September 10, 2025

How Much Are Southwest Rapid Rewards Points Worth?

If you aren’t familiar with Southwest Airlines, it’s the fourth largest carrier in the United States by several metrics. Southwest developed as a low-cost carrier and has operated differently than…

0 Comments42 Minutes

August 27, 2025

Basics of United MileagePlus

Given that United Airlines is one of the largest United States-based carriers, many travelers will have opportunities to fly on United and its partners and participate in the MileagePlus…

0 Comments43 Minutes

August 27, 2025

How Much Are United MileagePlus Miles Worth?

Earning points and miles is relatively straightforward, but the redemption side can be more challenging and complicated. Most of us share the desire to obtain good value for our points and miles, but…

0 Comments42 Minutes

July 30, 2025

What Is an Open Jaw Itinerary? When and How to Use Open Jaws

If you don’t know what an open-jaw itinerary is and haven’t booked flights this way, you’re not alone. The simplest way to think about an open jaw is that it represents a gap without flights at some…

0 Comments35 Minutes

July 23, 2025

Redeeming American Airlines Miles for International Travel

If you want to use American AAdvantage miles for your next international trip, there are numerous options. Award availability and award rates vary significantly depending on where and when you want…

0 Comments46 Minutes

July 9, 2025

How to Maximize Domestic Award Redemptions Using Citi ThankYou Points

If you’re interested in booking flights within the United States and have Citi ThankYou® Points, there are more options than you might have considered. Let’s start with some background. ThankYou…

0 Comments47 Minutes

June 25, 2025

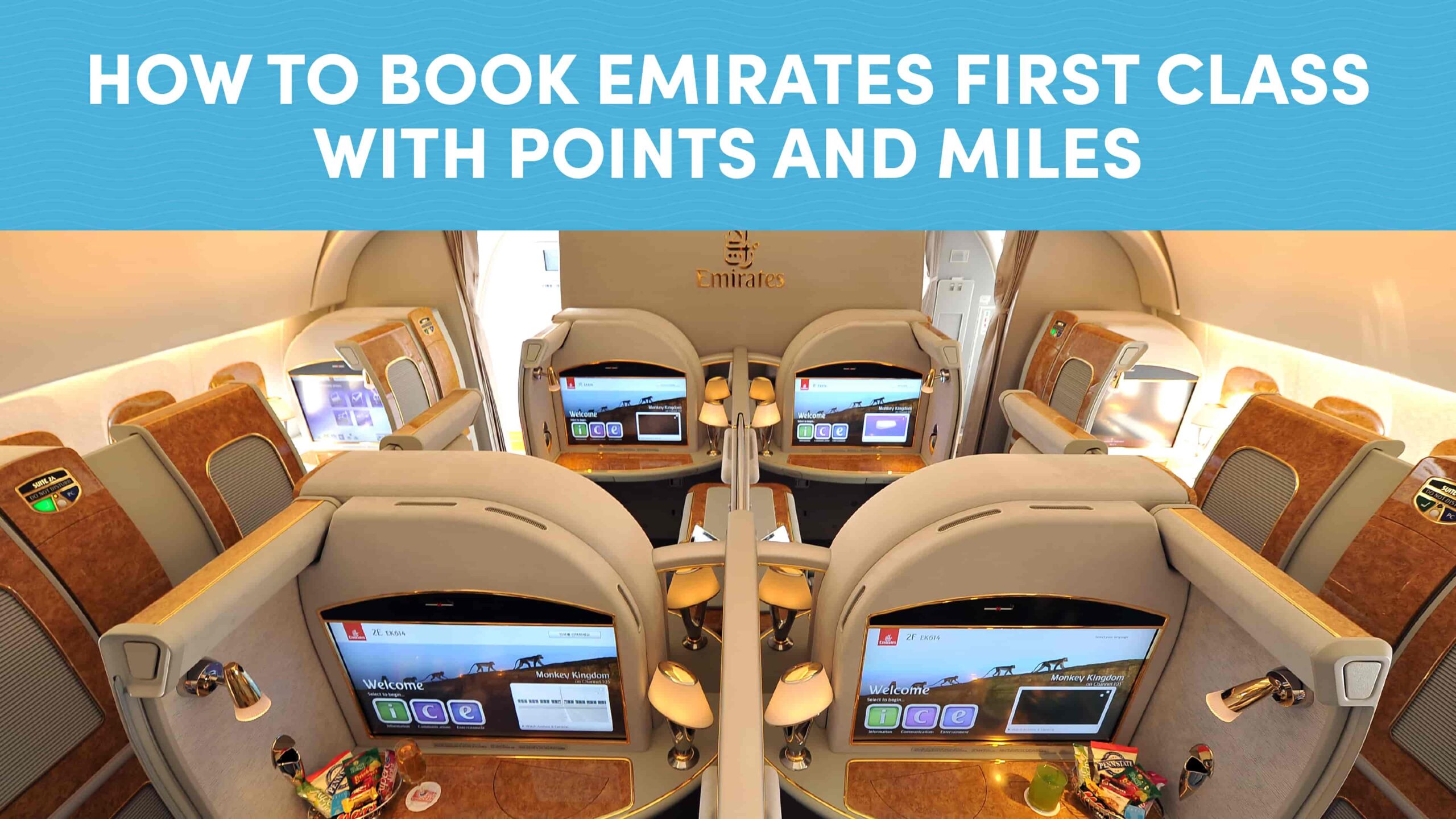

How to Book Emirates First Class with Points and Miles

Emirates first class is a bucket-list item for many travelers seeking luxury flights with points and miles. The aspirational product features onboard showers, onboard bars, luxurious suites,…

0 Comments30 Minutes

Chase Sapphire Preferred® Card

Chase Ink Business Cash® Credit Card

Chase Ink Business Unlimited® Credit Card

Sign Up for Our Newsletter

Get the best MileValue points and miles content, directly in your inbox.