MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

The Equifax data breach is a bit of a nightmare and at times disgusting to read about, but there’s no need to spiral into paranoia. I agree with a lot of what this Reddit thread talks about concerning the breach, especially that the chance of having your identity taken advantage of is akin to winning the lottery. Just in this case you’d be losing. That doesn’t, however, mean you turning a blind eye is a good idea. Taking a few precautionary steps could save you LOADS of strife down the line.

For those of you scratching your heads: A week ago one of the country’s three credit bureaus, Equifax, disclosed that potentially 143 million American consumers’ credit histories had been compromised after hackers gained access to their records. What’s in a credit history? Things like names and associated social security numbers, addresses, birthdates, driver’s license numbers, etc.

Here is what I’ve done to protect myself so far, in chronological order:

- Set up a fraud alert for my credit report (only necessary to do with one credit bureau).

- Called each bank I have credit and debit cards with and made sure fraud alerts are in place for each.

- Ordered an official credit report from one of the credit bureaus.

Other steps you may want to consider:

- Freezing credit reports

- Joining Equifax’s identity protection program (eventually…)

1. Setting Up a Fraud Alert on Credit Reports

The purpose of setting a fraud alert on your credit report is so you are notified if a new account is applied for in your name.

Setting a up a fraud alert on your credit report is free and seems like it would be easy, at least for a 90 day period (after which you have to set it again). And you only need to set up one fraud alert, as by law whichever bureau you contact has to inform the other two to do the same.

All three bureaus offer online portals for placing fraud alerts:

- Set up a fraud alert via Equifax

- Set up a fraud alert via Experian

- Set up a fraud alert via TransUnion

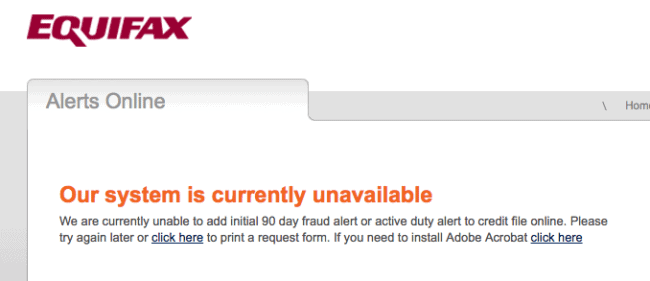

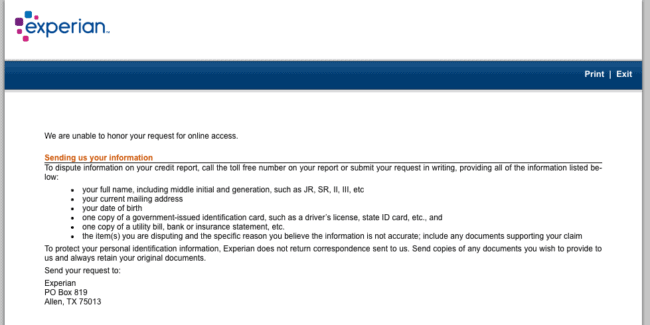

Unfortunately, it appears that all three systems are overloaded at the moment as you can’t (or at least I couldn’t, on 9/14/17) do it online.

So I called each bureau’s fraud department.

Experian’s line was busy, with no option to process anything automatically.

I got through to Transunion and was connected to an automated system for setting a fraud alert, and after following all the prompts to access my information I was told that “if my personal information was indeed delivered correctly, then the fraud alert would be put in place”. That was not a satisfactory conclusion for me, just a non-committal lack thereof.

I was left with my last choice, calling Equifax (1-888-766-0008). I would have loved to speak to a human being but I didn’t expect to. Their automated system took me through the process of identifying myself, and then confirmed that the fraud alert was not only in place but that they would also inform Transunion and Experian to do the same. For now that seems to be about the best I can do. Just to cover my bases, and because I don’t especially trust Equifax right now, in a couple weeks I’ll try setting fraud alerts again via Experian and TransUnion. Hopefully by then the amount of people requesting fraud alerts will have slowed down and their systems will be up again.

2. Setting Up Additional Fraud Alerts on Debit and Credit Cards

Why is it necessary to set up fraud alerts with a credit bureau as well as each of your banks? Because the credit report fraud alert is not going to inform you of potentially fraudulent charges on your existing credit cards.

As I said above, the reason you set a fraud alert on your credit report is to be notified if a new account is applied for in your name. That has nothing to do with your existing credit or debit cards, which is why separate fraud alerts (requested from each respective bank) is necessary. Perhaps your bank is already on top of monitoring for fraudulent charges, but perhaps they’re not. It’s a good idea to make sure they’re all keeping an eye out–especially for those cards you decided to keep open but put in the back of the sock drawer a long time ago and no longer check the accounts on regularly. Someone could be running up major debt on it if you turn out to be one of the lottery winners (losers?)

3. Check Your Credit Report

Going through your credit report at this point is a wise thing to do considering the breach happened a few months ago and your information could have been compromised in the meantime. Analyze it to make sure no new accounts have been opened that you don’t recognize and that all the money owed on any card is debt created by you.

You are entitled by federal law to three free credit reports each year–one from each of the three credit bureaus (Equifax, Experian, and TransUnion)–which you can request and view on annualcreditreport.com. You are also entitled to a free credit report each time you’re denied credit. Take advantage of those opportunities and keep an eye on your credit histories moving forward if you haven’t already been doing so.

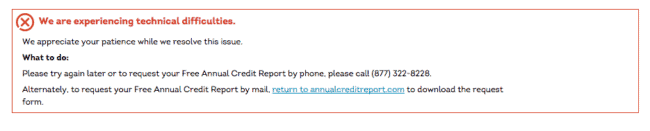

I tried accessing my credit reports online. Not too surprisingly, all three bureaus’ systems gave me error messages in response. I imagine there are a lot of people requesting their free credit reports right now and their systems can’t handle the traffic.

Equifax and Experian cut me off in the very beginning of the process of requesting a credit report. I got much farther with TransUnion and thought I had finally accessed my report when the following message popped up…

With no better option, I called TransUnion at (877)-322-8228 and followed the automated prompts to have a physical copy of my credit report sent to my home address. So a few weeks from now, I’ll be able to go through my official credit report.

If you end up having the same problem I did, here’s a stopgap and what I’ve done in the meantime to ease my mind: Check out the state of your accounts on Credit Karma.

Credit Karma is an online platform that provides free (non-FICO) credit scores and credit reports among other financial services. It’s not as accurate as looking at an official credit report from Equifax, Experian, or TransUnion, so don’t rely on it for the long term. For example, an account I opened over a month ago still isn’t showing up on creditkarma.com. Checking out Credit Karma in the meantime is better than nothing if you’re delayed in getting your actual credit report like I am and want to temporarily calm your mind.

Other Steps You May Want to Take

Freezing Credit Reports

When you freeze a credit report, you essentially make it inaccesible to lendors and creditors trying to check it to approve a new account. This makes the opening of new accounts almost impossible.

Here are the facts:

- Freezing a credit report costs money. How much depends on the state, but it’s never that much (around $10). Possibly the one thing Equifax has done right in this whole debacle is to waive the fee to freeze your Equifax report, so at least that one won’t cost you anything.

- Once you do freeze a credit report, you have to alert each bureau if you want to lift the freeze in any instance your credit report would need to be checked out by a lender or creditor (applying for a loan, opening a card, etc.)

So yes, freezing your credit reports will make applying for new cards a bit more complicated as you’ll need to figure out which credit reports get hard inquires for specific cards and then unfreeze those reports before applying (or just pay to have them all unfrozen).

To some credit freezes will be worth the peace of mind. I still haven’t decided if I want to freeze my reports, but I am seriously considering it. Doctor of Credit has a great guide with the fees for placing a freeze and unfreezing, listed by state, as well as other directions in Credit Freeze / Security Freeze.

Signing Up for Trusted ID Premier, Equifax’s Identity Protection Program

Equifax is offering free enrollment in their identity protection proggram to any American that wants to sign up. Trusted ID Premier comes with copies of your Equifax credit report, 3 Bureau Credit File Monitoring, Equifax Credit Report Lock, Social Security Number monitoring, and $1 million in ID theft insurance.

Aside from obvious trust issues you probably have with Equifax, you’ll also have trouble actually signing up for the program. The company can’t handle the amount of demand right now and when you attempt to enroll will only give you a date on which you can start as opposed to confirmation of enrollment.

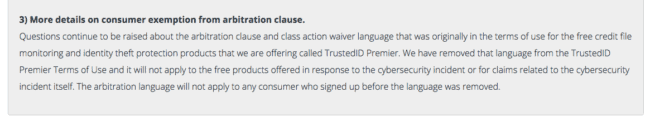

If you weren’t already TOTALLY sold on this protection program already, there was even buzz for a while that by enrolling in Trusted ID, thanks to wording of the terms, you waived your right to participate in a class action law suit against Equifax. Equifax has since changed the terms and published a statement on their website they created to keep consumers updated on the lastest: equifaxsecurity2017.com.

Frequent Miler has more useful suggestions of free ways to help protect yourself during this frustrating experience.

Bottom Line

I am not claiming to be an expert in the arena of cybersecurity–just sharing what I’ve done personally with hopes it can provide some guidance to those overwhelmed by the situation. What I’ve done and described in this post are first steps. If you find yourself actually victim to identity theft, you’ll need to take more serious action.

I would love to hear your opinions about best practices in data breaches (the scale of this one is unprecedented, but still). What are you going to do, if anything, to protect yourself? Are you going to freeze your credit? In the comments, please share your experience navigating through this mess to lend your fellow MileValue readers a hand.

Great post. All that I can say is Thank you.

Another means of keeping an eye on your credit cards is to set up an email when a certain amount has been charged and you can also do that if ANY amount has been charged from overseas. Rather than use the obvious $100 amount, I choose to use $89. I also check my bank account daily. This is the THIRD freakin’ time I’ve been breached in the last decade and, knock on wood, it hasn’t cost me a dime.

You absolutely have to remain pro-active. To not be so is to be a fool.

We had our identity stolen in 2007. We filed a claim, called the police, and finally got all things stopped. However, getting another credit card, loan, any banking situation was a problem each time. Placing a freeze on your credit reports will also put a stop to you getting valid credit cards without a whole lot of hassle.

This happened to my mom a few years ago. She is not fluent in English so I helped her file police reports, informed all credit bureaus, and filled out many paperwork to get the charges dismissed. It was time consuming so I was unhappy to hear about Equifax’s breach. Cross my fingers I don’t have to go through the same process.

Remember Landlords , Doctors, xspouses, IRS, State, GOES ,bank tellers and anyone who works for them has ur stuff .The best is Medical I think like $60 per by the nice person @ check in . There are so many cases the cops don’t care ..One credit report had the photo of the person who took my tenant ID .

Not Good not really much u can do .

CHEERs

your comments and recommendations make sense as they are common sense.

everybody will deal with this issue in a different way based on their previous experience in the field of

id theft and related.

my suggestion would be for everybody would be to use this urgent opportunity to dig into this subject matter in order to figure our what one feels most comfortable with how to react.

also, don’t shy away from talking to your local bank – investment advisor, who will be able to guide

you thought this – sometimes – jungle of options how to best proceed from here….

Great article and appreciate the information. I did just now set up a fraul alert online with Transunion and it worked just fine.

I have a creditkarma account and it’s definitely both handy and free, though I don’t think they update more than once a month or so. But you can see your cc accounts and all that.

That’s also how I found out that when I bought a car two years ago, with a loan, I got TWO hard pulls that never merged, grrr.

Great post–supplied information and suggestions I never would have thought of. THANK YOU.

I would point out to those on Medicare that you need to be vigilant about someone getting medical care under your SSN. You could end up getting stuck with some bills for the 20% gap if they get a lot of ER care or similar. A lot of time providers don’t ask to see the actual SS card and, as long as they have your number, birthdate, etc., you could get hit.

You’re welcome! Great point about medicare, thanks for the insight.

It would seem like my Life Lock account would be able to keep on top of this and I wouldn’t have to make those multiple phone calls and the hassles that go with them. Then again I’m not sure they’re that good! Maybe I’m being too optimistic.

Great article but I like to add a few ideas:

Freeze all big 4 (Chex Systems)

Call your banks and put a verbal password on all accounts (use a different pass for each bank) This is very important as they have your Mother Maiden Name and all related security questions from the web and Equifax (try Google yourself on the web)

Sign up for all the free credit reports as you can (freecreditreport, creditkarma etc.) the idea is you do it before they do it for you and see exactly which card you carry and the credit limit. (My local law enforcement caught someone with my credit report from Freecreditreport.com)

Do add the verbal password with your Cellphone co. They like to take over your cell number to call the banks.

Sign up for delivery alert with UPS and Fedex. They will sign up with your information and waiting nearby

If they do get a hold of your credit cards, let them spend some money (Banks won’t help you if they don’t loose money). I stopped them twice and all of my banks refused to help.

I like to add one more, Lifelock is the best. They will tell you which Whitepages posted your information on the web. They are quick to tell you if there is a change with your credit. I used USAA, Costco, AAA, Amex and many more but Lifelock is way better.

>”Signing Up for Trusted ID Premier”

Don’t Do it. The Equifax website is NOT SECURE. Just look at what it takes to reset your password, and then you’ll know what I mean.