MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Applying for business credit cards is a great way to earn more miles and points than you already do, but many people don’t apply for business cards because they incorrectly believe they don’t qualify.

You don’t need to have employees, nor does your business need to be profitable. Using a social security number instead of an EIN on the application is totally acceptable. Your business doesn’t even need to have it’s own name or separate address from your personal one!

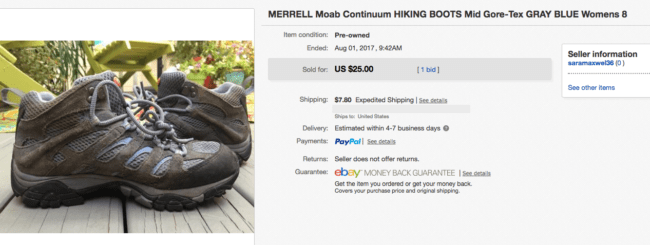

Sell things on Etsy? Ebay? Bake sales? Yard sales? These are legitimate businesses to open a business credit card for.

Learn more in How to Get Approved for Business Credit Cards.

And just because you have a consumer version of a credit card does not mean you can’t get the business version of the same card. If a co-branded card is available for consumers and businesses, they are generally considered separate products in terms of card eligibility. For example, if you have the Delta Gold Amex card–the consumer version–you can still open and receive the bonus on a Delta Gold Business Amex.

Without further ado, here are the ten most lucrative business credit cards for travel rewards on the market right now.

1. Chase Ink Business Preferred Credit Card

BONUS: 80K ULTIMATE REWARDS

The Chase Ink Business Preferred Credit Card offers 80,000 bonus Ultimate Rewards after spending $5,000 in the first three months. In my opinion that’s the most valuable sign up bonus the credit card market has to offer, considering return on spending.

Ultimate Rewards transfer 1:1 to United, British Airways, Singapore, Korean, Southwest, Virgin Atlantic, Hyatt, and more.

The Ink Preferred earns 3x points on travel; shipping; internet, cable, and phone services; and search engine or social network advertising (on the first $150,000 spent annually), and 1x points on everything else.

You’ll also get up to $600 in coverage per claim in cell phone protection against theft or damage for you and your employees, as long as you pay that cell’s bill with the Ink Preferred.

This business card offers solid benefits and return on spending as a stand-alone card. I think it’s the best option for the price.

Annual Fee: $95

2. Chase Ink Business Cash Credit Card

BONUS: $500 CASH BACK OR 50K ULTIMATE REWARDS

The Chase Ink Business Cash Credit Card technically comes with a $500 cash back sign up bonus for spending $3,000 within the first three months, but what you are actually earning is 50,000 bonus Ultimate Reward points. They are a different kind of point than what’s earned by the Chase Sapphire Reserve® or Ink Business Preferred.

I said technically above because it is marketed as a cash back card. But the Ultimate Reward points it earns don’t have to be redeemed for 1 cent each, as most card advertisements lead you to believe. If you have a Chase Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred, you can transfer the 50k Ink Business Cash Ultimate Rewards to one of those accounts to turn them into the kind of Ultimate Rewards earned by the respective account… that are transferrable to nine airline or three hotel loyalty programs for outsized value on international/premium cabin award flights and expensive hotel rooms. This increases their value to somewhere around 2 cents each (meaning 50k Ultimate Rewards would be worth around $1,000 instead of $500).

Alternatively, moving them to your Sapphire Reserve card also means you can redeem the points for 1.5 cents each on cash flights through the Chase travel portal, which is often the better deal (compared to turning them into airline miles) for domestic flights.

Category bonuses on this card are lucrative as well:

- 5 Ultimate Reward points per dollar on the first $25,000 in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services.

- 2 Ultimate Reward points per dollar on the first $25,000 in combined purchases at gas stations and restaurants

And you get all of this for no annual fee, ever. Just don’t charge foreign purchases on it as you’ll get hit with fees.

If you have a Sapphire Reserve, Preferred, or Ink Business Preferred, then I highly recommend scooping up this card for its earning potential with that 5x category bonus points in business specific expenses. Even if you don’t have one of those other Chase cards, 5x points redeemed as 5 cents cash back from cell phone, landline, internet, and cable TV services is a fantastic return.

Annual Fee: $0

3. Chase Ink Business Unlimited Credit Card

BONUS: $500 CASH BACK OR 50K ULTIMATE REWARDS

The Chase Ink Business Unlimited Card offers a sign up bonus of $500 cash back for spending $3,000 within three months of account opening. Just like the Ink Business Cash, however, if you also hold a Sapphire Reserve, Preferred, or Ink Business Preferred, then you can transfer those Ultimate rewards earned by the Ink Business Unlimited to your other Chase account and they magically turn into the kind of Ultimate Rewards that can be transferred to airline loyalty programs, increasing their value dramatically.

What’s also pretty appealing about this card, which is the business counterpart to Chase’s Freedom Unlimited consumer card, is that it will earn 1.5 points on ALL purchases with no cap. That’s a great return (especially if you can transfer those Ultimate Rewards to a more valuable account) for no annual fee. This card charges foreign transaction fees so it won’t be a good option to use when traveling.

Annual Fee: $0

4. Business Platinum from American Express

BONUS: 75,000 MEMBERSHIP REWARDS

While not unusual for business cards, the minimum spending requirement on the Business Platinum from American Express is rather high–$10,000 within three months of opening the card will get you 50,000 bonus Membership Reward points, and an additional $10,000 in spend will earn you an additional 25k bonus Membership Reward points within the same three month period. But a 75k bonus is a huge chunk of rewards. I don’t recommend manufacturing spend on Amex cards, as they are known for clawing back points for that kind of behavior. If you can manage the spending organically and can justify the hefty annual fee (checkout benefits below), then apply.

The card comes with many of the same valuable perks that the personal Platinum does, like $200 in airline incidental fee credits every year.

Other benefits include:

- 5x points on airfare and prepaid hotels booked through the Amex travel portal and 35% points rebate when paying with Membership Rewards for air travel booked through the Amex travel portal. The rebate applies to one designated airline when buying economy tickets, but any airline when purchasing premium cabin tickets.

- 1.5x points on each eligible purchase of $5,000 or more

- Up to $200 in statement credits annually for U.S. purchases with Dell

- Up to $100 hotel credit for qualifying hotels booked through Amex Travel.

Annual Fee: $595

5. Capital One Spark Miles for Business

BONUS: 200K CAPITAL ONE MILES

The Capital One Spark Miles for Business Card comes with a tiered bonus:

- 50,000 bonus “miles” after spending $4,500 on the card in the first three months

I called the card’s rewards “miles” because they’re not like traditional airline miles, but rather bank-issued points like Amex Membership Rewards or Chase Ultimate Rewards. There are two ways to redeem Spark miles:

- 1 cent each toward any travel expense. The 200k bonus miles are worth $2,000 in travel credit if you decide to redeem Spark miles this way.

- Transfer to various airline partners at a rate of 1,000 Spark miles to 750 airline mile(s), and a handful more at a rate of 1,000 to 500. 1,000 to 750 partners include Flying Blue, Aeroplan, Etihad Guest, Avianca LifeMiles and more. If you transfer the 250,000 Spark miles you’ll have after meeting the $50k spending requirement in six months, that translates to up to 187,500 airline miles!

You’ll earn 2 Spark miles per dollar spent on everything you charge to the card. The Capital One Spark Miles for Business does not charge foreign transaction fees.

Annual Fee: $95, waived the first year

6. Chase Southwest Rapid Rewards Performance Business Credit Card

BONUS: 70k RAPID REWARDS

The Chase Southwest Rapid Rewards Performance Business Credit Card comes with a large 70,000 point bonus, for spending $5,000 within three months, which is a significant help earning the Companion Pass. As long as you’re a regular Southwest Flyer, the perks will pay for the annual fee.

- 9,000 bonus points after your Cardmember anniversary (worth ~$135, bringing the effective annual fee to $64)

- Category bonuses: 3 points per $1 spent on Southwest Airlines® purchases, 2 points per $1 spent on social media and search engine advertising, Internet, cable and phone services and 1 point per $1 spent on all other purchases.

- 4 Upgraded Boardings per year when available

- 365 $8 Inflight WiFi Credits (wifi access on one device costs $8)

- Global Entry or TSA Pre✓ Fee Credit (worth up to $100)

- No foreign transaction fees

To fast track the process of earning the Companion Pass, open one of the consumer cards or the other Southwest business card, the Southwest Rapid Rewards Premier Business card.

Annual Fee: $199

7. United Explorer Business Card

BONUS: 100K UNITED MILES

For spending $10,000 on the Chase United Explorer Business Card within three months, you’ll earn 100,000 bonus United miles. If you spend $25,000 within the first six months of opening the card, you’ll get an additional 50,000 bonus miles. That means you’ll earn at least 110,000 miles for spending $10,000 on your card within three months, or in other words, 11 United miles per dollar spent.

The card comes with 2 United miles per dollar spent on United purchases, as well as local transit and commuting like trains, taxis, mass transit, tolls, and ride share services. Gas stations, restaurants and office supply stores purchases will also earn 2x.

You also get a ton of perks United related perks–one of my personal favorites being extra MileagePlus award space called “last seat availability”. This basically means cardholders have access to more United award space than non-cardholders.

You + one travel companion check your first bag for free, which saves $120 per roundtrip flight. Anyone on your reservation gets Priority Boarding, which means boarding before the majority of people and having a better chance to get carry on luggage in the overhead bin. Two United Club passes per year are also included.

MileagePlus Elite members that hold a United card are eligible for upgrades on domestic award travel.

Annual Fee: $99

8. CitiBusiness / AAdvantage Platinum Select World Mastercard

The CitiBusiness / AAdvantage card comes with 65,000 American Airlines bonus miles after making $4,000 in purchases within four months of opening the account.

- Free checked bag on domestic American Airlines itineraries for you and four companions

- Preferred Boarding on American Airlines flights (this means after Business/First/elite passengers and before economy)

- 25% discount on in-flight food, beverage, and wifi purchases on American Airlines flights

- Double AA miles on eligible American Airlines, telecommunications purchases, cable and satellite provider purchases, car rental merchants and at gas stations

- If you spend $30,000 in a year on the card, you also get a $99 companion certificate for use within the continental United States.

- Access to American Airlines’ domestic Reduced Mileage Awards

- No foreign transaction fees

The annual fee of $99 is waived the first year.

9. Barclaycard AAdvantage Aviator Business MasterCard

BONUS: 75K AMERICAN AIRLINES MILES

The Barclaycard AAdvantage Aviator Business MasterCard offers 65,000 bonus American Airlines for spending just $1,000 on the card within three months. You can get another easy 10,000 bonus miles when an employee makes their first purchase on an authorized user card, for a total of 75,000 bonus AAdvantage miles.

Other benefits include two American Airlines miles for every dollar spent on American Airlines purchases, as well as office supply, telecom and car rental merchants. You and four traveling companions get a free checked bag, plus other American specific perks like a discount on inflight purchases and preferred boarding. By spending $30k on the card within a cardmember year, you’ll earn a Companion Certificate ($99 + taxes for a companion on any flight).

This card does not charge foreign transaction fees.

Annual Fee: $95

10. Blue Business Plus Credit Card from American Express

NO SIGN UP BONUS, BUT 2X ON EVERYDAY BUSINESS SPEND

The draw for the majority of the credit cards on this list are their big sign up bonuses. That’s not the case with the Blue Business Plus Credit Card from American Express which does not currently come with an intro bonus. The fact that it earns 2 Membership Reward points per dollar spent on all everyday business purchases makes it the best small business credit card for everyday spending available. Note that the 2 points per dollar earned applies to the first $50,000 in purchases per year, and you’ll earn 1 point per dollar thereafter.

Since I value Membership Reward points at 2 cents each, that’s like getting a 4% return on everything–up to the first $50,000 in spending per year.

If you have lots of spending power that wouldn’t otherwise earn a higher category bonus on another card, then the Blue Business Plus Credit Card from American Express is a fantastic option for you. This card is a heavy-hitter for long-term value, especially because it has no annual fee! Just don’t use it abroad or you’ll incur foreign transaction fees.

Annual Fee: $0

Before rushing to sign up for new cards, remember to take into account that some miles are better than others for getting to specific destinations–not to mention issuing bank rules concerning eligibility if you have/had rewards cards in the past.

- If you need help deciding which card is the right one for you, try our Credit Card Consultation Service. We’re happy to help guide you in the right direction towards effectively and efficiently collecting the appropriate rewards.

- Need help redeeming your miles efficiently? Try our Award Booking Service. You send us your goal and current balances, and we do the work making sure your miles are stretched as far as possible.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Sarah, I think the Blue Business Plus is giving 10K right now. I got the card between the 20K and 10K offers. Sometimes you win, sometimes you lose. The Bus. Plat only gives 1.5x, yet this free card gives 2x.

Time to pay taxes soon, so which one will I choose.

Hey Bryon, are you sure that’s not a targeted offer you’re seeing within your Amex account online? I do not see a sign up bonus for the public offer.

B

I don’t know the time span of ur card BUT I have called on cards and the bank gave me the higher points . Taxes are a No Hassle way to hit min. BUT no one will give me a card To many Look sees on my credit .I’ll lay low for a year.

CHEERs

You state that the Amex SPG Business card gets “5 points per dollar spent at SPG properties.” You sure about that?

That line was confusing so I changed it–thanks for pointing that out. What I meant was that you can “earn up to 5 points per for each dollar of eligible purchases at participating SPG® hotels‡ – that’s 2 Starpoints for which you may be eligible as a Card Member in addition to the 2 or 3 Starpoints for which you may be eligible as an SPG member”… you’ll get 2 points per dollar spent on SPG properties from Amex, and you’ll get an additional 2 points per dollar spent on SPG properties just for being an SPG member. So even without status you’ll earn 4x. If you have status, you’d earn 3 points per dollar spent on SPG properties, making your grand total 5x if you put the spending on the Amex card. But the additional 2 or 3 points for being an SPG member/elite member you will earn regardless of whether you have this credit card.

Is it ok to sign up for a credit card under your employer’s business name if they don’t offer you a “company card” or is it better to just sign up under your own name and side business?

I would not open a card under your employer’s business name or EIN unless you have express permission. Just use your own social and put your business down as a sole proprietorship.

Thx!

You cannot sign up for a business card as an employee. Only as an owner/director.

Right. To clarify my prior response when I said “Just use your own social and put your business down as a sole proprietorship”, I meant your side business (as you mentioned you had one in your prior comment). Not your boss’ business.

Is your number 1 choice “The Ink Preferred . . .business card…” the same card as the “. . . Ink Business Preferred. . .” card discussed in your number 2 and 3 choices as a transfer option?

Yes

Overall it’s a good analyses of current offers.

There is a discrepancy in #2 (Ink Business Cash): 50K point offer later described as 30K offer.

With Chase 5/24 rule they supposedly can see all your Chase business cards as well as personal, so it’s harder to get under the 5 number. Otherwise the offers are really nice, plus cards offer decent benefits to hold on to them.

Hi Sarah, what ever happened to Scott Grimmer?

He’s not involved with MileValue anymore, I took over in the beginning of the year. He’s pursuing other endeavors and is currently in Russia for the World Cup.

Hi Sarah, anything new? These posts are just recycled and refreshed. How about some new content?

Hi Todd, I realize there has been less content lately. Definitely focusing on ramping that back up in 2019! Any style of content in particular that you appreciate?

subscribe

Hi. Which business cc’s don’t show on your credit report. Barclay’s business cc’s seem to show up on mine.

I have read that occasionally Barclay’s business cards will show up on your personal credit report. Usually they do not. The only other bank’s business cards that show up on personal credit reports (consistently) is Capital One.

Sarah, how would you respond to the first certification on all chase applications that the card must only be used for business purchases and not personal spending.It would seem with the high minimums and a small etsy,ebay business you wouldm’t have enough spend.

I would say that yes, indeed, that is what the terms say. I would also say that most people I know use business credit cards for all kinds of purchases without issue. But of course, that is anecdotal.

DB

I use my INK for everything .Just remember a bus. card has LESS safe guards so u may have to pay out if u get ripped off.

CHEERs

Post coming on this soon…

“That makes the 200k bonus worth 133,333 airline miles… in other terms, more than enough for a roundtrip in Business Class between the US and Southern South America.”

It’s not a 200k bonus; it’s a 50k bonus…

Deleted. That was old info pertaining to a prior bonus.

My friend applied for Chase Ink Business card and was denied. When he called them, they said his credit was “not mature enough”. It seems like anyone with a pulse and a social security card can get a business card but we here we have a full fledged business with income over $500k annually but didn’t get approved. He was approved personally for the Chase Southwest card the week prior. Any thoughts or advice? SHould he try again?

That doesn’t seem to be an issue of the business being legitimate enough. If they said his credit wasn’t mature enough, then it would appear your friend’s credit history isn’t very old. If that is actually the case then he should aim to age his accounts his existing accounts as much as possible.

And I agree with Ludwig, your friend should try going into a Chase branch to discuss the application. If he finds out different info from them there and you can share with us, that would be helpful for all of us to know moving forward.

It’s not that easy to get business cards anymore with Chase they’re all under 5/24 and with Amex they count towards your total of personal cards. Take your case and evidence of your business to a Chase branch and I’m sure he’s going to get the business card that way.

Why do you think Amex business cards count in your 5/24 total?

Thank you, very useful information. The amount that the bank is ready to lend to you is limited – each bank determines the limit based on the client’s solvency. If you are already a bank customer (you have an account where money is regularly received, or a deposit), the limit will probably be greater than in a new bank for you. The credit limit can be increased if you regularly spend money from a credit card and carefully return it. Some banks offer an increased grace period. However, not everything is so simple: during this period, you still have to pay off some fixed part of the debt. Or, a credit card with an increased grace period has limited functionality — you can pay for it not everywhere, but only from the bank’s partners. Good luck!

Can you provide the link that has the bonus term as you described on Barclaycard AAdvantage Aviator Business MasterCard? Thanks!

That offer has since changed and is now 50,000 bonus miles for $1k spend plus another 10,000 bonus miles after the first purchase on an employee card. Here’s the public link to apply.