MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Miles and points aren’t all about traveling in first class for pennies, although that’s the most aspirational aspect of the game, and the most fun to write about. In the last few weeks, I’ve used hotel points for massive savings on adequate rooms in convenient locations in expensive cities.

Through just a little bit of planning, I’ve spent about $255 total for my last six nights of hotels or $42 per night. Half of the nights have been in Europe in the summer, and two of them are at a hotel that has a retail price of over $325 per night currently.

My strategies haven’t involved any credit cards or hard work, just a bit of planning. They’ve been crucial strategies for me to get some affordable alone time away from hostels to break up an eight-month trip. And they’re strategies that anyone can employ to keep costs down and travel more.

What are the three tricks I’ve used to spend so little on hotels in Europe?

These are my recent hotel stays:

Two nights at the Holiday Inn in Sandton, Johannesburg, South Africa.

- My Price: $35 per night

- Retail Price: $166 per night

- Savings: 79% off

One night at the Holiday Inn Express in Pretoria, South Africa

- My Price: $35 per night

- Retail Price: $92 per night

- Savings: 62% off

One night at the Holiday Inn City Centre in Munich, Germany

- My Price: $70 per night

- Retail Price: $240 per night

- Savings: 71% off

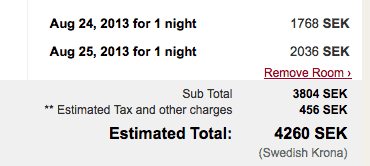

Two nights at the Clarion Hotel in Stockholm, Sweden

- My Price: $39 per night (cheaper than a hostel in this super-expensive city)

- Retail Price: $325 per night

- Savings: 88% off

All four of my recent hotel stays have been booked with points, and in all cases those points were purchased, not earned by previous stays or credit card usage. The methods used to save up to 88% off the cost of my stays have been three-fold.

1. Check the PointBreaks List

Both South African stays were at PointBreaks hotels. PointBreaks is the best year-round hotel promotion. IHG Rewards (formerly Priority Club) puts out a new list every two months of hotels that you can book for only 5,000 points per night. This price represents a 50-90% discount off the normal points price.

When the list comes out, I check it against my travel plans and book any hotels I might want as a series of one-night stays, so I can later drop any days I don’t want and still have the days I want locked up.

To get the IHG Rewards points, I buy them for 0.7 cents. That means a 5,000-point stay costs $35 all in.

For full details on my PointBreaks strategy, see my PointBreaks Primer. The new PointBreaks list for travel in September and October will be bookable Monday.

2. Buy Points During Daily Getaways

This year, I posted every day on the various Daily Getaway Deals. I personally purchased hotel points during several of the offerings. My best purchase was probably 72k Choice Privileges Points for $281, or 0.39 cents each.

I actually promoted the purchase as a way to cheaply buy Southwest points, since Choice Privileges points transfer to Southwest Rapid Rewards at a good rate. But I’ve ended up using the points for a stay in Stockholm and two upcoming airport-hotel nights in Rome and Oslo.

None of the properties are sexy, but the savings have been enormous. My hotel in Stockholm is only 10k Choice Privileges points per night–$39 at the price I paid–even though it retails for $325 per night. If I didn’t have Choice Priveleges points, I’d be staying at a hostel down the street for $50, more than I’m paying for my private room with free internet.

3. Follow the Milesphere on Twitter

Follow me on Twitter, and follow other bloggers and people who keep up with miles and points. On twitter seven months ago, I saw a link to this article on Loyalty Lobby about mistakes in the points price of several Priority Club (now IHG Rewards) hotels.

The mistakes prices didn’t last long, but I was able to snag a few nights at the Holiday Inn, Munich City Centre, which is a nice hotel with an excellent location that goes for $240 per night. I got a 60% discount on the normal points price and paid 10k points, which I had bought for $70 as explained in the PointBreaks Primer.

For limited-time deals like that, Twitter is the place to spot them.

I don’t usually stay in hotels–see my Cheapskate Lodging Guide–but when I do, it’s nice to save bundles of money. These hotel stays have been a nice way to break up the hostels and couchsurfing, so that I can recharge in private and restock on mini-shampoos. 😉

Best of all, these methods are easy-to-replicate, don’t involve credit-card sign ups, and can stretch your travel dollar, which ultimately means more travel for you.

[…] Both hotels were clean and comfortable, so I was very happy with my stays as I reported in my post about saving 88% on my hotel bill in Stockholm. […]

[…] Use hotel points. […]

[…] I described How I Saved 88% on My Hotel Room in Stockholm. Easy to Replicate Techniques for Huge Hotel Discounts. […]

[…] Use hotel points. […]

[…] Choice Privileges operates mostly motels in the United States, but some nicer hotels abroad like the $325-per-night Clarion Hotel in Stockholm. […]

[…] Both hotels were clean and comfortable, so I was very happy with my stays as I reported in my post about saving 88% on my hotel bill in Stockholm. […]

[…] Both hotels were clean and comfortable, so I was very happy with my stays as I reported in my post about saving 88% on my hotel bill in Stockholm. […]

[…] Both hotels were clean and comfortable, so I was very happy with my stays as I reported in my post about saving 88% on my hotel bill in Stockholm. […]