it took their Ultimate Rewards to hit their KrisFlyer account after initiating a transfer. Many say within a day, others two days. I haven’t seen many people report it taking any longer than two.

Putting Awards on Hold

Of course, the transfer times above are what you will almost always see, but occasionally there may be a mishap with a transfer and you’re left waiting in limbo. These cases are not common, but if it happens to you, here are some tips about how to put Ultimate Reward’s transfer partners awards on hold.

United

United allows you to pay to hold an award via their FareLock option. Price depends on the award but is generally anywhere from $10 to $30.

A member of our Award Booking Service team also came up with a simple hack for putting United awards on hold for free. I haven’t tried this in a while, but I assume it still works.

Singapore

Singapore doesn’t “officially” allow holds, but supposedly it is possible to put a Singapore award on hold for free. Some say you have to have 50% of the required mileage already in your account, others say 30%, and others have reported needing none. I think this is a case of YMMV. If you don’t get a good agent, call back until you find one that will hold your award.

Upon Arriving has a post with tips outlining how to put a Singapore award on hold.

Flying Blue

Flying Blue is known for holding awards for free for up to 48 hours, but this is also going to depend on the agent. If you don’t like what you hear, hang up and call again.

Korean Air, Virgin Atlantic

Award holds are allowed for free with Korean Air and Virgin Atlantic, no tricks or tips needed! You can put a Virgin Atlantic award on hold for 48 hours. Korean Air awards can be held for longer, weeks and maybe even months for awards flying their own planes.

Bottom Line

Luckily there isn’t lag time with the majority of Ultimate Rewards’ airline transfer partners. You may have to wait a bit for hotel points to hit your account, but hotel award space is not usually as scarce a resource as airline award space so that shouldn’t be a problem.

See http://www.flyertalk.com/forum/chase-ultimate-rewards/1509673-ultimate-rewards-transfer-partners-times-rules.html for lots of great info on transfer partners and time frames.

[…] How Long Does it Take Ultimate Rewards to Transfer? […]

[…] When I found the award space, we were all so shocked that we wanted to book it right away. I knew the transfer time between Ultimate Rewards and Singapore isn’t always instantaneous. Transfers can take up to two business days, and I had found the […]

[…] How Long Does it Take Ultimate Rewards to Transfer? […]

[…] How Long Does it Take Ultimate Rewards to Transfer? […]

[…] The same award space is bookable with Singapore miles, and Singapore wouldn’t charge any close-in booking fee. But it would cost 12,500 miles and they would have to be transferred from Ultimate Rewards to Singapore, which on average can take up to two business days. […]

Korean air allows awards on hold I had 3 awards on hold for up to 3 month and 5days before departure.

[…] The same award space is bookable with Singapore miles, and Singapore wouldn’t charge any close-in booking fee. But it would cost 12,500 miles and they would have to be transferred from Ultimate Rewards to Singapore, which on average can take up to two business days. […]

[…] out my series of charts with averages of all transfer times between the four major point currencies and their airline […]