MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

The card offer described in this post has expired. To see the latest top travel credit cards with big bonuses that will save you tons, check out our Top 10 List for Consumers and Top 10 List for Small Businesses.

I’ve used the rewards from my Barclaycard Arrival PlusTM World Elite MasterCard® to get $450 worth of free flights, award booking fees, and motels in the last few weeks.

You can do even better. You can get $500 in free flights, accommodations, car rentals, and other travel expenses in three easy steps:

- Get the Barclaycard Arrival PlusTM World Elite MasterCard®.

- Spend $3,000 on the card in the first 90 days. Make sure at least $500 of this is made up of travel expenses that you want to be free!

- Redeem your Arrival miles online in a few minutes. You’ll see $500 worth of travel expenses you put on the card disappear as soon as the next day.

1. Get the Arrival Plus

The first step is to apply for the Arrival Plus.

I got the card last month for the sign up bonus worth $456 in free travel, the double miles on all purchases, the free subscription to TripIt Pro, and the ability to redeem miles for any flight on any airline without searching for award space.

For more information on my thinking, see Why I Got the Arrival Plus.

I was instantly approved with a credit line of $5,000, and my card came in the mail in just a few days.

What are steps two and three?

2. Spend $3,000 in the First 90 Days, at Least $500 of which is on Travel

The next step is to use the card for your daily purchases until you hit at least $3,000 in the first 90 days, which will unlock the card’s 40,000 mile bonus.

Since the card earns double miles on all purchases, after spending $3,000, you will have 46,000 Arrival miles in your account.

Make sure that at least $500 of the money you put on the card is spent on travel expenses. Travel expenses include:

- Airlines

- Travel Agencies & Tour Operators

- Hotels

- Motels

- Resorts

- Cruise Lines

- Passenger Railways

- Car Rental Agencies

Some of the travel expenses that I’ve used the card for include:

- a motel stay on which I could not have used points

- a car rental

- flights on US Airways and Southwest that would have been poor value redemptions with other miles

- a change fee on a United award

Arrival miles are worth 1.14 cents each when redeemed for travel expenses and far less when redeemed for other purchases, so it’s imperative to use the card for at least $500 worth of travel expenses in order to use our 46,000 Arrival miles to remove the $500 worth of travel expenses.

3. Redeem the Arrival Miles for $500 Worth of Free Travel

Redeeming Arrival miles is incredibly simple. All the travel purchases we made in the course of meeting our minimum spending requirement are put together in one place in our online Barclaycard account, and we can use miles to remove those charges from our bill any time in the 90 days after making the purchases.

Upon making a travel redemption, 10% of the miles used for the redemption are automatically rebated to your account.

I just got $448 of free travel with a few clicks. (You can get $500 in free travel because you’ll have more miles than I did at the time of my redemptions.)

After signing into my Barclaycard account, I clicked on Manage Rewards where my Arrival miles balance was shown. If you’ve completed steps one and two, your balance should be 46,000+ Arrival miles.

On the page dedicated to rewards, choose to “Pay yourself back for travel” because as I mentioned, that is the highest value redemption of Arrival miles.

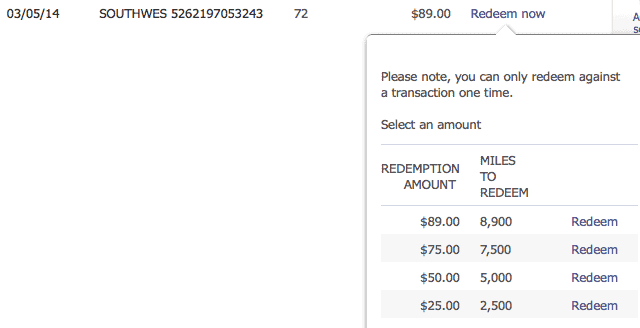

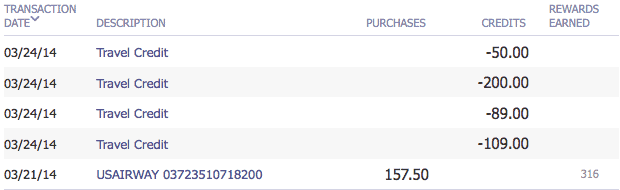

On the next screen, a list of all travel purchases for the last 90 days will appear.

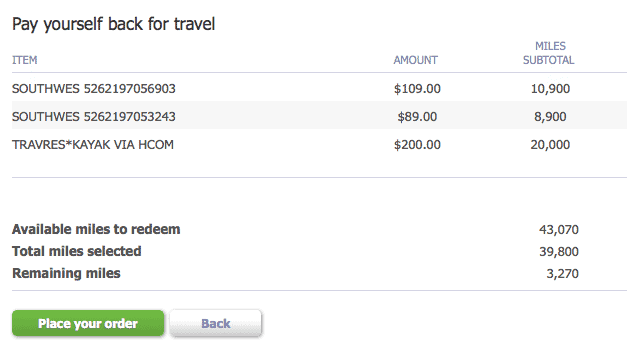

Mine (above) included two Southwest flights, a motel booking through kayak.com, and a $100 change fee on a United award that I paid to switch an award to Lufthansa First Class.

If you click “Redeem now” next to any charge, you are given redemption options to remove the charge in its entirety or to remove $25 increments.

The best value is always the largest $25 increment available. (Tell us why in the comments; Bill told us why here.) You can do one redemption at a time or bunch several together at once.

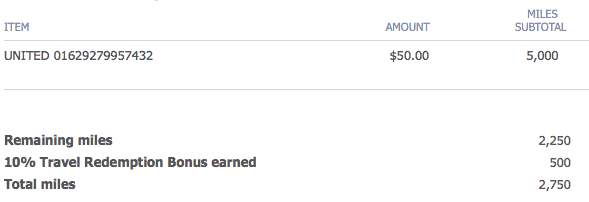

You are taken to a final confirmation screen where your current balance, the miles needed for your redemption, and your new balance are shown.

Here’s me about to do three redemptions at once to get $398 in free travel:

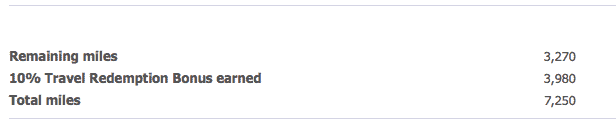

Immediately after clicking “Place your order”, you are given an instant 10% rebate of the miles you just redeemed. In the above example I redeemed 39,800 miles for free travel and got back 3,980 immediately.

With your new balance, make more redemptions. My 10% rebate put me over the 5,000 mile threshold needed to make another $50 redemption.

My $398 redemption and $50 redemption combined for $448 in free travel.

For every redemption, you will get an email like this:

The email explains that your statement credits will appear in 5-7 business days. Mine actually appeared the next day in my account.

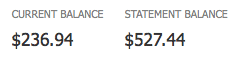

My redemptions were reflected in my current balance being less than my statement balance even though I hadn’t yet made a payment.

The Math of $500 in Free Travel

You spend $3,000 on the card at 2 miles per dollar for 6,000 miles from spending. That spending unlocks a 40,000 miles bonus for 46,000 total Arrival miles.

You redeem 45,000 Arrival miles for $450 off one or more travel expenses, and you have 5,500 Arrival miles left in your account.

46k balance – 45k redemption = 1k, 1k + 4.5k [instant 10% rebate] = 5,500

You can redeem 5,000 of those miles for $50 off another travel expense.

A $450 redemption plus a $50 redemption is $500 in free travel!

And you’ll still have 1,000 Arrival miles left.

5.5k balance – 5k redemption = 500, 500 + 500 [instant 10% rebate] = 1,000

It’s that easy to put $500 back in your pocket in three easy steps.

Complementary Card

Traditional miles and hotel points are better than the Arrival Plus for some redemptions, and Arrival miles are better for some redemptions. For that reason, I always say that the Arrival Plus is extremely complementary to other rewards cards you have:

- You can use Arrival miles to pay taxes/fees on traditional airline awards.

- You can use Arrival miles to pay for positioning flights or low cost carriers when traditional miles are not an option.

- You can use Arrival miles to pay for lodging when hotel points are not a viable option or when you prefer not to stay in a chain hotel.

How have you spent your $500 in free travel for the Barclaycard Arrival PlusTM World Elite MasterCard®. Do you use the Arrival card instead of cards that earn traditional miles or to complement those cards?

Full Offer

Barclaycard Arrival PlusTM World Elite MasterCard® with 40,000 bonus miles after spending $3k in the first 90 days

- Earn 40,000 bonus miles if you make $3,000 or more in purchases in the first 90 days from account opening. 40,000 bonus miles equates to $400 off your next trip!

- Earn 2X miles on all purchases

- No mileage caps or foreign transaction fees

- Get 10% miles back when you redeem for travel (i.e. redeem 25,000 miles for travel and get 2,500 miles back)

- Use miles for a statement credit toward any airline purchase to any destination with no seat restrictions and no blackout dates

- Easily redeem your miles for statement credits toward flights, cruises, car rentals, hotels and more

- Complimentary subscription to TripIt Pro mobile travel organizer – a $49 annual value!

- Complimentary FICO® Scores as a benefit to active cardmembers. Opt-in to have instant and convenient access to FICO® Scores from your Barclaycard online account.

Application Link: Barclaycard Arrival PlusTM World Elite MasterCard®

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

anyone tried using Arrival to buy IHG pts and get reimbursed by Arrival? should be ok right?

I bet it’s OK since IHG point purchases are processed by IHG.

I have Barclays’ US Air / Miles @ More / Football CC. I applied for that card but no success. Could you give us some more background info about your own situation which gave you “instant approval”. My own experience has been that Baclays is rather stingy.

Thanks!

Is it true you can’t redeem for partial charges? For example, you can’t redeem $450 on a $1000 plane ticket charge.

Yes, you can see that my last redemption is $50 on a larger charge. You can redeem in increments of $25 on larger charges.

Hello

Can we buy American Airlines or any other gift cards from the airlines website with the BARCLAY card and then reimburse that as a travel expesne ?

I got the miles but didnt have any travel expenses in the first 3000$ spent. So I am thinking now to use the above strategy but no travel is upcoming…

Thanks

Abdul

[…] meeting the minimum spending requirement on the Arrival card, you can use your Arrival miles for $500 in free travel. Travel is broadly defined to include hotels, flights, and car […]

[…] charge from your statement. Currently meeting the spending requirement on the Arrival card gets one over $500 in free travel including paying award taxes and […]

[…] With this card you can book any flight on any airline at any time, or any hotel, or rental car, then redeem your miles for a statement credit equal to the cost. Here’s how. […]

[…] For the newly christened Barclaycard Arrival PlusTM World Elite MasterCard®, you still get 40,000 bonus miles after spending $3,000 in the first 90 days and 2x miles on all purchases. That means that clearing the sign up bonus is worth $500 in free travel. […]

[…] The card still comes with the same 40,000 bonus miles after spending $3,000 in the first 90 days and double miles on all purchases, which adds up to over $500 in free flights after meeting the minimum spending requirement. […]

[…] your award with your Barclaycard Arrival PlusTM World Elite MasterCard® and use the card’s $500 in free travel to get the flights or taxes for […]

[…] Miles are worth 1.14 cents each, so spending $3,000 on the card in the first 90 days earns more than $500 in free flights or other travel expenses. […]

[…] Miles are worth 1.14 cents each, so spending $3,000 on the card in the first 90 days earns more than $500 in free flights or other travel expenses. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free domestic flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] If there is not MileSAAver award space on the flight you want (only AAnytime space), you are almost certainly better off using Arrival miles to book the ticket. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts, sitting or standing. […]

[…] days. Just meeting that minimum spending requirement means you’ll have 46,000 Arrival miles, which are worth more than $500 in free flights on any airline with no blackouts, any hotel stay, any car rental and more. Book your hotel stays with the Arrival Plus then redeem Arrival miles to […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline, including Southwest, with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline including Southwest with no blackouts, regardless of the s… […]

[…] the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. Use the $500 in free flights to book three roundtrips from Atlanta and get a free companion […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline including Frontier with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Meeting the minimum spending requirement on the Arrival Plus give you about $500 worth of free flights on any airline with no blackouts. […]

[…] Further Reading: Three Steps to Get $500 in Free Flights, Hotels, and Car Rentals from the Arrival Plus Card […]

[…] charge from your statement. Currently meeting the spending requirement on the Arrival card gets one over $500 in free travel including paying award taxes and […]

[…] The card still comes with the same 40,000 bonus miles after spending $3,000 in the first 90 days and double miles on all purchases, which adds up to over $500 in free flights after meeting the minimum spending requirement. […]

[…] I talked my brother into getting the Barclaycard Arrival PlusTM World Elite MasterCard® earlier this year for the same reasons that I got one, the big sign up bonus and the two miles per dollar on all purchases. He quickly spent $3,000 in the first 3 months to unlock 40,000 bonus miles. That 46,000 miles–40,000 bonus plus 6,000 from spending–is worth $500 in free flights, hotels, car rentals, and more. […]

[…] And, of course, you could pay for your WOW Air ticket and fees with a Barclaycard Arrival PlusTM World Elite MasterCard® to get a free ticket. Here’s how to get $500 in free flights from the Arrival Plus. […]

[…] Here’s the full post on Three Steps to Get $500 in Free Flights, Hotels, and Car Rentals from the Arrival Plus Card. […]

[…] Further Reading: Three Steps to Get $500 in Free Flights, Hotels, and Car Rentals from the Arrival Plus Card […]