MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Hey! You’re reading an outdated Free First Class Next Month series. Check out the latest version published in April of 2015 here.

This is the eighth post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flier miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go. Previously Double Credit Card Miles with Business Cards.

Tomorrow, I am going to recommend the cards for your first applications. Here are the best practices for those applications.

1. Apply for no more than one personal card and one business card at a time from each bank.

The major issuing banks are Chase, Citi, American Express, Barclay’s, Bank of America, US Bank, and more. I have separate pages for the best offers from each, so you can pick the best personal and business card from each.

2. Space your applications out at least 91 days apart.

You may apply for more than one card on the same day. But I make that days that include credit card application(s) are 91+ days apart.

3. Call in.

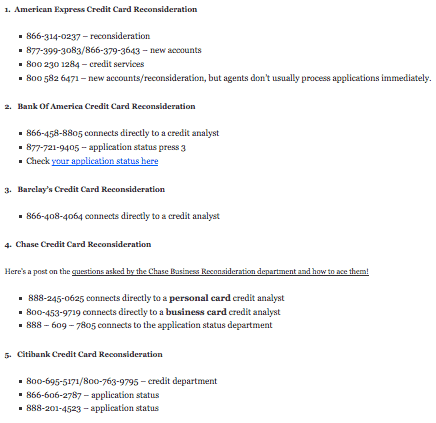

If your application is not immediately approved, call the bank’s reconsideration line right away. Here are the relevant phone numbers from Million Mile Secrets:

Ask the agent if they need any more information to process your application. Answer the questions politely and truthfully.

Ask the agent if they need any more information to process your application. Answer the questions politely and truthfully.

If you have a relationship with the bank already–a business loan, a checking account–highlight it. “I’m a loyal [bank] customer. I already do my banking here, so I wanted to get a credit card you offered.”

If the agent says they cannot extend you more credit, and you already have credit cards from the bank, offer to close one or move some of your existing credit lines around. “I don’t need any more credit. I’d be happy to move over some of my Starwood card’s credit line to open this Delta card.”

If the agent says there is nothing he can do to approve you, politely thank him. You can call back and see if the next agent is more helpful if you wish.

4. Do not cancel a card for at least six months.

Many rewards cards have an annual fee to hold them. Usually it is waived for the first 12 months you have the card. If you want to cancel the card before an annual fee is due, that is common and fine. But make sure you hold a new card at least six months, preferably 11 months before canceling it. Doing otherwise is a red flag that you are an unprofitable customer who is just collecting sign up bonuses.

Continue to Best Current Credit Card Offers.

Excellent presentation – thanks.

I’ve had only one bad experience in a applying for many CC ‘s. over the last 3 years — it was with US Bank .

Specifically, for their Club Carlson card – too many inquiries on my credit report – I called reconsideration, then escalated to supervisors, many times – all to no avail . I used all the spiels I’ve read about, we have great credit, always pay on time etc US Bank wouldn’t budge – too many inquiries – when I asked how many was too many – 3 or more – which I find incredible ? I ordered a copy of my report from ARS, the monitoring co used by US Bank, — there were several pages worth but I can’t negate any of them, even though they go back 2 years.

Anyone else had a bad experience with US BANK ???

Please share. Are they more difficult or perhaps I was singled out for special treatment.

I have since got CC’s from Chase & AMEX, so I’m puzzled and annoyed.

Graham….Exact same story for me. Although I only had around 8-10 inquiries. I have excellent credit. I also got a copy of my report and had no idea that when I purchased a car for my daughter in September they did three pulls. Then when I hooked up her cable and internet at college they did a pull. So almost 1/2 of my inquiries are pointless. I would love to hear from someone that was able to get US Bank to reconsider!!

I got the US Bank FlexPerks Rewards card a few months ago. At the time, I had a few recent applications on my Experian report and possibly 6-8 that year. They called to verify it was me as they said many people with many recent inquiries are actually victims of fraud. The card I applied for had a 17.5k bonus after spending $1500. This was the black card. They approved me for a white card with a 2.5k bonus after spending $300. But they also sent a letter pretty much the same day as my white card saying they would upgrade me to the black card… through no action of mine. A bit strange, but I did get the card I want at the end without much trouble.

My mom applied for the Club Carlson card with many 3-4 inquiries the past year. Got approved with no problem.

My suggestion is stay away from new applications for maybe 6 months, then apply with them first. They’re a temperamental bank 🙂

I’m sure this is obvious to most, but since the article was targeted at first-timers I’d like to make a note about the, “I just moved to X” ruse: Don’t use it unless it’s true. If you tell the agent you just moved to Denver, but your application says you live in Chicago and you’ve been at your current residence for 8 years, that’s not going to go well. However, “I’m planning on moving to X” will do nicely.

Good twist.

Inquires appear in real time on your credit report, so I don’t believe #1 is accurate. It’s best to distribute your inquires across bureaus because new accounts don’t appear on your report for several days (sometimes weeks) and if, for instance, Chase pulls Equifax and Amex pulls Experian, Amex will have no idea you just applied for a Chase card.

AMX gave me 2 in 2 weeks ..SW chase took 3 weeks to ok it so I got the other 2 then canceled the sw chase card because I couldn’t spend the min . Can’t wait for April I going to sign up for at least 4 because I can spend $9k in one month at least .

Need Paris .

Thanks to everyone who responded re my US Bank & Club Carlson

Bad experience. Any others that can share would be welcomed in this

Discussion.

Would like to hear from some of the blogger experts, too ????

I think US Bank is the toughest on “recent applications.”

[…] Best Practices for Your First App-o-Rama […]

Hello,

Barclays asked me why I applied for those many cards(7 cards with 3 banks) 3 month ago.

what should i tell them to get it approved?

I would call back and hope the next person didn’t ask. All you can do is tell them the truth that you travel a lot, so you wanted the co-branded card for each airline and hotel you patronize since the airlines and hotels offer better deals to cardholders. You probably want the Frontier card because you are thinking about switching your loyalty to them because you like their route network and service.

[…] to Best Practices for Your First App-o-Rama. This entry was posted in Free First Class Next Month and tagged Free First Class Next Month. […]

I completed my first app o rama back in late January. Do I wait 90-95 days from the application date or 90-95 days from the last credit card that was activated? I ended up getting 2 personal cards from Chase but I had to wait a month in between so I’m not sure if I can do my 2nd app o rama at the end of April or wait till the end of May. Thanks.

Wait 91 days from your last application.

[…] them to contact me. I immediately called the reconsideration line as recommended in Scott’s Free First Class Next Month: Best Practices for Your First App-o-Rama […]

Hey all,

Quick question, I am about to do my first app o rama and am targeting a total of 5 cards. I know I will be able to handle the minimums, but I am worried that 5 is too much. Should i scale back?

Also, all 5 cards are with a diff bank. Thanks for your help!

That’s fine.

Awesome resource – so glad I found your site!

Regarding US Bank Club Carlson, I’ve read that it is best to freeze the two credit companies that they tend to pull (ADS and IDA) before applying.

Also, I have a question… is it advisable to apply for both Chase SW personal and business cards at the same time? I know with Citi, it’s better to space them out by a week or so.

For Chase, do it the same day. I got denied for the Club Carlson personal card, probably should have frozen the credit files, but then I got approved for the business card a few months later. If you have an established credit file for a business, that might work for you too!