MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the MileValue team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

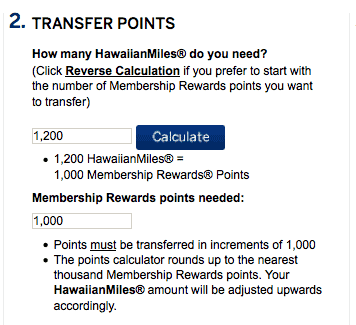

There is a 20% transfer bonus from American Express Membership Rewards to Hawaiian Airlines miles until June 23, 2014.

This can be a good way to top up your Hawaiian Miles balance if you’ve recently gotten The Hawaiian Airlines® World Elite MasterCard® with 35,000 bonus miles after spending $1,000 in the first 90 days.

- Is this a good deal?

- What is the fee to transfer Membership Rewards to Hawaiian Miles?

- What are the best deals with Hawaiian Miles?

I generally value Membership Rewards at around 2 cents and Hawaiian miles at more like 1.3 cents, so a 20% transfer bonus is NOT a good enough deal for me to speculatively move my more valuable AMEX points to Hawaiian Miles.

Transfers from Membership Rewards to American airlines like Hawaiian incur a $0.60 fee per 10,000 points transferred. That means that transferring 10,000 points has a $6 fee.

The transfer bonus is hard-coded into the Hawaiian Miles transfer page.

When to Transfer

Transfers can make a lot of sense if you need to top up your Hawaiian Miles account. Just a few weeks ago, I transferred Membership Rewards to my Hawaiian Miles account (and from there to my sister’s with the free Share Miles feature if you have The Hawaiian Airlines® World Elite MasterCard®.) She needed a few thousand extra miles to book my niece a trip from Honolulu to New York City.

Hawaiian Miles can be used on Hawaiian flights, though the chart is a bit costly at 20,000 miles each way from Hawaii to the mainland even though all of Hawaiian’s destinations are in the Western United States except New York City. (The price is only 17,500 miles each way if you have The Hawaiian Airlines® World Elite MasterCard®.)

Interisland flights are 7,500 miles each way even though United charges only 6,000 miles for the same seats.

Flights to Asia and Australia are 40,000 miles each way from Hawaii or 60,000 from the mainland United States.

The Full Hawaiian Airlines Award Chart

Hawaiian Miles can also be used on several partners including:

- American Airlines

- ANA

- JetBlue

- Korean

- Virgin America

- Virgin Atlantic

- Virgin Australia

- China Airlines

Unfortunately, Hawaiian has greatly increased the miles needed for partner awards. Think 200,000 miles roundtrip in Business Class from the mainland to Australia on Virgin Australia or getting 1 cent per Hawaiian mile for Virgin America flights.

One possible good deal is 125,000 Hawaiian Miles from the East Coast to the United Kingdom in Virgin Atlantic Upper Class with no fuel surcharges. From the west coast, it costs 160,000 miles. Two years ago, the price was only 100,000 miles from anywhere in the United States.

Bottom Line

Don’t dump your Membership Rewards balance into your Hawaiian Miles account. If you need to top up your Hawaiian Miles account, though, enjoy the automatic 20% transfer bonus until June 23, 2014.

American Express continues offering frequent transfer bonuses. Chase continues not to.