MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

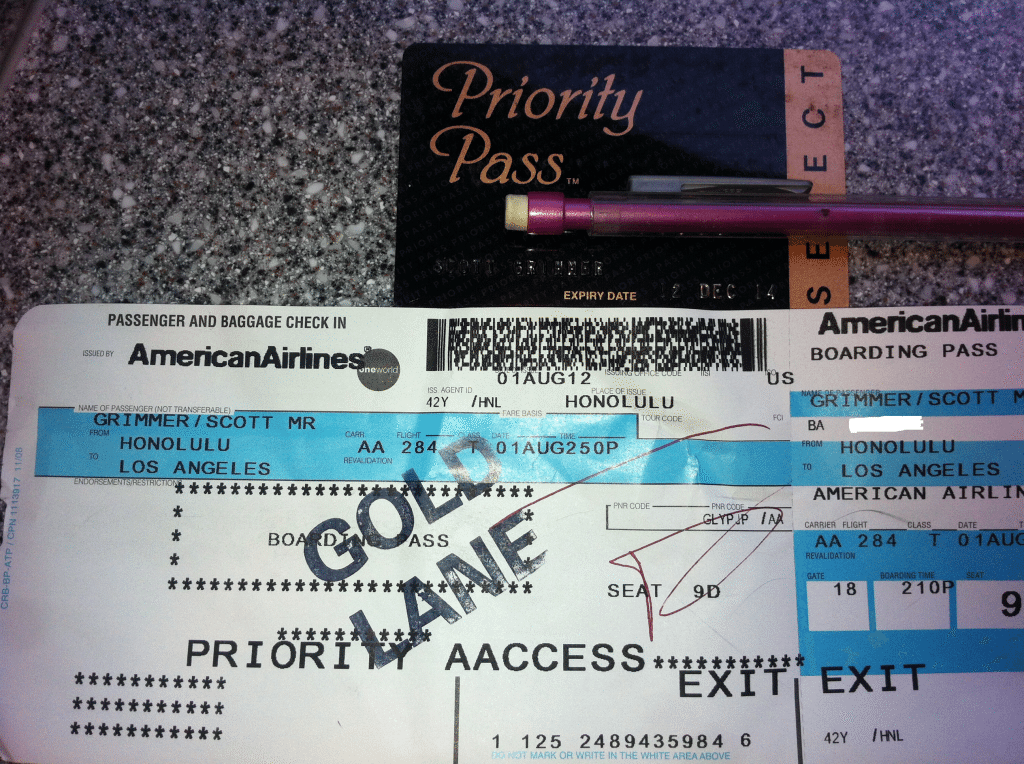

Today I am flying from Honolulu to Los Angeles on a flight operated by American Airlines. I bought my ticket with 12,500 British Airways Avios and $11 as described in this Anatomy of an Award. I listed 12,500 Avios and $11 as one of the cheapest ways to get to Hawaii recently.

Yesterday at 2:50 PM, when I got the email to check in, I did so. My mobile boarding pass showed Priority AAccess, which means I can use the priority security line at the airport and board before general boarding.

I was surprised because I have no status with British Airways or American Airlines.

When I got to the airport, I printed a boarding pass, and it also said Priority AAccess. When I went to an agent to drop off my golf bag, I got another piece of good news.

“There’s an aisle seat available in an exit row. Would you like that?”

I sure would like a free upgrade to an exit row. She printed me out a new boarding pass with my extra-legroom seat and Priority AAccess:

So I’ll be enjoying my 12,500 Avios flight even more than I thought I would. Has anyone else redeemed Avios for an AA flight and been given Priority AAccess? I think this has to be a mistake, so I’m asking around.

It was a huge time saver at security–several flights to Asia leave at the same time as this flight to LAX–and I have my normal carry on plus a tennis bag, so I’ll be happy to snag bin space for everything with my priority boarding.

Did I just get lucky or has this happened to you?

Got the same when I went to YYZ from DFW in early July. Found it strange but was not going to say anything. I was not able to select exit aisle during online check in/seat selection though.

I wasn’t able to select an exit row during check in or at the airport either. I think that was just a bonus because the agent had nothing to do, while the other agent tagged my bag. Perhaps she offered it because she see the Priority AAcess and thought I was elite, or maybe she was bored.

Had it happen to my wife last month on a flight to Chicago,she called to thank me for it and I had no idea why she got it. Did some snooping around and I had forgotten it was part of the new perks on the AAdvantage Citi Card.

I’ll have to look; I don’t know if I used my Citi AA card to pay the $11 taxes on the BA award.

Every time I’ve booked an Avios award on AA metal I’ve gotten the same, and I don’t have an AAdvantage Citi Card.

Yep, I got it two years in a row LAX-LIH/OGG. The lines are always so short at LAX it barely saves time IME. No exit row for us because of our 2yo. Nothing to do with Citi, unless you have the Executive card.

Ditto – have booked 4-5 AA award tickets with Avios for my girlfriend and me and each time I get Priority AAccess. A great unadvertised (I think?) perk.

ssshhhhh…don’t tell….

oops

I’ve read reports of this the past several months in the blogosphere. It’s not an error. #Sweet

Yes every flight I’ve taken by redeeming Avios has been priority access. However, no free checked bag on domestic flights.

Same here both way LAX-DCA and DCA-LAX. I had a carry on and was offered to check it in for free.

At check in, they offered to check a carry on for free? Who offered? I almost tried to ask if I could get my golf bag checked free but chickened out.

Yes, everytime for me..

ATL to DFW.

Booked (AA metal) using Avios on BA.com for party of 4

Paid fees using Chase BA visa

Got Priority access and aisle seats

Also have Citi AA visa and Citi AA AMEX.

Wasn’t sure if trigger was booking with Avios alone, paying fees using Chase BA visa, or being a CITI AA cardholder. Great perk to Hawaii, aren’t these unsuspected benefits awesome

[…] Another “hidden” perk of using Avios to fly American is that you get to enjoy Priority AAccess on your American flights. This means that you get to use the Priority/Elite security screening lane and you get early boarding. The elite security line can save you a massive amount of time at some airports and early boarding can help ensure you find a spot to place your carry-on bag. It may also help you wiggle your way to a better seat at the airport, as it did for Milevalue. […]

[…] Trip Report: Does Booking an Avios Award on American Airlines Grant Priority AAccess? […]

[…] I noticed in August 2012 that on my Avios award flight from Honolulu to Los Angeles, my boarding pass printed with “Priority AAccess,” granting me priority security and priority boarding. […]

[…] MileValue and Mommy Points have written that when they’ve booked American Airlines flights with Avios, the words Priority AAccess prints out on their boarding passes. I’ve also had similar experiences, and it has always made my day (especially since I was even able to do a free same-day flight change too at the gate somehow). […]

[…] Flying an Avios award on American Airlines flights shouldn’t get you special treatment. But for years, it has gotten you Priority AAccess, which means priority security and boarding. […]

[…] Another “hidden” perk of using Avios to fly American is that you get to enjoy Priority AAccess on your American flights. This means that you get to use the Priority/Elite security screening lane and you get early boarding. The elite security line can save you a massive amount of time at some airports and early boarding can help ensure you find a spot to place your carry-on bag. It may also help you wiggle your way to a better seat at the airport, as it did for Milevalue. […]