MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Through the end February, you can pay your bills with your American Express card via Plastiq with just a 2% processing fee instead of the usual 2.5%.

This is good news for those of you who recently signed up for Amex cards with high minimum spending requirements like the Business Platinum Card ($15,000 in three months for the 100,000 Membership Rewards) or the Business Gold Rewards Card ($5,000 in three months for 50,000 Membership Rewards).

Credit card links have been removed from posts and added to the menu bar at the top of every page of MileValue under the heading Top Travel Credit Cards.

But should you pay your bills on your Amex via Plastiq if you’re not trying to meet a minimum spending requirement? Probably not, but that depends on how much you value Membership Rewards. We value them at 2 cents each, so to us, paying a 2% fee to earn them is like breaking even. Read Is Plastiq Worth It? Paying Your Bills Online with Credit Cards to Earn Miles to learn more.

Back up… what’s Plastiq?

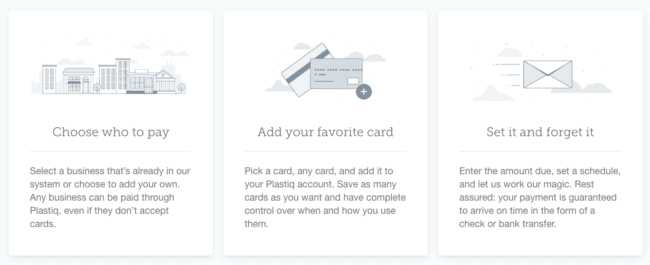

Plastiq is an online bill payment processing system that “empowers you to use your existing debit and credit cards to pay any bill, regardless of acceptance”. The normal charge for that convenience is 2.5% of each payment on a credit card and 1% on a debit card. At the moment they accept Visa, MasterCard, and American Express. You can pay with Visa, MasterCard, and American Express gift cards as well but the 2.5% credit card fee is applied.

I’ll let their infographic explain the rest.

Who and What You Can and Cannot Pay via Plastiq

Examples of Who and What You Can Pay

- Anyone providing a good or a service

- Tuition and housing fees

- Taxes (income and property)

- Rent

- Utilities

- Insurance

- Mortgages

- Car payments

- Home loan payments

- Home repairs/construction

Examples Who and What You Cannot Pay

- Yourself (cash advances)

- Recipients who have not provided a good or service (i.e. you can’t pay your friend back for lunch)

- Recipients that are located outside the United States or Canada (however the sender can be)

- Payments to savings accounts, trust accounts, retirement accounts, health savings accounts, or similar

- Payments to 529 Education Savings Programs

Never Used Plastiq?

Register via my referral link. When you make you first payment of at least $20, you’ll get 200 “Fee Free Dollars”, meaning you can make $200 in credit card payments free of any processing fees.

What to Do

You don’t have to do anything specific to activate the processing fee discount aside from using your American Express to charge the payment and making sure it’s scheduled for no later than February 28, 2017.

If you’re going to use Plastiq to pay any bills this month or next month, make sure to give the bill plenty of time to arrive before it’s due since Plastiq has to send it in the mail.

The following statement is from Plastiq.com’s terms and conditions page:

“Delivery of funds to the Merchant typically takes between forty-eight (48) and seventy-two (72) hours but may take additional time.”

Bottom Line

You can pay your bills on your American Express card on Plastiq.com through the end of next month at a 2% cost versus the normal 2.5%. Meeting the minimum spending requirements on American Express cards is a little cheapier and easier for the time being.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

This is excellent. Anyone know if you can pay months in advance and get the 2% rate?

Plastiq’s blog post about the promo says: ” Offer does not apply to payments scheduled during the promotional period which are set to process after the promotional period.”

So I guess the answer to your question is going to depend more on the person/institution accepting the payments (and whether or not the bills you’re trying to pay would actually be processed before the end of February).

Ahhhhh. Thanks Sarah!

Any worries about MS issues using Plastic? We all keep reading about clawback issues with Amex.

There are other kinds of Amex, of course… I have an spg Amex with no interest until like June… Hmm.

Good point, and we value SPG points at 2.5 cents a piece, so that might be worth it.