MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

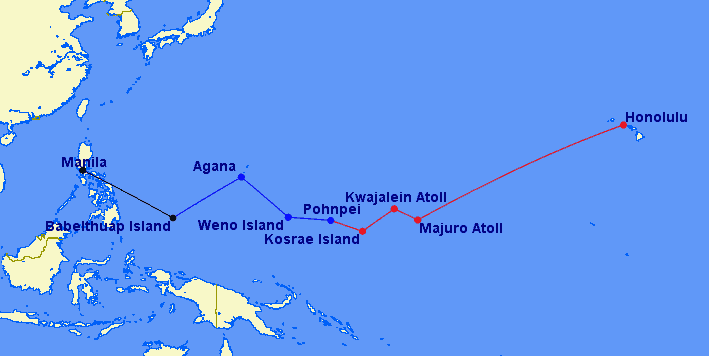

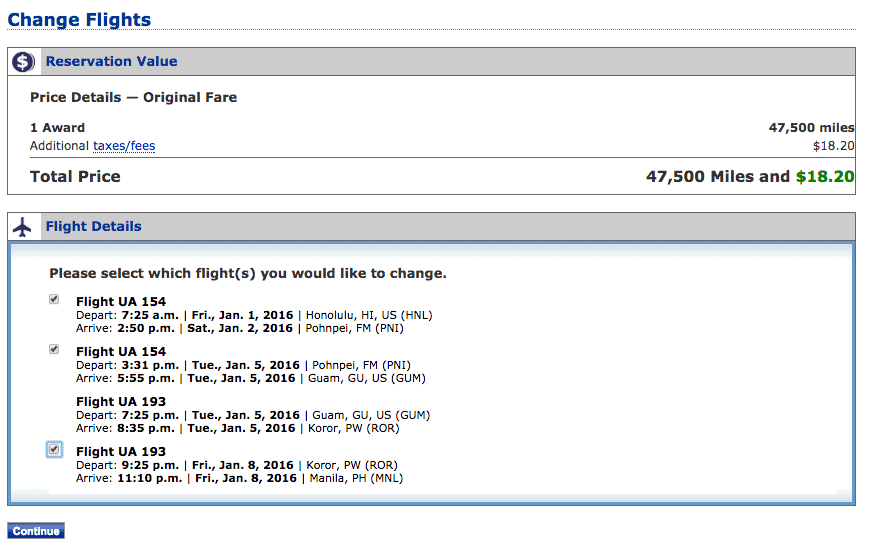

In October, I booked what might have been my favorite award ever: a Three One Way award that would allow me to see Pohnpei, Palau, and the Philippines while flying the Island Hopper. Read about it here.

Alas, something came up, so I can’t fly it. I decided to just fly directly to Japan instead, but that still left the thorny issue of how to turn my old award into an award to Japan.

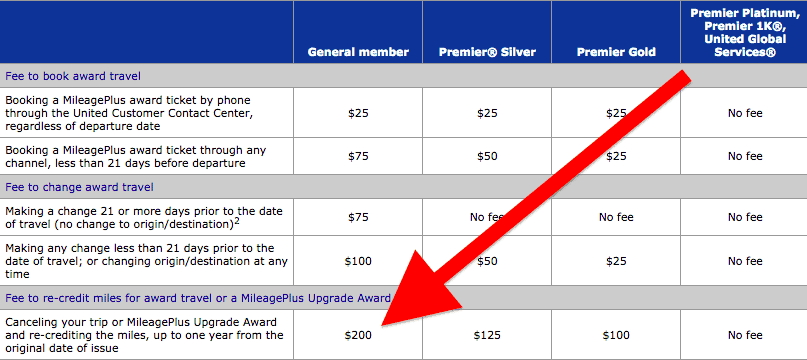

United charges $200 to cancel an award and re-credit the miles. (You do get the taxes back, so you end up paying less than $200 at the time of cancellation.)

But there’s two ways to save big on that fee.

- If there is a schedule change, you can call up and tell the agent the new flight schedule doesn’t work for you. They will cancel and fully refund the ticket. How big of a schedule change? I don’t know United’s rule. American Airlines requires a 60+ minute change.

- Instead of canceling, you can change your award and pay the much lower change fee.

Unfortunately there had been no schedule change since I booked my ticket, so I went with the second plan.

You can make any change to the ticket and pay the lower $75 fee ($50 in practice).

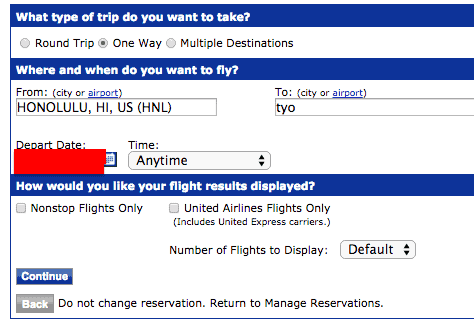

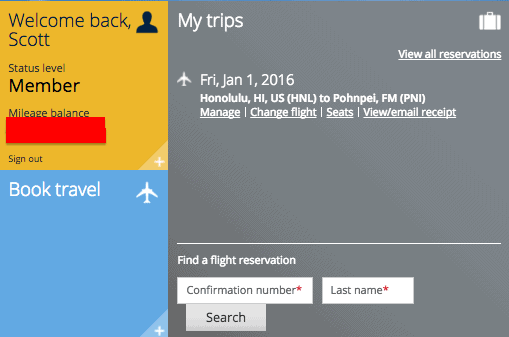

To change an award, sign in to your United account, click “My trips,” and click “Change flight.”

Check all segments of the award, and then continue.

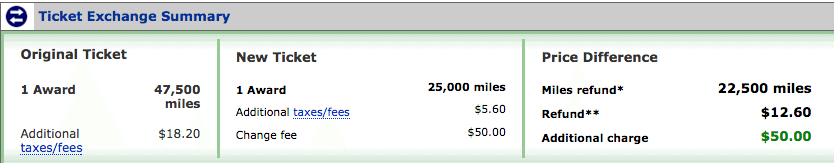

As I mentioned, I just wanted to book a simple one way award from Honolulu to Tokyo to see Japan for the first time and start a month in Asia. There was economy award space on the day I want to fly, which costs 25,000 United miles + $5.60. My old award cost 47,500 miles + $18.20. I get refunded the difference but have to pay a $50 change fee. (Why that is not a $75 change fee as United’s website says it should be is beyond me but for at least 2.5 years, United has been under-collecting this fee online.)

There was economy award space on the day I want to fly, which costs 25,000 United miles + $5.60. My old award cost 47,500 miles + $18.20. I get refunded the difference but have to pay a $50 change fee. (Why that is not a $75 change fee as United’s website says it should be is beyond me but for at least 2.5 years, United has been under-collecting this fee online.)

I made the change, paying with my Citi ThankYou® Premier Card to earn 3x points, and got instant confirmation that I am booked on my new flight. I signed out of my United account and back in and saw that my 22,500 mile refund had already posted.

Bottom Line

I’m missing Pohnpei and Palau for now. I hope to see them later in 2016 or in the more distant future.

You should never pay a $200 cancellation fee on a United award. Hope for a schedule change for a free cancellation. Failing that, just change the award for a $50 fee.

The new award does NOT need to have anything in common with the old one. I could have changed the award to any award flight. As far as I know, the cheapest United award is 6,000 miles for a one way award within Hawaii. In a pinch, it is better to pay a $50 change fee and eat 6,000 miles by changing to an intra-Hawaii flight that you never plan to fly than to pay $200 to cancel an award and get all your miles back.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

There’s a typo: “To chance an award,” should be “To change an award”….

My question: how close does your new award trip have to be to your old award trip dates? The same dates? One month a part? Six months? (Just wondering.)

There’s a typo: “To chance an award,” should be “To change an award”….

My question: how close does your new award trip have to be to your old award trip dates? The same dates? One month a part? Six months? (Just wondering.)

Good question. The new flight has to be within one year of your ORIGINAL booking date. Its relation to your old flight is not important.

Timely article. I had a one way award flight this past October, Denver to Chicago, that I no longer needed. However, I was able to change with no mention of fee online. I pushed it out to February hoping for a schedule change. Is there any strategy to increase my chances of schedule change? Certain day and or time of day? Thank you

Timely article. I had a one way award flight this past October, Denver to Chicago, that I no longer needed. However, I was able to change with no mention of fee online. I pushed it out to February hoping for a schedule change. Is there any strategy to increase my chances of schedule change? Certain day and or time of day? Thank you

There probably is, but I don’t know it. Sorry.

You always post what I need after the fact Thanks 4 Nutthing .. I was in Kona Hi. @ the Marriot across the street from the surf shop . Had a few glasses of Cheap French Wine so started looking 2 stay longer in 1 hr I got a better return flt $50 and 4 nites more with a beach & surf shop view . If the change or room had been more I would not have done it . Hawaii is a lot different then it was 10 years ago everyone wants to book the high end resorts out of town I go for the locals . So look like I did while there lots of great rooms from 1/10 to 3/20 for the normal price . This year $50 per nite same room .

Thanks

$50 per night? Wow!

That’s $50 per nite avg x 14 with ALL fees per card ect. .Why do U think I donate SW gift cards because I’m a Nice guy I think Not. Knowledge is power BUT the trips are work not freebies..

You always post what I need after the fact Thanks 4 Nutthing .. I was in Kona Hi. @ the Marriot across the street from the surf shop . Had a few glasses of Cheap French Wine so started looking 2 stay longer in 1 hr I got a better return flt $50 and 4 nites more with a beach & surf shop view . If the change or room had been more I would not have done it . Hawaii is a lot different then it was 10 years ago everyone wants to book the high end resorts out of town I go for the locals . So look like I did while there lots of great rooms from 1/10 to 3/20 for the normal price . This year $50 per nite same room .

Thanks

What if I want to make a change to a new flight that is within the next 21 days? Would I then pay $100? Or would it (mysteriously) by only $75? Or would it still only be $50 like in your example above? My guess is that in your case your new HON-Tokyo flight is more than 21 days out.

Mine is more than 21 days from now. I don’t know within 21 days what the change fee would be, but $100 max and hopefully, mysteriously less.