MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The American Express Platinum Card is one of the best credit cards for frequent travelers. The card comes with Delta, American, US Airways, and Priority Pass Select lounge access. (American/US lounge access ends 3/22/14.) Coupled with no foreign transaction fees and $100 towards Global Entry, this is a great all around travel card.

Many people balk at this card due to the $450 annual fee. However one of the biggest incentives to get the card is you can get $400 worth of of airline fees reimbursed by American Express in your first year of being a cardholder.

That’s because the $200 annual airline fee reimbursement is a calendar-year benefit.

This fee reimbursement should apply to baggage fees, change fees, award ticketing fees, and other fees. It should not apply to purchased tickets or purchased gift cards. But American Express does code many gift card purchases as fees that it then reimburses.

For instance, I got my AMEX Platinum in November 2011. I immediately designated American Airlines as my 2011 airline for fee reimbursement and purchased three $67 gift certificates from aa.com. I received a $200 statement credit within a few days.

In January 2012, I changed my airline to United for 2012 fee reimbursement. I bought a $200 gift certificate from united.com, and again I received a $200 credit within days.

Those $400 in gift cards almost completely “eliminated” the $450 annual fee.

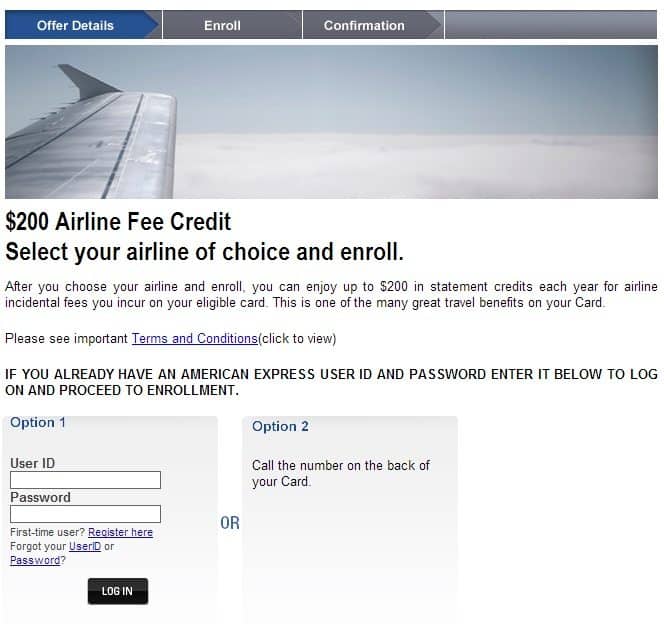

I just got the AMEX Platinum. How do I choose my designated airline for the year?

After signing up for the card, you should immediately register your card with American Express through this link. You will then be asked to select your chosen airline for the calendar year. For reference, the page looks like this.

After I make my airline selection for the year, can I switch if I change my mind?

No. You must choose carefully. Your selection can’t be changed until January of the following year. Once you make your choice, you are locked in for that calendar year.

That means you should pick an airline where you will run up $200 in fees in a year or one whose gift cards AMEX reimburses.

I just made an eligible purchase with my card, what will a reimbursement from AMEX look like on my billing statement?

Most are reporting that the fee reversal posts as “AMEX Airline Fee Reimbursement.” It should post within two-three weeks of making the eligible purchase.

What is the best use of this airline fee reimbursement?

Everyone’s situation is different, but using the $200 credit for gift certificates is very handy. If you know you have travel plans on that airline, then you are essentially reducing the annual fee of the card by $200. Like I mentioned above, this is a calendar year benefit, so you can get $400 off the first year’s $450 annual fee!

Which airlines allow you to purchase gift certificates and which will American Express refund properly?

I’ve collected the wisdom of the various FlyerTalk threads on gift-card reimbursement.

AirTran Airways

As of December 5, 2011, AirTran no longer sells gift certificates. This is not a viable option. Keep in mind, though, that AirTran is merging with Southwest Airlines. Check out the Southwest Airline section below for details.

Alaska Airlines

According to this thread on FlyerTalk, there are some very recent conflicting reports about being reimbursed for Alaska gift cards. Until very recently, purchasing Alaska gift cards in $50 or $100 increments was no issue. AMEX Platinum reimbursements posted within several days. However, two recent posters note that the charge posts to their account as “ALASKA AIR GIFT CERTSEATTLE WA.” They have not received credit for these purchases most likely due to this new coding. It looks like buying Alaska gift cards and getting reimbursed is dead. If you still want to try your luck, click this link to purchase e-gift certificates for Alaska.

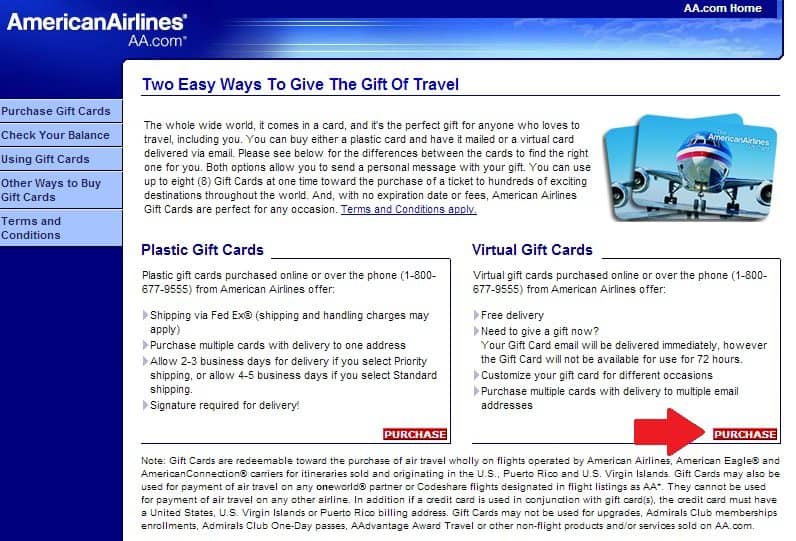

American Airlines

FlyerTalkers are still noting success in purchasing low denominations of e-gift certificates. AMEX appears to be reimbursing $50, $75, and $100 increments without any issues. American Airlines sells both physical cards and e-gift certificates through the same landing page here. To expedite your order, I highly suggest purchasing an e-certificate on the right side of the page.

Delta Airlines

As hard as it is to believe, Delta Airlines does not sell gift certificates (physical or e-certificates) on its website. They must be purchased at airport ticket counters in the United States. To make matters worse, Delta gift certificates are not available for purchase in California, Connecticut, Hawaii, Illinois, Maine, Massachusetts, New Hampshire, or Rhode Island. The FlyerTalk thread does note success with incidental charges like stand by fees, change fees, and Economy Comfort seat purchases, and checked bags.

Note that some FlyerTalkers are also reporting that inexpensive tickets (<$150) are being reimbursed by AMEX.

Frontier

There are no data points on FlyerTalk nor MilePoint about any reimbursements. I would choose another airline to use the $200 credit.

Hawaiian Airlines

Hawaiian Airlines does sell e-gift certificates here, but there are no reports on the small FlyerTalk thread about anyone using their AMEX Platinum to buy them. Unfortunately, there isn’t enough evidence to make a conclusion either way, but I might try to talk my dad into being the guinea pig since he is a frequent inter-island flyer.

JetBlue Airlines

There have been no successful reimbursements reported in the short FlyerTalk thread about JetBlue gift certificate purchases. This does not appear to be a viable option.

Spirit Airlines

There are no datapoints on FlyerTalk nor MilePoint about any reimbursements. I would choose another airline to use the $200 credit.

Southwest Airlines

Recent posts in this FlyerTalk thread indicate that this door might be closing. Reports from 2011 and early 2012 show that getting reimbursement for $50 or $100 gift certificates was no issue. However, it appears now that the reimbursements are not automatically posting. I would proceed with caution if choosing Southwest. If a gift certificate purchase does not post, there are not a lot of other uses for the credit. Southwest does not charge for checked bags or change fees, and doesn’t have any airport lounges. To purchase physical or e-gift certificates, click this link.

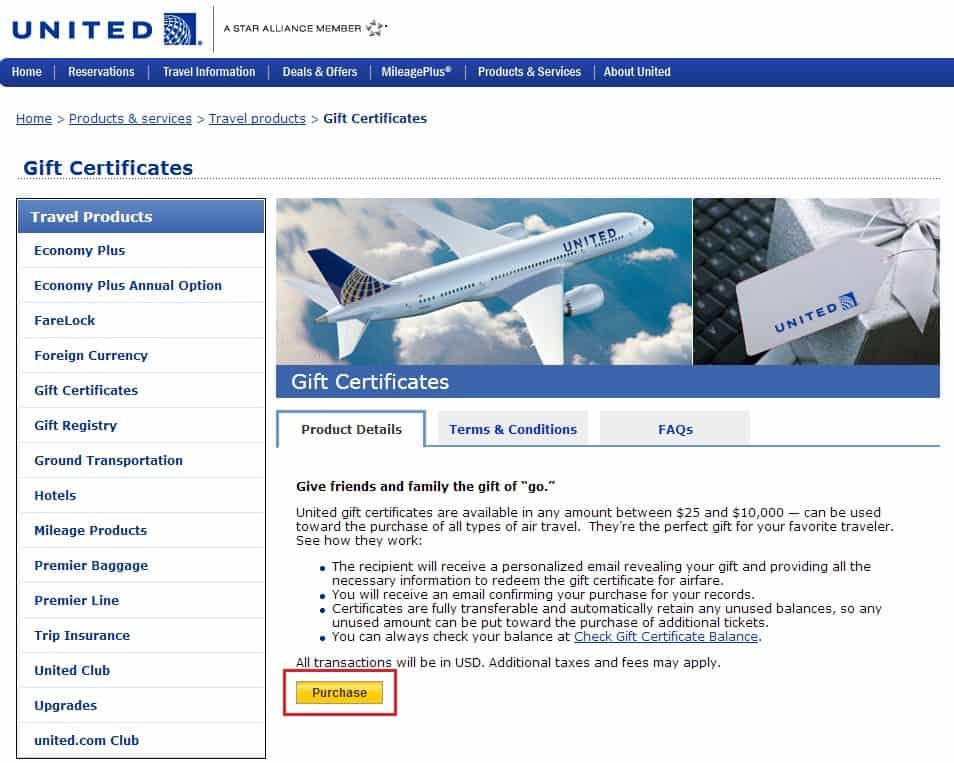

United Airlines

This thread on FlyerTalk notes that many are having success with gift card purchases and quick reimbursements. $50 and $100 increments appear to have the highest success rate, while a one time $200 purchase has been hit or miss in being covered by American Express. ($200 worked for me!) To play it safe, I would purchase four $50 certificates or two $100 ones to not draw attention to the transactions. To purchase, simply go to this link and click on the Purchase button. Note that I had some trouble with a flight I purchased using my United gift certificates bought with my AMEX Platinum. For more details, read my post, American Express/United Gift Card Trouble.

US Airways

Though the thread is scarce with recent anecdotes, it appears that purchasing US Airways gift certificates will work. Some have reported success with one $200 purchase while others have been buying two $100 certificates. Be warned, though, as US Airways does not have e-gift certificates. The physical cards must be mailed, and any order you place will incur a $15 shipping fee. If you purchase two $100 certificates, the total will come out to $215, and AMEX should reimburse up to $200. To purchase gift certificates line, follow this link.

Recap

The American Express Platinum card appears to have a high $450 annual fee. However, you can greatly reduce the fee by using your $200 airline credit each calendar year on gift certificates.

This thread has summarized which airlines’ gift certificates American Express is reimbursing.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Got an invite to apple for Personal AMEX Gold w/ 50K after 3000 spend in 1st 3 months. Went to check out further on app website page and was offered 100K for Plat card same spend. Delay app for now b/c of the $450 annual fee. My question …Is the fee charged in the 1st month of having the card, does this $450 count as parts of the $3K sopend requirement, and if I spend my $3000 in the 1st week will they delay awarding points till after the 3 months has past. Thanks for all you do with the blog.

Yes, fee charged immediately. No, fee doesn’t count toward spend. You should get 100k on the statement where you exceed spending requirement. I would take that offer and run!

Thanks for the tip to combat that big fee. Didnt even consider a gift card.

It may sound strange, but I used my $200 credit to buy a US Airways Club membership. Yes, I know that the Amex Platinum card gets you that membership already, but the separate US Airways Club membership gets you into United Clubs as well. I am a SP member on US Airways, so my cost was $325 – $200 credit = $125 for United Club access. The best part was that I purchased the membership during a promotion where I also got 5000 Preferred miles, which helped me qualify for GP status for 2013!

I tried and its works for award booking fees and tax

I could second @miles data as Amex reimbursed award booking taxes on United.

@HF, like the $75 close in booking fees?

Yes

Great post and timing for anyone that is considering applying for the card.

I was wondering if the $200 credit could be applied to US Air Trial Preferred status? I purchased this back in 2010(got platinum easily with the Expedia.ca $300 codes) and Amex coded it as a “frequent flyer fee.” Not a bad way to get status with an airline if you can hit the required miles.

If this works, I would do this next year of course so you could have status for nearly 2 years.

I think the reason no one has tried Hawaiian airlines is that although they sell gift certs, they don’t take Amex on their website.

That is correct. I learn something new every day. Thanks!

The real benefit here is to get the card before the year ends, get the $200 credit, and then getting the $200 credit again in January, right?

Whenever you get the card, you should be able to get 2 x $200. If you get it in November, you’ll get the $400 especially quickly.

I’ve had success purchasing up to $125 AA gift card. Haven’t tried anything higher.

Perhaps it’s just another case of Murphy’s Law kicking me where it counts, but I’m at 7 business days since the purchase of a $50 AA eGC and still no love on the reimbursement.

Anyone have any wisdom to share?

Any insight on what happens if I claim the airline credit, get reimbursed by amex and then decide to close my amex plat card? Technically, I would get my prorated unused months annual fee refunded if I closed my account after just a couple of months- so in this case would amex also try and get the reimbursed airline fee back from me?

I doubt it. I think you’d be fine closing and getting a prorated fee back.

[…] Home › Frequent Flyer News › Which Airlines Gift Cards Does American Express Reimburse? […]

You could possibly anger Amex and they decide they dont want your business any longer? Or maybe they just let it go. How much do you like being a Guinea Pig?

Off topic, but could you double check that your RSS feed is set up correctly? I keep trying to subscribe to you feed using the RSS icon, but it is bringing me to the feed FROM FeedBulletin to you, rather than the feed of your own posts. Thanks!

I got the AMEX Platinum in October of 2011 and designated USAirways as my airline. I bought 4 $50 gift cards in November 2011 and was reimbursed. In 2012 I was reimbursed $200 in baggage fees when traveling on USAirways. I’ve now reupped the card. Can I $200 in credit again in these next two months and $200 again in the first ten months of 2013? Thank you very much.

@ Kevin F – I am currently doing the USAir Trial Preferred and was recently reimbursed. I actually forgot to call about it and was pleasantly surprised to see it go through

AMEX AIRLINE FEE REIMBURSEMENT-200 DOLLARS AND .00 CENTS

CATEGORY FEES & ADJUSTMENTS – FEES & ADJUSTMENTS

I purchased two USAir. $100 gift cards and Amex did indeed credit me $200 back. (I did have pay the $15 shipping fee……)

FYI, the coding description on the Alaska girt certs changed in January, so it’s not that. Amex could have changed their policy w/r/t these, or those two people on the thread may have done something wrong(forgot that they hit their $200, tried an additional cardmembers #, etc). I was last credited on 10/12. Will be trying again in a week or two.

Why would you pay $25 more to get $1000 less spending threshold? That’s like paying a 2.5% fee…

$2,000 less. That’s like paying a 1.25% fee.

Ohhh, BY $2k, not TO $2k. Prepositions are our friends, man!

Ordered a $200 gift card. Was reimbursed $200 within three weeks. Talk about free money.

Trying to decide what to do with the gift card.

Can you purchase miles and be refunded?

I haven’t seen reports of that. Many airlines (like US Airways) don’t process their own points purchases, so those definitely wouldn’t work.

[…] a definitive list Bill made of the airline gift certificates that are reimbursed under this […]

[…] 2014 calendar year $200, then cancel your card or downgrade before the annual fee is due.Here is an extremely detailed and helpful article written by fellow blogger MileValue that will help you understand the process of get $400 credit […]

FYI, I received my United $200 reimbursements 12/12 and 1/13. No issues. They posted within 5 days of the gift card purchases.

which airline would give you reimbursement if you buy gift cards?

(T.R.W. PLEASE SHARE IT WITH ME)

THANKS

Fine prints says bonus offer not available if you have had gold account within 90 days. I’ve got a couple current Gold Amex accounts. Am I out of luck? Or is this the standard safe-to-ignore disclaimer. I don’t want to pay a $450 fee unless I can count on the points!

I’ve never been in that situation. Sorry I can’t help more.

[…] airlines (this is the preferred redemption of those in the points community). Mile Value wrote a comprehensive post on this […]

[…] several carriers is invaluable. You also receive an annual $200 airline credit that can be used to purchases gift cards. Reimbursement for the Global Entry fee can be a real lifesaver. The Platinum card is also a […]

[…] about it, I realized that this card actually offers a lot of good bonuses. Bill covered how those airline-fee credits can be used to buy gift cards which can then be used to purchase flights, the Global Entry voucher will save me hours of […]

[…] Airline Fee Credit (or gift card credit) Per Calendar Year ($400 in your first year of […]

[…] Airline Fee Credit (or gift card credit) Per Calendar Year ($400 in your first year of […]

[…] I love my American Express platinum card. My wife and I both have the personal card, I have the business card, and many of my family and friends have one or the other. A great benefit is the $200 airline fee reimbursement. Lots of different fees are reimbursed, even some that aren’t officially reimbursable according to the terms and conditions of the program. Here is more information from thepointsguy and milevalue. […]

[…] after spending $1,000 in three months, $100 credit for Global Entry signup, $200 calendar-year airline-fee credit, and free airport lounge access. Note: You don’t need to be affiliated with Mercedes-Benz, and […]

[…] incurred. I decided to designate American Airlines as my airline to receive fee credits in hopes of purchasing gift cards that I can then use to book flights on AA. Designating your airline is as simple as picking up the […]

[…] you may be able to use this $200 towards buying airline gift cards. Check out this post by Milevalue for more details on which airline gift cards count towards the $200 […]

2 updates

1. Delta gift cards can now be purchased online

2. American will no longer sell gift cards to NJ residents (Amex let me change to Delta after I discovered this the same day as I selected American)

[…] The card also comes with a $200 airline fee credit each calendar year, which means you’ll get $400 worth of statement credits in your first year of cardmembership. Many people have reported using this $400 to purchase $400 of airline gift cards and having the purc…. […]

[…] into $200 worth of Delta gift cards. The process is different for gift cards from each airline, so check out this post where I link to threads on each […]

Did your dad ever find out if hawaiian airlines gift cards get reimbursed?

Thanks

Hawaiian Airlines does not allow Amex cards to be used for purchase of gift cards online. They only accept Visa/Mastercard credit cards and debit cards

So Hawaiian Airlines recently unveiled a new “Beta” website and apparently they accept AMEX as a form of payment for GCs now. Seeing as how I set my 2015 airline reimbursement selection as Hawaiian Airlines earlier this year, I tried purchasing a $200 GC with my AMEX Platinum. Will report back to let you guys know if it gets reimbursed.

Awesome! Thanks.

So it’s only been two days since I made the purchase, but I’m pretty sure the charge is NOT going to qualify for the Platinum fee credit. On my AMEX statement, the charge was coded as: “HAWAIIAN GIFTS HAWAIHONOLULU HI” rather than Hawaiian Airlines, and it appears this falls under the “Category: Merchandise & Supplies – Internet Purchase” category. I’ll keep checking over the next few weeks, but I would be really surprised if this ended up getting reimbursed.

[…] after spending $1,000 in three months, $100 credit for Global Entry signup, $200 calendar-year airline-fee credit, and free airport lounge access. Note: You don’t need to be affiliated with Mercedes-Benz, and […]