Capital One Spark Cash Plus

Earn a one-time cash bonus of $2,000

once you spend $30,000 in the first 3 months. Earn an additional $2,000 cash bonus for every $500K spent during the first year. You can earn this bonus multiple times over the course of year 1!

Learn How to ApplyQuick Summary

Perhaps the best cash back card on the market for business owners thanks to a hefty bonus and great ongoing spend earnings.

Business owners can use this card to earn a flat 2% cash back on every purchase with no limits. If you’re looking for simple and great cash back, this is probably the card for you.

Learn How to ApplyHow to Earn Rewards

2%

Earn unlimited 2% cash back on every purchase, everywhere—with no limits or category restrictions

5%

Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Business Travel

Annual Fee

$150

Benefits

No Minimum Redemption

Redeem cash back at any time with no minimums

Get your $150 annual fee refunded every year you spend at least $150,000

Compared to Other Cards

Capital One Spark Cash Plus

Welcome Bonus:

Earn a one-time cash bonus of $2,000

once you spend $30,000 in the first 3 months. Earn an additional $2,000 cash bonus for every $500K spent during the first year. You can earn this bonus multiple times over the course of year 1!

Annual Fee:

$150 Learn More

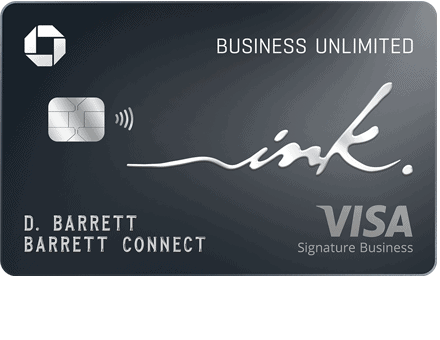

Chase Ink Business Unlimited® Credit Card

Welcome Bonus:

Earn $750 bonus cash back

after you spend $6,000 on purchases in the first 3 months from account opening

Annual Fee:

$0 Learn More

Capital One Spark Miles for Business

Welcome Bonus:

50,000 Bonus Miles

after you spend $4,500 in the first 3 months

Our Take

This revamped version of the previously known Capital One Spark Cash for Business card includes a great welcome bonus, in addition to uncapped 2% cashback on every purchase, regardless of the category.

This card is a no preset spending limit card, meaning that the card adapts to your ongoing business needs based on your spending behavior, payment history and credit profile. You don’t have a traditional credit limit as you do with a traditional card. However, note that because of this, your balance is due in full every month, and you’re unable to carry a balance, so if you need payment flexibility, this isn’t the product for you.