MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

In general, buying back expired miles is a good deal. Of course it’s better not to let your miles expire and not have to pay a fee, but mistakes happen. I recently received an email from reader John H. He spoke of buying back miles that had once belonged to him but had expired. Here’s an excerpt…

“I call AA to see if I have any expired miles. To my surprise I had 5,723 and then paid $40 to get 5000 back. That is the quickest and easiest miles gotten. It is worth the call just to check. Imagine my surprise…

Prices and Policies of Major Loyalty Programs

I’ll go over popular USA-based loyalty programs here and include links to policies on other popular loyalty programs below for you to check out if you desire.

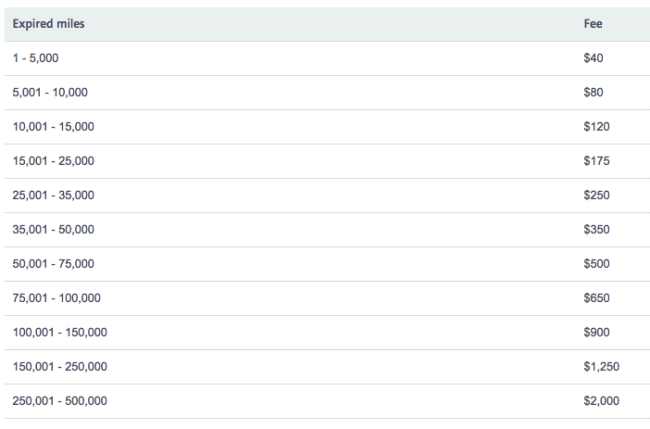

You can reactivate expired AAdvantage miles that date back as far as December of 2002. Here’s what it costs to buy back your expired American Airlines miles.

AAdvantage breaks down their reactivation prices into tiers, so obviously the higher your balance falls within a tier, the better mileage price you get. That’s why John H decided to buy 5,000 of his miles back instead of all of his 5,723 expired ones (and paid .8 cents per mile instead of 1.39 cents per mile).

Note also that reactivated miles won’t count toward elite nor Million Miler status.

Call 1-800-882-8880 to check if you have any expired AAdvantage miles.

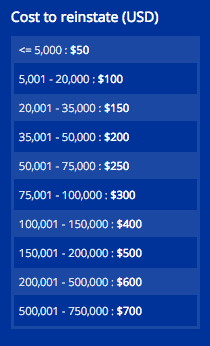

United MileagePlus’ policy isn’t as lenient as AAdvantage. You can only reinstate miles that have expired within the last 18 months.

United also breaks down their reactivation prices into tiers, so the same logic with buying back specific amounts on the upper end of a tier as described above with AAdvantage miles also applies to United miles. The maximum amount of miles you can reinstate is 750,000.

Reinstatement Challenge

For amounts larger than 20,000, you can complete United’s reinstatement challenge instead of spending a lot of money to get them back. All you have to do is pay a flat fee of $100, and then either fly one United flight OR open and make one purchase on a United co-branded credit card within 90 days of paying that $100 fee.

Login here to see if you have any expired United miles that you’re eligible to buy (or earn) back.

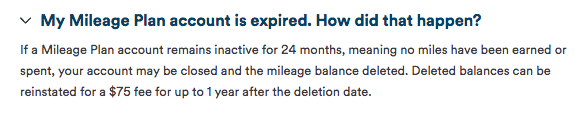

If you accidentally let a ton of Alaska miles expire within the last year, then you’ll be happy to hear that Alaska MileagePlan allows anyone to buy back their total expired balance for a flat fee of $75. It appears that no matter how many you let expire, you can get all of them back. The primary stipulation is that you reinstate within a year of expiration.

Call 1-800-252-7522 to reinstate expired Alaska miles.

Delta and JetBlue miles never expire! That’s pretty cool.

Southwest oddly doesn’t offer a way to reinstate expired miles, which I find surprising as every other part of the loyalty program is extremely customer friendly.

Info About Reinstating Miles from Some Other Popular Loyalty Programs

- British Airways Executive Club (Avios) (same advice could also apply to Iberia Avios)

- Air Canada Aeroplan

- Hawaiian Airlines HawaiianMiles

- Singapore Krisflyer

- Cathay Pacific Asia Miles

- Asiana Club

We Are Talking About Miles, NOT Points

Note this post references airline miles, NOT bank points like Chase Ultimate Rewards, American Express Membership Rewards, or Citi ThankYou Points. Bank points are much more sensitive to expiration than airline miles as closing the card that earned them can cause you to lose all your points.

Bottom Line

Try to make sure you they don’t expire in the first place by keeping tabs on your expiration dates with Award Wallet. It will keep track of all your loyalty programs and miles balances. And bookmark our Guide to Miles and Points Expiration to cross reference.

If you do accidentally let your miles expire, there are many circumstances in which it costs very little to buy back your airline miles. It will certainly be loads cheaper than buying airline miles outright.

If you’ve been collecting miles for years on end, it could also be worth a call to a program’s customer service to see if you have any expired miles floating around out there like John H.

I seem to recall that Delta Miles did expire in the past. Wonder if I could buy those?

Not sure but it’s definitely worth a shot. Call SkyMiles customer service 1-800-323-2323 and let us know how it goes!

I lost a ton of Sheraton points where I stayed in a Sheraton, for business, for nearly 2 years. During that time I could have cared less about those points as I was working 7 days a week and about 16 hours per day. My wife kept asking me about those and I just told her they do not expire. At least at the time our Marriott points did not expire. I am kicking myself as 2 years of SPG points would be quite valuable. SPG has been adamant about not allowing those points. Maybe Marriott can do something when they are fully joined. Always worth a try.

I believe your math may be off. $40.00/5000 = 0.8 cents per mile and not .008 cents per mile.

Forgot to move the decimal over, thanks for pointing that out! Fixed.

[…] the midst of research for Monday’s post, Buying Back Expired Miles, I stumbled upon some information from milecards.com that mentioned another way to earn back […]