MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

A card offer in this post has expired so its links have been removed. Click here for the top current credit card sign up bonuses.

A week ago I wrote about a 75,000 mile sign up bonus on the Citi Executive AAdvantage World MasterCard.

That bonus is now 100k American Airlines miles after spending $10,000 on the card in the first three months.

What are the full offer details? What’s the big drawback?

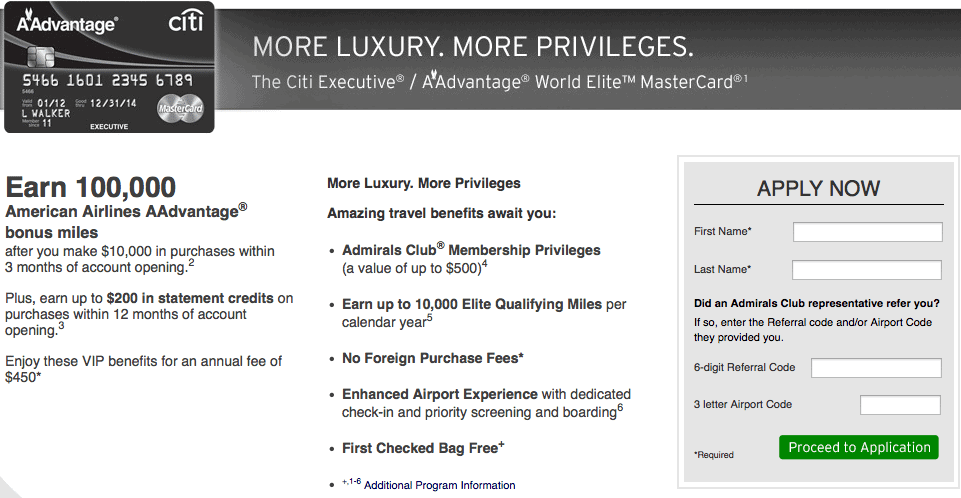

Here are the bullet points available on the landing page:

- Earn 100,000 American Airlines AAdvantage® bonus miles after you make $10,000 in purchases within 3 months of account opening.

- Plus, earn up to $200 in statement credits on purchases within 12 months of account opening.

- Enjoy these VIP benefits for an annual fee of $450

- Admirals Club Membership Privileges (a value of up to $500)

- Earn up to 10,000 Elite Qualifying Miles per calendar year after spending $40k

- No Foreign Purchase Fees

- Enhanced Airport Experience with dedicated check-in and priority screening and boarding

- First Checked Bag Free

For more details and to apply, click here.

The landing page asks for a referral code–given out at Admirals Club locations according to reports–but the referral code is not required to get to the application.

This card is the Executive Card. It is different than the Platinum and Gold versions of American Airlines credit cards. If you only have those cards, you can get this card and its bonus as a new customer.

The two things that will hold people back from getting this card are the minimum spending requirement and annual fee.

The minimum spending requirement is a huge $10,000 in three months. There are many great ways to meet minimum spending requirements, but make sure you only get this card if you can meet the minimum spending requirement without spending more than you ordinarily would and if meeting the minimum spending requirement will not cause you to go into debt.

The annual fee is $450 per year. For that price, you get Admirals Club access. If you normally pay for Admirals Club access, this perk has real value. If you normally fly international business class awards–which come with lounge access–this perk has zero value. Figure out how much value lounge access has to you and mentally deduct that value from the annual fee.

My take on this card is that for some people it will be one of the best offers of the year. For other folks, this will be an offer they should skip in favor of cards with spending requirements and annual fees that more closely align with their comfort levels.

Will you apply for the card?

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

This is the kind of card I avoid. Hefty non waived fee, massive opportunity cost given a huge minimum spend that keeps me from meeting spends on other cards. Sure, you could manufacture it but that costs money. I’m not in this to spend money I wouldn’t spend otherwise.

I do worry that these types of bonuses are becoming the norm. What happened to 1k min no first year fee ?

Does united/chase have a similar offering? The 10k EQM benefit caught my eye.

My wife and I both applied for and received the 75,000 mile version of this one day before this 100,000 mile version came out. Any idea how to get them to switch our account to the 100K mile after $10K spend promotion? Is it even possible?

It’d be a real bummer to leave 50,000 points on the table. For us, the extra $5K minimum spend wouldn’t be a problem.

Many thanks for any advice!

You can send Citi a secured message and ask them to match you to the higher offer. Just be polite and include the link for the new offer. I’ve had luck with this in the past.

Card is expected to arrive today. I paired it with Bank of America Alaska cards and a chase IHG Card with low spending needs to overall in spending would be about what it would be for four cards.

Jim, there are many people on FT who have gotten the bonus matched. Check this thread http://www.flyertalk.com/forum/credit-card-programs/1511082-up-100k-miles-citi-executive-aadvantage-offers.html

Wife and I both got approved for the card. We will both use it for our primary spending as well as the focus all of our MF spending until we hit the bonuses. IMO the annual fee is actually $250 (after factoring the $200 statement credit). I’d gladly pay $250 for lounge access + 110K AAdvantage miles.

Does anyone know when this promo ends? I dont have any large purchases in the next month or two but might in April/May….do you see anywhere where there is an application deadline?

Thanks much — I’ll give it a try!

Hi. I already have the regular citi aadvantage visa signature card (not the executive one). Any idea if I can apply for the exec one and receive the 100K miles? Thank you

So if you have this cc, can you use an AA lounge no matter if you’re traveling on AA or not? IE if i’m flying Delta but have this cc, can I still use the Admiral’s Club?

[…] to access the Admirals Club, though this benefit ends March 22, 2014. And you can always use the Citi Executive AAdvantage card for lounge […]

If we have an Existing Citic Executive AAdvanage Citic Palnium Level card does that mean that we ratin access to the AA and US Airways Lounges?

Any idea if we will be able to combine AA and US airways miles for award travel?

[…] I wrote about this card in “100,000 Mile Sign Up Bonus.” […]

[…] Greg has had success with getting matched via SM. […]