MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

There were some great deals this week:

- US Airways Share Miles with 100% Bonus = 1.13 Cent Dividend Miles

- Citi Offering 3 AAdvantage Miles Per Dollar on Gas, Groceries, and More. Targeted?

- Barclay’s offering US Airways Offering Cardholders up to 50% Back on Redeemed Miles

- How to Combine US Airways Promotions to Get Two Tickets to Europe for $284 Each

- Barclaycard Arrival World MasterCard Offering 7 Miles Per Dollar on Gas, Restaurants, and More

But there were also a few bad deals that superficially looked a lot like the good deals that I want to warn you about.

What are the bad deals to avoid this week?

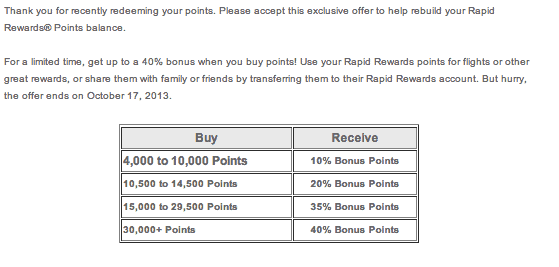

Southwest is offering a 40% bonus on purchased points through October 17.

Why it’s a bad deal:

Even with a 40% bonus, the Southwest points cost 1.96 cents each. Southwest points are only currently worth 1.69 cents each toward any Southwest airfare. (60 points per dollar on redemptions, but tax and other issues make the value about 1.69 cents) And starting March 31, they’ll only be worth about 1.44 cents after the recently announced massive devaluation of Rapid Rewards.

And these aren’t traditional region-to-region miles where they may only be worth X amount normally, but you can redeem them for international first class and do better. These are fixed-value points. You will never get 1.96 cents of value for Southwest points, so buying them for that amount is burning money.

TACA Transfer Miles with 100% Bonus = Buying TACA Miles for 1.5 Cents

Why it’s a bad deal:

The US Airways 100% bonus on transferred miles gets you US Airways miles for 1.13 cents.

Through February 20, 2014, the TACA 100% bonus on transferred miles gets you TACA miles for 1.5 cents. There are near constant promotions to buy TACA miles for 1.5 cents. Those are a decent deal if you want to book a TACA award right then, though I wouldn’t stockpile TACA miles because I don’t trust the airline to give fair notice of devaluations.

So this isn’t actually a bad deal, it’s just a near-constant deal that runs through February 20 that you don’t need to get involved with unless and until you are ready to redeem the TACA miles.

Also a bad deal worth mentioning is Virgin America 50% bonus on purchased or gifted miles: https://www.virginamerica.com/buy-gift-points.do

Does “You will never get 1.96 cents of value for Southwest points, so buying them for that amount is burning money.” still hold if you consider the Companion pass? Mine is good though 2014 and, even with the devaluation, won’t a point still be worth 2.88 cents to me? (Purely academic as I have no intention to buy any).

I think Scott’s formula still holds. Since you could pay cash for the one ticket and your companion flies free, just like he or she would if you paid for the one ticket with points, the cash to points valuation or “exchange rate” is unchanged. irrespective of whether you have the companion pass.

Good question. Still holds. Because you have to buy one ticket. You can either do that with cash or by buying points here and getting the one paid ticket more expensively.

TACA MILES!!!

Note that Southwest points bookings are fully refundable, but Wanna Get Away revenue bookings are nonrefundable (yes, they can be reused without a change fee within one yeaar, but that’s much less flexible than “fully refundable”). I value this flexibility (I frequently book trips with points if I’m not sure about my travel plans). So, if my Rapid Rewards point balance was low, I would eagerly buy the Southwest points with 40% bonus.

You are willing to pay an 18% premium for that? That means you’re saying–I think this math is wrong but close–there’s an 18% chance you wouldn’t use the credit if you cancelled a wanna get away fare?

Another deal to avoid: I got targeted (?) for an extra 3000 Southwest points if I spend at least $5000 on my Chase Southwest card before the end of the year: http://www.flyertalk.com/forum/southwest-rapid-rewards/1506484-chase-wn-visa-promo-3-000-bonus-points.html .