MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Hey there, you’re reading an outdated post! The updated series from April 2015 can be found here.

This is the twentieth post in a monthlong series. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go.

Today I’ll continue the theme of cheap paid travel when you don’t have or don’t want to use points.

This is a topic I love: saving 60% on hotels using priceline. If you aren’t being reimbursed for your hotel expenses, and you have any flexibility over which hotel you can stay in, priceline.com’s “name your own price” section can save you hundreds of dollars per stay, so bookmark this post!

Let’s imagine you’ve booked free first class into an exotic city; now it’s time to get your room.

There are a few tricks to know when bidding on priceline, so read this post (and tomorrow’s) carefully before setting off to make your bids. First let me explain how priceline’s bidding section works.

As the commercials say, hotels give their unwanted inventory to priceline to sell at a steep discount to get at least some revenue. Priceline categorizes their inventory by city and then by zone within a city.

Priceline does not let you select a hotel in which you want to stay. All you can select is the quality of the hotel (in stars), and the zone in which you want to stay. That’s crucial. If you need to stay in a specific hotel, do not use priceline’s bidding feature.

Another aspect to consider is that you earn no hotel points and no status for stays booked through priceline. For me, this is not a problem because I don’t believe that hotel loyalty programs are worth the 150% premium I would often have to pay if I didn’t use priceline.

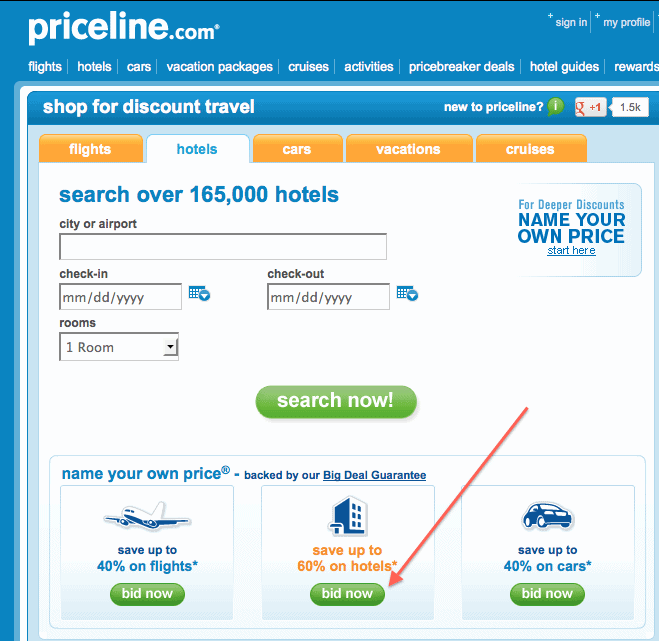

With those caveats in mind, if you still want to save 60% on hotels, scroll down on the priceline homepage and click “bid now” under the hotel in the “name your own price” section.

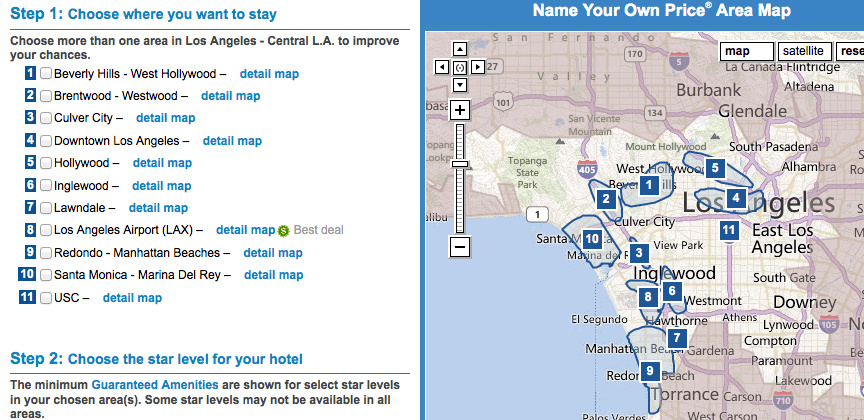

Type in the city, your dates, and the number of people. Now the city map will come up with a number of zones–Los Angeles has 11.

You can click on a zone to zoom in on it. Do this for any zone you’d consider staying in to make sure you are willing to stay in the entire zone.

Why? Because if you bid on a zone and win, you could end up with a non-refundable charge on your credit card for a stay anywhere in the zone.

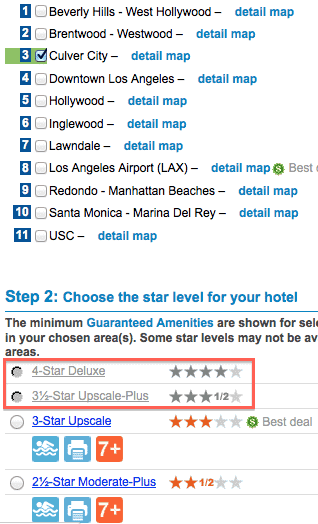

If you’ve identified one or more zones in which you would stay, check their boxes. Now decide which quality hotels you want to stay in. The priceline star system does not necessarily correspond to any other star system, so click on each star level to learn about that star level and see what brands fall under that star level.

Now you’re almost ready to make your bid, but let me explain how bidding works. To make a bid, you have to give your credit card info because if your bid is accepted, the hotel is booked. You are given the hotel information, and a non-refundable charge is made to your card.

You can only bid once per day. This is designed to keep you from bidding $1 per night and increasing your bid $1 at a time until you find the lowest price at which a bid is accepted. Luckily there are two circumventions to the one-bid-per-day rule.

The first is that you can add lower quality hotels and rebid.

The second is that you can add a new zone and rebid. This is a huge loophole we will exploit to save hundred of dollars.

Before bidding, you need to note every zone in your city of choice that has only lower quality hotels than you’re searching for. Reread that sentence.

If you are searching for 4 star hotels in the Downtown section of Los Angeles, note every section of Los Angeles that has only 3 and 1/2 stars and below.

The way to do this is to check each area’s box one at a time and see which do not allow you to check 4 or 5 star hotels because they have none.

Write down all these zones that lack 4 star hotels and above because each such zone is a free rebid that we’ll use later. For Los Angeles, there are four zones that lack 4 and 5 star hotels, I noted that they are zones 3, 6, 7, and 11.

Now make your bid. The FAQ section on the biggest site related to priceline bidding suggests the following opening bids:

- 1* $15

- 2* $17

- 2.5* $19

- 3* $25

- 3.5* $25

- 4* $40

- 5* $55

- Resort $40

I think those are good starting points. You will be prompted to enter your credit card info. And priceline will show the total amount of your bid including taxes and fees.

The most likely outcome is that your bid will be rejected. Fear not. We’ve got some tricks up our sleeves like free rebids! I’ll walk you through using those tomorrow!

Continue to Part 2 after 8/31 at 5 AM ET.

I sometimes use priceline, but not very often. Here are some other things to think about before using priceline:

1. Make sure you are completely flexible with your accommodation. For example, if you are a couple, you can’t specify what type of bed you would like. If you usually like rooms with two queens, could you live with two doubles? What about a smoking room? What about a very small room? Maybe they will upgrade you at the registration desk, but they have no obligation to do so, so I wouldn’t count on it.

2. Don’t forget about ancillary costs such as parking, internet, etc, which Priceline won’t provide any information on. For this reason, when using Priceline I usually try to book 2.5-star hotels (e.g. Courtyards, Holiday Inn Express, etc), and preferably in suburbs, which more commonly have free parking.

3. Bid with knowledge: Before submitting a bid, check with the hotel directly or hotels.com to see what you can get a non-opaque room for. Also, check Hotwire to see what you can get there with slightly more certainty. But don’t forget to adjust for fees: both Hotwire and Priceline add fees to the bid/quoted price that the non-opaque channels don’t. After the adjustments, often times Priceline and Hotwire don’t do any better.

Finally, don’t do what my parents do, which is book through hotwire or priceline, and then change plans. If you don’t use the room, it’s a throwaway.

“Parents just don’t understand!”

Not necessarily. I’ve gotten hotwire credit when I legitimately had my flight cancelled. All they did was ask for the airline and flight number, but YMMV.

In my parents’ case, there is no legitimate cancellation. They look for the lowest price, book an inflexible reservation, and then change their minds. That is just how they roll.

What’s wrong with bidding once per day? If you look for the room long enough in advance and do $5 increments, you can reach your maximum price within a week or two at most.

I prefer to do it all at once.

I guess, as long as once-per-day is allowed it’s not a bad strategy in cities with uniformly high rated hotels.

In your experience, how much of a discount on average can you get on a 3+ star hotel?

In my experience, there is no consistent answer because different cities have different levels of availability at different times. It is sometimes the case that a 4* hotel costs less than a 3* hotel. However, you can usually use Hotwire as a guideline. They tend to be fairly close to one another, and Hotwire quotes you a price before you buy.

There is also a web site betterbidding.com and perhaps others where people report their winning bids. These tend to be useful in thickly traded markets (NYC, etc) where you are buying a fairly standard product.

Interesting, maybe I’ll try this out next time. I wonder how well, and if, it would work in other countries.

[…] loyal readers know, I’m not big on hotel rewards programs; I usually get a better deal pricelining as I explained here. But PointBreaks are a great deal since Chase Ultimate Rewards transfer 1:1 to Priority Club (not […]

[…] As loyal readers know, I am not usually big on hotel rewards programs and can usually get a better deal using Priceline. For more details on how I go about that, check out my post on the subject, Saving Hundreds on Hotels with Priceline. […]

[…] Saving Hundreds on Hotels with Priceline Part 1 […]