MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The U.S. Bank FlexPerks® Travel Rewards Visa Signature® Card is offering a larger sign up bonus for those who apply by March 7, 2014 based on how many medals the US Olympic team wins in Sochi this month!

The card normally comes with 20,000 bonus FlexPoints after spending $3,500 in the first 4 months.

Those who get apply for the card by March 7 and make a purchase by March 31, 2014 will earn bonus FlexPerks based on how many medals we take home:

Two years ago, the same promotion was run during the Summer Olympics, and the it bumped the sign up bonus to 33,150 points. If Team USA repeats its performance from the 2010 Winter Games, the sign up bonus will total 29,550 points.

This promotion is amazing! It spurred me to apply for the U.S. Bank FlexPerks® Travel Rewards Visa Signature® Card for myself this week. Other than the Olympics promotions, I haven’t seen the bonus on the card exceed 20,000 points, so I jumped at the chance to potentially get around 30,000 bonus FlexPoints based on how we do in Sochi.

For those not familiar with FlexPoints, 30,000 FlexPoints could be used to purchase an airline ticket that costs up to $600 on over 150 airlines with no blackout dates.

Like other bank point cards that can be used to get free tickets, the award ticket you fly will earn miles and status since the airline sees it as a cash ticket. Unique to the FlexPerks card, you are given a $25 statement credit for incidentals on the day of travel like checked baggage fees, lounge access, or onboard food purchases.

Full offer details:

- Get 20,000 Bonus FlexPoints after the first $3,500 in net purchases in the first 4 months;

- Award travel starts at just 20,000 FlexPoints (up to a $400 ticket value) on over 150 airlines with no blackout dates or redemption fees;

- Earn one FlexPoint for every $1 of eligible net purchases charged to your card;

- Earn two FlexPoints for every $1 spent on gas, grocery or airline purchases %u2014 whichever you spend most on each monthly billing cycle %u2014 and on most cell phone expenses;

- Earn Triple FlexPoints for your charitable donations;

- Earn 5,000 FlexPoints when you refer a friend who acquires and uses the card;

- $0 Annual Fee* the first year, after that $49*;

- Earn 3,500 bonus FlexPoints each year when you spend $24,000 in Net Purchases.

Redemption Levels

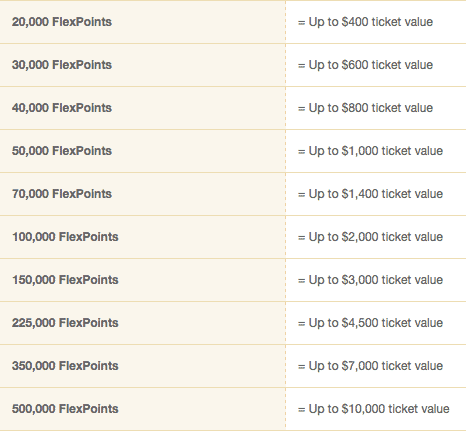

FlexPoints have a semi-fixed value. They are worth 2 cents each toward any available airfare on any day with no blackouts if you find a cash ticket that costs exactly $400, $600, $800, etc. If you redeem for a $500 ticket though, you get only 1.67 cents. Here are the exact redemption prices:

Because of the card’s incredible category bonuses,

- 3x on charitable donations

- 2x on gas, grocery or airline purchases – whichever you spend most on each monthly billing cycle – and on most cell phone expenses

I plan to get about 2 FlexPoints per dollar I put on the card. If I can redeem my FlexPoints for airfares near the top of their respective bands, I can effectively get 4% back on those purchases in the form of airfare.

That’s basically unbeatable!

A Great Complementary Card

I want to highlight the fact that a $401 and a $600 ticket both cost 30k FlexPoints. That means you really don’t want to use your FlexPoints for a $401, but a $599 ticket is a great use of FlexPoints.

You really want to use your FlexPoints for tickets that cost specific dollar amounts, and not all the tickets you buy will cost those amounts. That’s where the Barclaycard Arrival Plus™ World Elite MasterCard® comes in.

Holding both the FlexPerks card and Arrival card maximizes both of them.

On the earning side, the Arrival card-at 2.22% back on all purchases–is better for purchases that aren’t in a FlexPerks category bonus while the FlexPerks is far better in its 2x and 3x categories.

On the redemption side, 1 Arrival mile is worth 1.11 cents on all travel redemptions (see How to Redeem Arrival Miles) while a FlexPoint can be worth 1.33 to 2 cents. Use the FlexPoints when they are worth close to 2 cents (ie a $390 or $580 ticket) and the Arrival miles for other redemptions.

For a full comparison of the Arrival, FlexPerks, and other similar cards, see my Comparison Table of Fixed-Value Bank-Point Cards.

Recap

Folks who apply for the FlexPerks card by March 7, 2014 will earn 20,000 bonus FlexPoints after a minimum spending requirement plus more bonus FlexPoints depending on how many medals Team USA earns.

For full details on the promotion and to apply, see here.

Do u know if the entire $3,500 has to be spent before march 31 to get the olympics bonus?0

I got this card about 6 months ago. Have you heard of anyone being able to get a second one and get the bonus?

Hmm.

Never imagined there would be an upside to the US team performing well at the Olympics.

But not wanting to profit from a sad occasion, I’ll pass on this one.

~ A proud non-financialised supporter of another national team in Sochi 🙂

I have had this card for less than a month, and just emailed US Bank customer service to ask for the higher of the two promotions, the one I have or the Sochi one. I’ll keep you posted.

Please do. I am very interested in whether they will match.

No luck. Got this in an email today: “We understand that you were inquiring about a promotional offer, Jill. The promotional offer involving the Olympics is only for new applications. Unfortunately, we are unable to apply this to your existing account. We apologize for any inconvenience.” I’m surprised. Others have been better at this in the past.

Scott,

TY for another great tip/review.

If I earn a total of 40,000 points, can I book 2 tickets for 20,000 points each (up to $400 each) or do I need to use all 40,000 points (up to $800) on 1 award ticket?

TY

You can use any of the redemption tiers, not just the maximum one for the points you have. So in that case, yes you could do two 20k redemptions instead of one 40k redemption.

TY.

Not as good as Barclay Arrival,But I think this is good enough for me to bite…

I got this card during the last Olympics with the same promotion. Tried multiple times to redeem points for tickets, it was a PITA. Gave up and redeemed the points for $400 in Amazon gift cards, then canceled. Their program is stacked to take much points as possible while delivering you minimum value (tickets). Be warned.

For FlexPerks “Travel” card, it charges 2% on foreign transactions.