MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The 25,000 Starpoint bonus for opening the Starwood Preferred Guest® Credit Card from American Express and spending $5k on the card in the first six months is one of my absolute favorite bonus offers. To help people better understand the cards, I’ve already written:

- Starwood Preferred Guest Primer to explain the program in depth

- How to Get 10 Nights in Hawaii and First Class Flights for Free to explain the program’s Nights & Flights awards

Now I want to delve into what I think is one of the most interesting and often best ways to use Starpoints: Cash & Points awards. You’ve probably heard people touting these awards before as a way to get 5, 6, or 7 cents per Starpoint.

That’s very possible, but I look at Cash & Points awards as a way to do one thing: buy Starpoints for as little as 1.1 cents each. Since I value Starpoints at 2.5 cents, this is a fantastic deal for me.

Why is Cash & Points a way to buy Starpoints for 1.1 cents? Why should that interest you?

This is what I said about Cash & Points in my Primer.

To see why, let’s look at the Sheraton Frankfurt Congress Hotel, a Category 3 property. For a Tuesday this month, the hotel wants 149 euros for the refundable rate. Or you could spend 7,000 Starpoints for a Free Night, or you could spend 3,500 Starpoints + $55.

Comparing them:

- 149 euros is $198

- 7,000 Starpoints for a free night is a respectable 2.83 cents per point

- 3,500 Starpoints + $55 is an incredible 4.09 cents per point

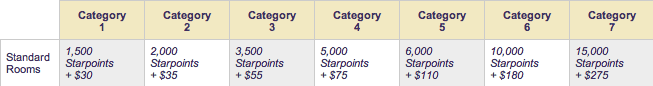

But I didn’t explain what I mean when I say that booking a Cash & Points award is like buying Starpoints. To see what I mean, compare the Free Nights chart to the Cash & Points chart.

The difference in the charts is that you pay fewer points by subbing in some of your dollars when booking Cash & Points. This is conceptually equivalent to buying the number of points you are saving for the number of dollars you are spending.

Let’s continue to use Category 3 as an example, you can spend 7,000 points for a free night or 3,500 points plus $55. That is like buying the 3,500 points you save for $55 or 1.83 cents each. The “purchase price” varies by Category and whether the stay is on a weekday or weekend and at a peak or off peak time.

- Category 1 weekday: 2 cents

- Category 1 weekend: 6 cents

- Category 2 weekday: 1.75 cents

- Category 2 weekend: 3.5 cents

- Category 3: 1.83 cents

- Category 4: 1.5 cents

- Category 5 off peak (12k): 1.83 cents

- Category 5 peak (16k): 1.1 cents

- Category 6 off peak (20k): 1.8 cents

- Category 6 peak (25k): 1.2 cents

- Category 7 off peak (30k): 1.5 cents

- Category 7 peak (35k): 1.375 cents

Cash & Points stays offer a chance for me to buy Starpoints for future use every time there is Cash & Points availability. And in all cases except Category 1 and 2 weekends, the purchase price is below my 2.5 cents per point valuation. And when using a Cash & Points night on a Category 5 property during peak time, I am buying Starpoints for future use at only 1.1 cents per point, an incredible rate!

Amazingly some “Starpoint purchases” through Cash & Points are so valuable that they can make an otherwise bad value stay a good value one.* (Example below.)

When Should You Choose a Cash & Points Stay Over Free Nights

There are two things I haven’t mentioned yet:

- Free Nights are available whenever a standard room is for sale. Cash & Points awards are capacity controlled.

- Free Nights get the fifth night free; Cash & Points awards don’t.

Those two can both change the analysis, which is very simple: Book Cash & Points–that is, buy Starpoints–when the implied purchase price is lower than your future valuation of Starpoints.

Note that I said future valuation. Ignore the valuation of Starpoints on the award in question and just focus on the value you expect to get from the Starpoints you’re buying on future awards. Things that affect this valuation:

- How you’ll use them. Airline transfers have a different value than hotel nights.

- How many Starpoints you have. If you already have a million Starpoints, you might not want to buy 5,000 more for 1.5 cents. If you only have 50,000, you should be more likely to buy at that price.

- How much cash you have. If you’re cash-poor at the moment, you’ll be less inclined to buy Starpoints.

How Does This Affect Whether You Should Get the Cards?

Starpoints are very valuable for their flexibility. That makes buying them so cheaply through Cash & Points very attractive. But you can’t buy more through Cash & Points until you have some.

Your Take

Do you look at Cash & Points awards as a way to buy Starpoints for as little as 1.1 cents? Do you prefer Free Nights, Cash & Points, or Nights & Flights awards?

*Let’s work with the Sheraton Frankfurt example I mentioned earlier with some numbers to back up that assertion.

Example: 2.5 cent valuation for Starpoints, $150 hotel valuation

The list price of the hotel is $198, but you value it at only $150 because you have other options in Frankfurt. Clearly you wouldn’t pay $198 cash for a room you value at $150, but should you use a Free Night, Cash & Points stay, or skip the hotel altogether.

A Free Night is a bad deal for you at these valuations. You’d have to give up $175 worth of points (2.5 cents * 7k) for a room you value at $150.

But Cash & Points is a good deal for you. For Cash & Points you pay $55 cash and $87.50 in points (2.5 cents * 3.5k) for $142.50 in total value that you spend. Since the room is worth $150 to you, this is a good deal. And the good deal is entirely because of the points purchase inherent to a Cash & Points stay.

In this example, you are buying 3,500 points for 1.83 cents each that you value at 2.5 cents each. That means you are profiting about $23 on the purchase. [3.5k * (2.5 – 1.83 cents)]

Despite the $23 profit on the points purchase, you are only profiting $7 on the hotel stay. ($150 valuation – $142.50 outlay in cash and points)

That means the points-purchasing aspect of Cash & Points stays flipped an otherwise bad-value stay to a good-value one. This is fairly common. Any time your valuation of Starpoints makes a Free Night a bad deal, but Cash & Points a good deal, it is due to the discounted rate at which you “buy” points during Cash & Points stays.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

This is misleading — you’re not buying Starpoints at 1.1, you’re simply using cash to fill in the rest of the award (and there is less C&P availability that full points availability). It would be “buying” points at 1.1 if I could cancel a reservation and be refunded in Starpoints (a la a certain South American mileage program).

[Edited at 6:09 PM CET]

In response to the criticisms in the comments I’ve put quotation marks in the title. To be clear: there is no way to buy Starpoints for 1.1 cents that I know of, but I think Cash & Points is conceptually the same as buying Starpoints.

Yes, what is with these misleading titles? They are making me not want to read the blog anymore.

Also there are taxes that you pay when you book with C&P, you dont pay these taxes on free nights.

Also just bc you get a high redemption value, it is not meaningful unless you are allowed to spend enough points at that high redemption value.

Agree with Amol, this logic is slightly flawed.

You’re not buying Starwood points, and since taxes are paid on the cash part, even if you were, it wouldn’t be at 1.1 cents

The title isn’t just misleading. It’s factually wrong

Agree with Amol. Misleading.. not the first and won’t be the last at milevalue!

I agree with Scott that you are buying Starpoints when you use C&P. For example, assume that you have exactly 7000 points in your account and you make a reservation to stay at a Cat 3 property. Two or your payment options are 1) 7000 points or 2)3500 points plus $55. If you select option 1 you will have 0 points left in your account. If you select option 2, you will have 3500 points in your account with a cash outlay of 55 plus taxes. You have bought 3500 points for $55 plus tax. It is true that if you cancel the reservation , you don’t get to keep the points, but you also haven’t paid the $55 either.

Me and Jim Shoe got our 56K points from Untied card today , not bad 5 weeks time.

THANKS SCOTT !!!!!!

Cj back to the Cave

Don’t forget that if you use just points for an award, you get the fifth night free on a five (or more) night redemption. You don’t get that benefit with cash and points. That could significantly affect your calculations. (although it still might be better to do cash and points anyway, depending on how you value the points)

[…] used in several ways other than airline transfers including Free Nights at SPG properties, Cash & Points stays, and Nights & Flights. For more information, see my Starpoints […]

[…] Cash & Points stays let you stretch your Starpoints over more redemptions. […]

[…] A Chance to “Buy” Starpoints for 1.1 Cents: Starwood Cash & Points Awards (Cash & Points Awards) […]

[…] can be used for free hotel nights, complete vacations, discounted hotel nights, or transferred to airline miles with over 30 airlines. It’s not uncommon for hotel points to […]

[…] report getting several cents per point from using their Starpoints for hotel awards using the Cash & Points option–even after its recent […]

I dont know why people are not getting the concept of buying here?

it is like booking a Hotel for 7000 points and buy 3500 back with $55 (thats an amazing value add, when it is the only option to “buy” points)

this will be life saver when you dont have that much points to book for a week long trip. Lets say i would either need (6*7,000=42,000 points or 21,000 points with $320)

[…] after spending $5,000 in the first six months. Points can also be used for free hotel nights, Cash & Points stays, and Nights & Flights […]

[…] A Chance to “Buy” Starpoints for 1.1 Cents: Starwood Cash & Points Awards (Cash & Points Awards) […]

[…] they can be used on a very cheap award chart for free nights, starting at 2,000 points per night; used for Cash & Points nights, which offer some good values to stretch your points for more hotel nights at the cost of a cash […]

[…] Starwood Cash & Points Awards […]

[…] can be used for free hotel nights, complete vacations, discounted hotel nights, or transferred to airline miles with over 30 airlines. It’s not uncommon for hotel points to […]

[…] Cash & Points stays let you stretch your Starpoints over more redemptions. […]

[…] A Chance to “Buy” Starpoints for 1.1 Cents: Starwood Cash & Points Awards (Cash & Points Awards) […]

[…] I’d conserve my Starpoints and spend my Membership Rewards. I want to use my Starpoints for Cash & Points, Nights & Flights, and American Airlines miles or US Airways […]