MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

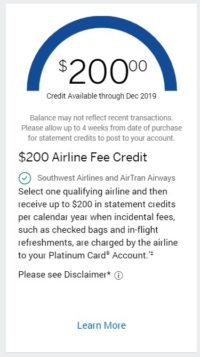

One of the most valuable benefits of the Platinum Card from American Express is its $200 per year–calendar year–of incidental travel fee credits. You get a couple other credits as well this month, at least another $85 worth of Saks Merchandise + Uber credit, that would be a shame to forget about. Don’t leave them on the table!

If you haven’t maxed out your statement credits yet, there are still some strategies for squeezing out any remaining value.

Platinum Card from American Express‘s Incidental Fee Credits

Amex Platinum Cardholders get $200 in statement credits for incidental fees with a designated qualifying airline every calendar year.

The airline fee credit is supposed to be for “incidental fees” likes change fees, cancellation fees, and bag fees. The fee credit is not supposed to apply to ticket purchases, miles purchases, or gift card purchases.

While many travelers do spend $200 a year, organically, on airline fees and checked bags, the savvy ones that read this blog likely do not. They have other cards that cover those fees, or they book awards wisely using foreign partner programs with lower or no change/cancellation fees. So how do those people maximize their incidental fee credits?

The loophole used to be airline gift cards (which could later be spent on flights), but unfortunately Amex’s computers have stopped recognizing gift cards as incidental fees. Gift cards, even in smaller amounts, are no longer triggering statement credits.

Is your designated qualifying airline Alaska, Frontier, Hawaiian, JetBlue, or Southwest?

Then you may be in luck. I’ve seen reports online of cheap flights with those airlines purchased on the Amex Platinum triggering statement credits. Specifically…

- Alaska: Reports indicate flight needs to be sub-$100

- Frontier: Needs to be sub $100

- Hawaiian: Needs to be sub $50

- JetBlue: Needs to be sub $150

- Southwest: Needs to be sub $100

Tip of the hat to Frequent Miler for collecting those data points.

Southwest allows changes for free, and has a very cheap $5 cancellation fee, so if Southwest is your designated airline I see no reason not to buy a speculative flight or two if you still haven’t maxed out your statement credits yet.

Similarly, Frontier doesn’t charge a change fee if the change is made 8+ days before departure. They do charge a cancellation fee of $75 though.

Other Annual Credits

Saks Fifth Avenue

Amex will credit you $50 in Saks Fifth Avenue purchases January – June, and another $50 July – December. Purchases can be online or in a store, but nothing shipped internationally will count. You must enroll here before using your card at Saks if you want the statement credits.

Uber Credits

You get $200 in Uber credits every year on your Platinum. That comes in the form of $15 a month, except for December when you’ll receive $35 in Uber credits. Don’t drink and drive tonight, folks! Take an Uber home. Note that you don’t actually have to pay for Uber with your Platinum card, BUT you do need to add your Platinum Card as a payment method within your Uber account, and choose to use the credit for payment before completing the ride.

Business Platinum Card from American Express‘s WeWork and Dell Credits

While this post focuses on the consumer version of the Platinum card, the Business Platinum Card from American Express also has a big annual credits and a benefit registration deadline:

- $100 in Dell purchases. The following lines are taken from the Business Platinum’s terms: “…each Card Account is only eligible for up to $100 in statement credits between January and June and up to $100 in statement credits between July and December for a total of $200 per calendar year in statement credits across all Cards on the enrolled Card Account. Valid only on purchases made directly with Dell or at dell.com in the US and US territories where Dell is the merchant of record for the purchase. Not valid on online purchases shipped outside of the US.”

- While this doesn’t apply to those who apply now, if you already have an American Express Business Platinum card, you can enroll in the WeWork benefit by the end of the day today to qualify for WeWork access for all of 2020. You MUST enroll by the end of the day today, however, to gain access to WeWork locations.

And of course, the Business Platinum also comes with $200 in travel incidental fee statement credits… so don’t forget to take full advantage!

Bottom Line

If you have an Amex Platinum or Business Platinum, double check your online account to make sure you’ve maxed out your incidental fee statement credits. If not, go into an already made travel reservation for the upcoming year on your designated airline and pre-pay for any checked bags you’ll otherwise have to pay for in the airport. Can’t or don’t need to do that? If your designated airline is Alaska, Frontier, Hawaiian, JetBlue, or Southwest, purchase a cheap flight that you see yourself (possibly) taking. Chances are it will be reimbursed as an “incidental fee”.

And don’t forget about the Saks, Uber, and Dell credits!

Happy New Year, folks! Stay safe tonight and give the new decade a big hello.