MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

To compete with AMEX Offers, Citi has launched Citi Smart Savings, which offers discounts at major retailers when you add the offer to your account and then use your Citi card at that retailer.

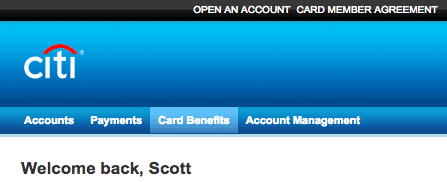

To see your targeted Smart Savings offers, sign into your Citi account and click Card Benefits.

Halfway down the next page on the right, click Offers For You.

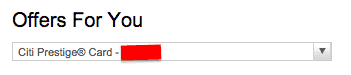

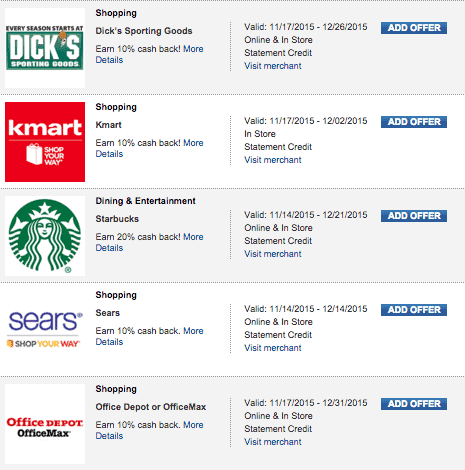

On the next page, you’ll see your offers for one card. Use the dropdown menu at the top to see your offers for each card. My Citi Prestige® Card didn’t have any offers. My Citi ThankYou® Premier Card had 11 offers for 10-20% off major retailers.

My Citi Prestige® Card didn’t have any offers. My Citi ThankYou® Premier Card had 11 offers for 10-20% off major retailers.

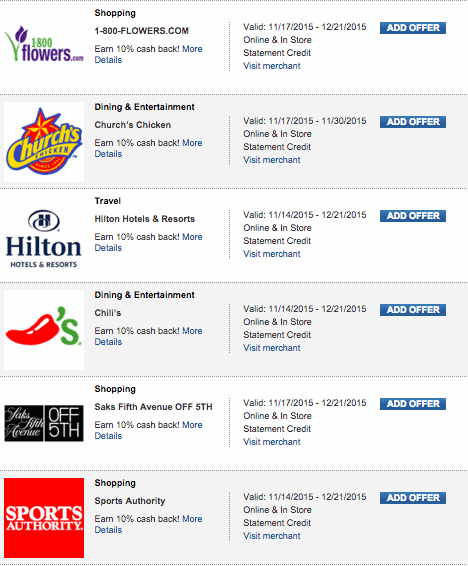

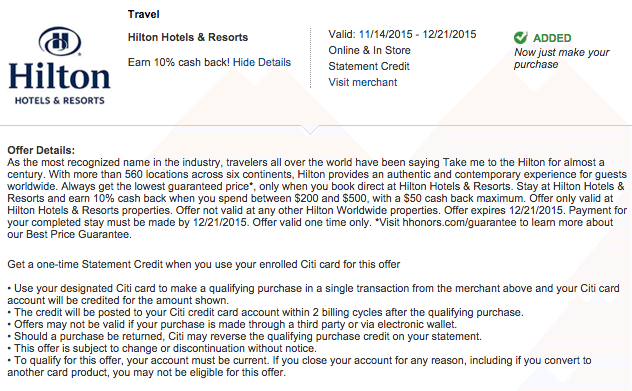

These offers are not automatic. You have to click ADD OFFER for each one that interests you. Once you do that, the offer details are shown. The headline 20% off Starbucks isn’t that great because it is limited to the first transaction and limited to $4 cash back. The Hilton offer is much better. It is limited to one transaction that must be between $200 and $500, but at least you have a chance to earn $50 back. Considering the Citi ThankYou® Premier Card always offers 3x points on travel and gas, including hotels, this is a nice way to stack 3x points and 10% back.

The Hilton offer is much better. It is limited to one transaction that must be between $200 and $500, but at least you have a chance to earn $50 back. Considering the Citi ThankYou® Premier Card always offers 3x points on travel and gas, including hotels, this is a nice way to stack 3x points and 10% back.

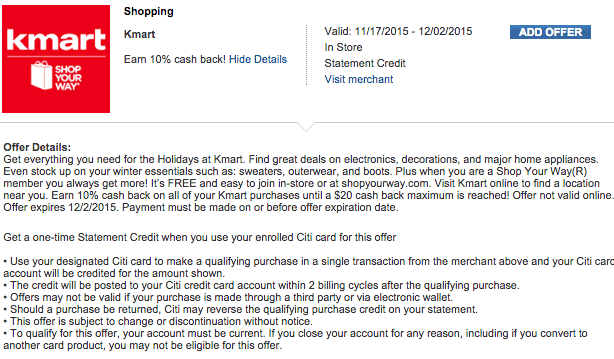

I also really like the Kmart offer for 10% back on unlimited purchases up to $20 back. That’s a good return on a low margin retailer.

Hopefully the Citi Smart Savings offers will continue to increase and improve. I think of AMEX Offers as a way to offset my cards’ annual fees, so offers like this make it more likely I will hold onto a card when the annual fee is due.

What Smart Savings offer did you get/do you plan to take advantage of?

SCOTT…Check out Saw on FNC(Fox News Channel) TWO United Club passes for a Unwrap Toy donation…

LOOK Seee

CHEERs

Good find. I had missed that.

SCOTT…Check out Saw on FNC(Fox News Channel) TWO United Club passes for a Unwrap Toy donation…

LOOK Seee

CHEERs

Good find. I had missed that.

Bank of America also offers these cash back deals on their credit & debit cards. The retailers are nearly identical, except I don’t see the Hilton offer on my B of A cards.

Great tip!

Bank of America also offers these cash back deals on their credit & debit cards. The retailers are nearly identical, except I don’t see the Hilton offer on my B of A cards.

Great tip!

I am curious to see how this plays out. I have 4 Citi cards (AA Visa, AA Amex, Prestige, and Premier) and have no offers on any of them.

I am curious to see how this plays out. I have 4 Citi cards (AA Visa, AA Amex, Prestige, and Premier) and have no offers on any of them.