MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Delta changed the wording on its SkyMiles News & Updates page to include a heavier discount on annual CLEAR memberships for Delta SkyMiles Credit Card Members.

Usually a CLEAR membership costs $179 per year. If you have one of the following Delta co-branded American Express cards (or the small business version) than you (the primary cardholder) get a $100 yearly discount, reducing the cost to $79 per year.

What’s CLEAR?

CLEAR is a means of bypassing TSA security lines. The process for enrolling looks similar to that of Global Entry and involves an online application as well as an in-person meeting. Once you’re enrolled, you stop at a CLEAR kiosk located near airport security and the kiosk’s biometric technology scans your iris and fingerprint to confirm your identity as pre-checked. Then you get to bypass the normal security line.

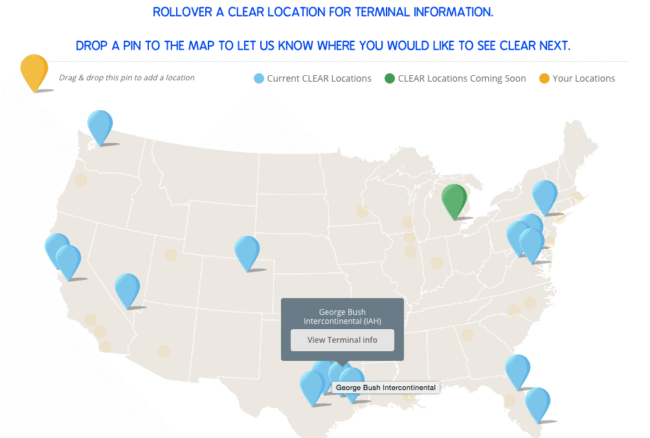

CLEAR is available at 16 major airports.

When CLEAR Is Worth It

For many people, Global Entry or TSA Pre✓ ® will be more advantageous for the cost, especially considering that:

- you pay a $120 fee for Global Entry/TSA Pre✓ ® and the membership lasts for five years before you have to renew it

- a Gobal Entry/TSA Pre✓ ® credit statement that negates the applicaiton fee is a common perk of premium credit cards like the Citi Prestige® Card , Chase Sapphire Reserve®, and Platinum Card® from American Express

- Gobal Entry/TSA Pre✓ ® are more widespread in airports around the United States than CLEAR

The distinct advantage of CLEAR is the discount for family members.

So if you travel with a pack and you highly value time, then CLEAR could be a great option for you.

It’s doubly as advantageous if you’re a family that frequently flies Delta. CLEAR is instituted in almost all Delta hubs.

Plain Old SkyMiles Members Get a CLEAR Discount Too

This might even be beneficial to you if all you are is a SkyMiles member.

All you need to be eligible for an $80 annual discount (not $100, like you get from being a Delta cardholder) on a CLEAR membership is to have a SkyMiles account. Register here for CLEAR at the SkyMiles discounted rate.

Bottom Line

Do you have a Delta Amex card and travel with your family often? Then it will probably interest you that Delta changed the wording on its SkyMiles News & Updates page. You are now eligible for a $100 discount off the yearly $179 membership fee for CLEAR, the security pre-check system that helps you skip normal TSA lines and offers cheap add-on memberships for other family members and free memberships for kids under 18 traveling with you.

Already have CLEAR? What are your experiences with the program?

Hat Tip Rene’s Points

Based on my experience, CLEAR is not quite ready for prime time. It’s only available at a limited number of airports. It’s quite expensive compared to Global Entry, which speeds you through US Customs as well as TSA Precheck. CLEAR’s biometrics fail to work maybe 50% of the time and that means you spend 3X the amount of time going through the security line compared to plain old TSA Precheck. CLEAR needs to improve its biometrics recognition equipment and reduce the cost if they want to compete. Just my 2 cents.

You said the only Delta hub without Clear is Detroit. ATLANTA also does not have Clear.

Thanks, corrected.

I am a retired disable military vet. I understand my annual fee should be wavered.