MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

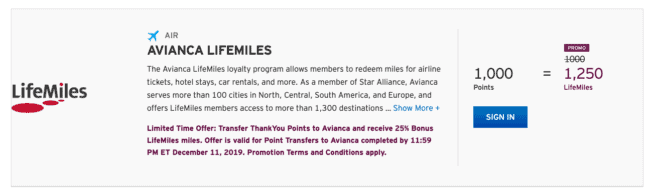

Through December 11, 2019, you will earn 25% more Avianca LifeMiles when transferring Citi ThankYou Points.

Three of the four major transferrable point currencies–American Express Membership Rewards, Citi ThankYou Points, and Capital One Miles–periodically run transfer bonuses to airline mileage partners. Chase Ultimate Rewards offered their first transfer bonus in May to British Airways Avios.

Sometimes the transfer bonus is offered by the bank that issues the points, and sometimes the transfer bonus is offered by the mileage program you can transfer said points to. Both kinds are included in this list.

When Was the Last Transfer Bonus? Series Index

- When Was the Last Transfer Bonus? Membership Rewards

- When Was the Last Transfer Bonus? ThankYou Points (this post)

When Was the Last Transfer Bonus? SPG Points*- When Was the Last Transfer Bonus? Capital One Miles

- When Was the Last Transfer Bonus? Ultimate Rewards

*Prior to the merger of Marriott and SPG, there were two separate reward currencies for each hotel chain. In August of 2018, all SPG points were converted to Marriott points. You can still transfer Marriott points to airline partners as you could before with SPG points, but Marriott has not offered any transfer bonuses on top of the consistently available 5k airline mile bonus you’ll receive for every 60k Marriott points transferred so I’ve left them out of this series.

Why Should You Care?

If you have the flexibility to wait to book your award, and you have an idea of when the next transfer bonus is, you could wait to save points.

Transfer bonus histories are especially useful if you want to transfer points to a partner that doesn’t normally have a favorable transfer rate, and a bonus would make the transfer feasible.

Transfer Bonus History of ThankYou Points

Information below only concerns transfer bonuses from the last ~five years. If a transfer partner isn’t mentioned, it’s because there have been no transfer bonuses offered in the last four years. For partners that don’t transfer 1:1, I’ve included a reminder of the rate.

Avianca

- From mid November through mid December 2019: 25%

- From early June through early July 2019: 25%

- From mid November through mid December 2018: 25%

Avianca transfer bonuses are a welcome recent addition for ThankYou Points. So far the pattern looks strong: one month in the summer (June/July) and one month of winter (November/December). Keep an eye out as these Star Alliance miles have fair award chart prices and that could prove extra useful now that United has switched from award charts to a revenue-based award pricing system.

Cathay Pacific

- From early June through early July 2018: 15% transfer bonus

- From early August through early September 2017: 20% transfer bonus

Looks like an annual summer transfer bonus can be expected.

Etihad

- From mid June through the beginning of July 2017: 10% transfer bonus

- In October 2016: 20% transfer bonus

- In July 2016: 25% transfer bonus (note this bonus was not Citibank specific, it applied to transfers in from a variety of hotel partners–excluding SPG–as well)

- From mid November through December 2015: same as above

There doesn’t really appear to be a pattern. There’s never been a transfer bonus in the first half of the year.

Flying Blue (Air France/KLM)

- From late June through late July 2019: 25% transfer bonus

- From early July through August 2018: 30% transfer bonus

A yearly transfer bonus in the summer is the emerging pattern.

JetBlue

- Late September through mid October 2019: 25% transfer bonus

- In mid September 2018 Citi improved the transfer ratio from 1,000 ThankYou Points = 800 TrueBlue Points to 1:1 for the Citi Premier and Prestige cards.

- From mid March through late May 2018: 30% transfer bonus that made the rate 1,000 ThankYou Points : 1,040 TrueBlue Points

- From the second week of September through the third week of October 2017: 25% transfer bonus that made the rate 1:1

- In March and April 2017: 50% transfer bonus that made the rate 1,000 ThankYou Points: 1,200 TrueBlue Points.

JetBlue gets pumped in March and September every year.

Qantas

- From early March through mid April 2019: 25% transfer bonus

- In June 2016: 15 to 30% tiered transfer bonus (the more you transferred, the bigger the bonus)

Only one bonus in recent history means no pattern yet.

Turkish Airlines

- Late January through Late February 2019: 25% transfer bonus

Always happy to see transfer bonuses to new partners!

Virgin Atlantic

- From late May through late June 2019: 30% transfer bonus

- From September through mid October 2018: 30% transfer bonus

- From early January through early March 2017: 25% transfer bonus

- From early March through early April 2016: 25% transfer bonus

- From early June through late August 2015: 25% transfer bonus

Virgin Atlantic transfer bonuses tend to vary, but it’s safe to say there’s at least one per year. I recently redeemed just 45k Virgin Atlantic miles on Delta One to Argentina from Atlanta (and only $5.60 in taxes), which would have cost just 35k ThankYou Points with the standard 30% transfer bonus. That’s an unbeatable price to Southern South America in a flat bed. Membership Rewards also often offer transfer bonuses to Virgin Atlantic. The program is full of sweet spot awards that are made dirt cheap with these kind of transfer bonuses.

ThankYou Point Earning Cards

Citi Double Cash

The Double Cash card has offers a competitive cash back rate: 1% upfront upon purchase and another 1% upon bill payment, for a total of 2%. But it recently joined the ranks of valuable point-earning travel cards due to a benefit added recently by Citi. The rewards earned by the Double Cash are called Citi Cash Rewards. Now you can morph Cash Rewards into ThankYou Points (at a 1:1 rate), the reward currency earned by the Citi Premier and Citi Prestige, as long as you have one of those accounts open to transfer them to. Earning two points per dollar on everyday spending is currently unparalleled in the travel rewards card market. Even better, there is no maximum amount of bonus points you can earn!

Citi Premier

The Premier comes with 60,000 ThankYou Points after spending $4,000 within three months of opening the card. It has an annual fee of $95. You’ll earn 3 ThankYou points for every dollar spent on travel (including gas stations), 2 for every dollar spent on restaurants and entertainment, and 1 for everything else.

Citi Prestige

The Prestige is Citi’s premium travel rewards card, so it comes with an expensive annual fee of $495. However, as long you’d organically spend $250 a year on travel expenses, then the annual fee is negated by the $250 per calendar year travel credit that you can collect twice before the second annual fee is charged. That makes the 50,000 ThankYou Point sign up bonus (for spending $4,000 in three months), 5x Thank You Point category bonus on air travel, restaurants, and hotels, and the 4th hotel night free on paid stays benefits icing on the cake.

Bottom Line

Having a historical reference of when the last transfer bonus occurred can be valuable information if you’re trying to plan an award. Time it right and you can pay even less points.

Bookmark this page for future reference! And let me know below if there was a past transfer bonus I missed.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Please let us know of transfer bonuses ASAP, if happens,

Thanks

Transfer bonus to United Airlines. Several days ago I transferred Marriott to UA and NO bonus.

Also transfered Chase points to United and it was instantaneous whereas the Marriott to UA still hasn’t posted.

You comments please.

Not sure I understand what you’re trying to say as this post is about ThankYou Points, and they don’t transfer to United.

Thank you for these posts.

I wonder if there is a way to get instantly notified of transfer bonus for ThankYou points?

And thanks for the elaborate description and history Sarah.

You’re welcome! If you mean automatically by Citi, I’m not sure, but I don’t think so. I can make an effort to write more posts about them when they happen, though, and as long as you’re signed up for the newsletter than you’ll get an email notification!

Sarah, Do you also keep track of Chase and Amex on when they have given bonuses in the past?

Here is the record of Amex bonuses. Haven’t made one for Chase yet but plan on it.

I would love to see these in a tablular or calendar format

Noted!

Are the points forever or do they have to be used by ? Or loose them?

ThankYou Points don’t expire as long as the card you earned them with is open. If you close it, the ThankYou points expire after 60 days. If you have a Premier or Prestige, and don’t want to pay the annual fee anymore, downgrading it to a Citi Rewards+ card keeps the points alive and transferrable to airlines for 90 days (and that card does not have an annual fee). Any shared ThankYou Points expire 90 days after being shared. Transferring ThankYou points to a frequent flyer program makes them subject to the miles expiration policy of whichever program you transfer them to.

Do LifeMiles expire? I have a planned use for them on Lufthansa this coming summer 2020