MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

American Airlines is offering roundtrip First Class flights between Atlanta and Hawaii for $1,152. Travel dates are available now through the end of the calendar–for more specific travel date windows see below.

Considering the difficulty of finding premium cabin award space to Hawaii these days, this cheap fare is interesting. It is especially interesting if you have a American Express Business Platinum and can pay with points–it would only cost you 57,600 Membership Rewards total.

Contents

- When are the cheap fares?

- How good is the product?

- Why Hawaii?

- Mileage Earning

- Baggage Allowance

- Best Way to Buy the Ticket

Roundtrip First Class Between Atlanta and Hawaii

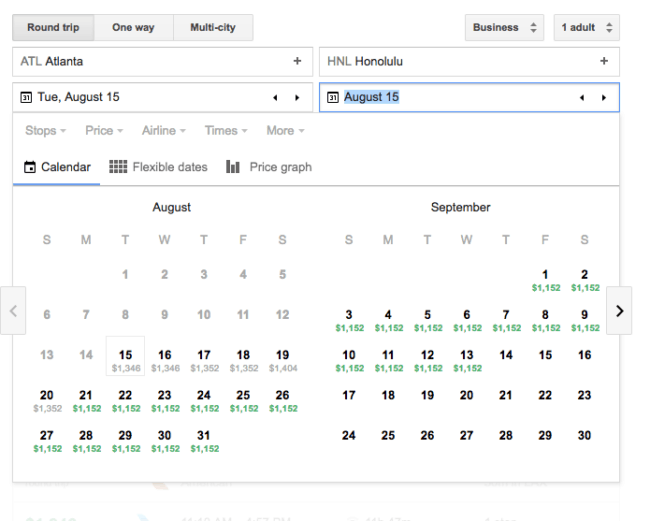

The cheap fares can be found with outbound travel dates between:

- April 10 & May 25, 2017

- August 15 & November 15, 2017

- November 20 & December 12, 2017

- December 26, 2017 and March 7, 2018

According to FlyerTalk contributor CokeandTaco, no stopovers are permitted and you also must book the ticket at least 14 days in advance. All routes have one connection, either through Dallas, Los Angeles, or Phoenix from what I saw.

The easiest way to see the cheap fares is on Google Flights. I brought up the following calendar of prices between Atlanta and Honolulu on Google Flights.

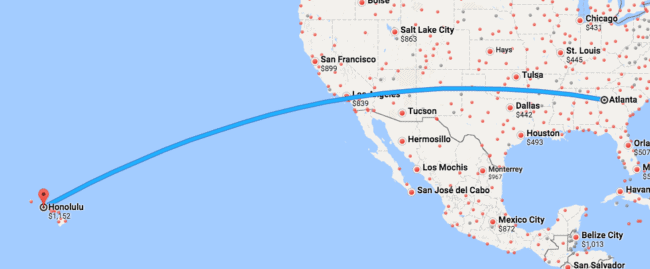

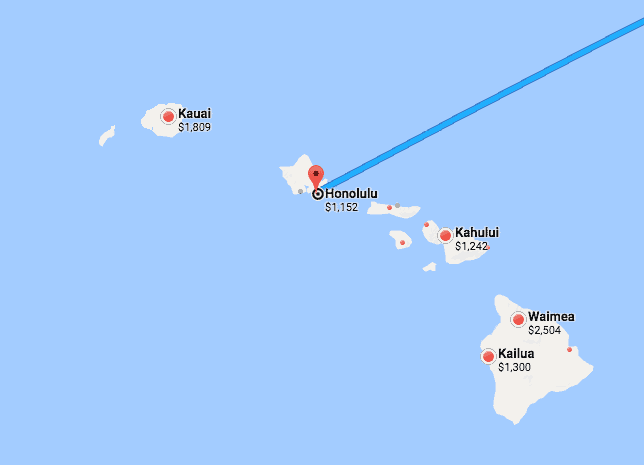

The cheapest fares are to Honolulu…

…but there are also good prices available to the other islands.

How Good is the Product?

It depends on which route you purchase as to what plane you fly. If you want a totally lie-flat seat, your best bet is routing through Dallas, flying a Boeing 777 or 767 between Texas and Hawaii. Google Flights now shows you the type of seat the aircraft flies in your search results which is nice. Pay attention to it.

Why Hawaii?

Beaches, surfing, mountains, hiking, and you don’t need a passport.

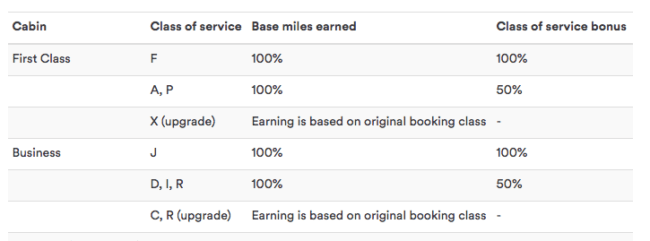

Mileage Earning

If you credit to American Airlines, assuming you have no status, you’ll earn 5 American Airlines miles per dollar spent (not including government imposed taxes). For this ticket that means you’ll earn about 5,270 redeemable miles ($1,054 x 5). Elite Qualifying Segments, Elite Qualifying Dollars, and Elite Qualifying Miles earned will vary by route. Learn more about potential earnings on aa.com.

But you don’t have to credit miles earned to the airline’s program that you’re flying. Here’s how the process of crediting to a partner works.

Crediting to Alaska Airlines is probably a better idea as you’d earn a ton more redeemable miles (this fare is booking code I–I found that as well as itemized taxes by checking ITA Matrix).

How many exactly will depend on which route you take as earnings depend on distance flown. If you flew ATL-DFW-HNL-DWF-ATL, you’d earn 13,546 redeemable Alaska miles (9,031 x 1.5).

Baggage Allowance

You get a free personal item, free carry on, and two free checked bags up to 70 pounds each included in the ticket price.

Best Way to Buy the Ticket

If you have enough Membership Rewards and the American Express Business Platinum card–which gives you a 50% rebate–you should buy this ticket by Paying with Points (through the Amex Travel Portal). You’d effectively be getting 2 cents of value per point on all Business/First fares after that rebate. A $1,152 roundtrip First Class fare to Hawaii would ultimately cost 57,600 Membership Rewards, which is much less than the 80,000 legacy airline miles you’d pay for such a flight, and even less than the 60,000 Singapore miles you’d pay to fly United Business Class. Not to mention the 57,600 Membership Rewards is all you’d pay. With traditional miles, you’d pay taxes on top of the award. You’d even earn redeemable miles as well as elite qualifying segments/dollars/miles on the trip, which you wouldn’t if you were redeeming miles on the ticket as an award.

If you don’t have an American Express Business Platinum or enough Membership Rewards to Pay with Points through the Amex Travel Portal (115,200 before the rebate) buy it with an Amex Platinum card for 5x earnings. Don’t have one those either? Check out the Best Credit Card to Buy Airfare.

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards

Hat Tip One Mile at a Time

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Good luck getting the lie flat seat. That equipment seems to never be what the seat map shows.

check out this thread at Flyertalk.

http://www.flyertalk.com/forum/american-airlines-aadvantage/1781594-hawaii-probability-763-equipment-swap-dfw-hnl-daily-non-stop.html

Interesting. I only paid $5.60 tax each way when I redeemed AA miles for my trip in 2 weeks. Now, I certainly did not get the great deal you’re advising about and might have considered paying for the ticket at these prices.

[…] example, last month I wrote about a cheap roundtrip First Class fare between Atlanta and Honolulu on American Airlines. American Airlines was offering roundtrip First Class flights between Atlanta and Hawaii for […]

[…] If you can’t utilize American/Alaska/Virgin America award space, you’re probably better off using Google Flights Price Tracker and waiting to buy the cheapest premium cabin ticket that comes along if you have an Amex Business Platinum card (and only if you signed up by May 31). Those Amex Business Platinum cardholders can redeem Membership Rewards by Pay with Points at a value of 2 cents per point (after the 50% rebate). […]