MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

Update at 11:45 PM ET on Saturday May 31: I have sent a referral to all who have requested. To spread the love, I won’t send out any more. If you want a referral, contact one of the commentors offering to send referrals.

Until June 30, 2014, the Starwood Preferred Guest personal and business credit cards are offering 30,000 bonus Starpoints each to new cardholders who are referred by existing cardholders. This deal is much better than the current public offer of 25,000 bonus Starpoints and matches the best deal we’ve ever seen on two amazing cards.

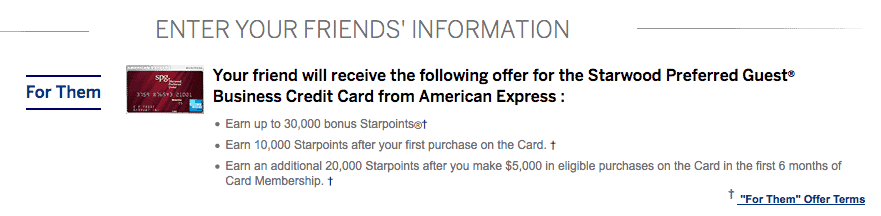

The applicant will get 30,000 bonus Starpoints:

- 10,000 bonus Starpoints after first purchase

- 20,000 bonus Starpoints after spending $5,000 in the first six months

- $0 annual fee the first year, $65 thereafter. See Terms and Conditions of emailed offer for full details.

The referrer gets 5,000 Starpoints.

This sign up bonus is identical to the deal that ran last August that many of us got in on. Back then I got the personal and business Starwood cards on the same day. After spending $5,000 on each card, I had 70,000 total Starpoints (60,000 bonus Starpoints plus 10,000 for the spending.)

Great Uses of Starpoints

Seventy thousand Starpoints transfer to 85,000 American, US Airways, Delta, and dozens of other airlines’ miles, since Starwood gives you 5,000 bonus miles for every 20,000 points transferred to airline miles.

So far I’ve transferred 20,000 Starpoints to 25,000 US Airways miles to top up my account for a dream First Class award to the World Cup in Brazil. And I used 6,000 to win an auction for a once-in-a-lifetime meet and great with the band Capital Cities in Argentina.

I value Starpoints at 2.5 cents each, and I certainly got more value than that from both redemptions. That means that the 70,000 potential Starpoints you can earn by getting both cards are worth $1,750 to me.

Here is my Starwood primer, so you can understand how to use Starpoints for transfers to airline miles, hotels, and all the other great uses.

Here are some in-depth articles on top uses:

- How to Get 10 Nights in Hawaii and First Class Flights for Free (Nights & Flights Awards)

- A Chance to “Buy” Starpoints for 1.1 Cents: Starwood Cash & Points Awards (Cash & Points Awards)

- How to Transfer SPG Starpoints to Airline Miles

- Moments by SPG: Redeem Starpoints for Experiences

As far as I can tell, the only way for an applicant to get this 30k bonus instead of the public 25k bonus is to be emailed by a current cardholder. I currently hold the personal and business SPG cards, so I can refer people.

Comment on this post with whether you’d like a referral to the personal offer, business offer, or both. The comment form asks for your email address, which I can see, but which is not public, and that’s where the offer will be sent.

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

I would like the refferela to personal offer.

Sent. Should arrive within 10 minutes.

Scott, I’d like a personal referral link. Thanks!

Sent. Should arrive within 10 minutes.

Got it. Thanks!

My recent best use of SPG points took a month ago when I was a lucky winner of one of 7 bids to see Champions League semifinal Bayern against Madrid. 71K points gave me an access for 2 to incredible seats with awesome vistas plus pre/post-match time in a lounge where we were able to eat as if in a first class terminal 🙂 There were also some celebrities from German TV shows but only my friend aus Munchen seemed to know them.

I’d like a referral. Thanks.

Sent. Should arrive within 10 minutes.

Please send me both. Can i use the same links for my wife as well? thanks

Sent. Should arrive within 10 minutes. And I think you should be able to use the same link.

business offer, please!

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Don’t forget that the elite credits stack past 2 cards – http://www.therewardboss.com/2014/05/20/easy-short-cut-to-starwood-spg-platinum-elite-status/

can you send me both business and personal invite

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Hopefully it’s okay to offer another source of referral for both of personal and business – please contact me through FT – look for ‘illesus’ user – http://www.flyertalk.com/forum/members/illesus.html.

—

Scott: please let me know if it’s okay to post this possibility – otherwise please delete this comment

Thanks.

Illes

Also I can be reached directly at illes-at-outlook-dot-com.

Thanks again

[…] MileValue posted, you can get a 30,000 sign up bonus with the Starwood American Express (both the business […]

Personal referral please

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Please send link to both cards. Thanks

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Interestingly enough I received an email today from spg asking me to sign up for the card for 30,000 points no referel, so it might be possible for some people to receive this offer via email. For invitation only is what it states.

Dear Dina,

You’re invited to apply four days early to take advantage of this limited-time offer. Now, you can earn up to 30,000 bonus Starpoints® 1,2 with The Starwood Preferred Guest® Credit Card from American Express. With 30,000 Starpoints, you could enjoy 3 free nights at a Category 4 hotel or 7 free nights at a Category 2 hotel.3 Note: Some hotels may have mandatory service and resort charges.

My wife just received the same one directly from them.

Scott,

If you don’t mind and have reached your 10 max referrals, can others email me at funkdrr@yahooDOTcom for a referral on either personal or business card?

TIA

could you refer me for the Business Amex SPG card? thanks.

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

I got the same email too to refer friends. I have the personal card not the business card. Not sure if I can apply for the biz SPG card as I already have 4 person credit (one of them I am planning to cancel) and 1 business gold. I think amex allows a maximum of 4 credit cards.

Can I have a referral for both the business and personal? Thanks, Scott.

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Could I get a referral for the personal card? Thanks!

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

I’d like referrals for both. Thanks!

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Hello – I would like to have a personal referral please. Thanks!!

Sent. Should arrive within 10 minutes. Drop me a line if you’re approved.

Hi, Scott,

I would like links to both the personal and business 30k offers.

Thanks.

I’d like a referral for both Personal and Business. Thanks.

I’d like a referral for both Personal and Business.

Thanks.

I’d like referrals for both

Personal and Business. Thanks.

Please send me a personal referral. Thank you!

I’d like both referrals. Thanks!

Hi Scott,

When you reach your max referrals, can others email me at briane350 AT yahoo DOT com for a referral on either personal or business card?

THX, Brian

i would like a business card referall thanks

Scott, please send me referrals for both personal and business SPG cards. Thanks in anticipation.

Please refer me for the Business card offer…. Thank you

Please send a referral both business and personal cards.

Thanks,

Garry

Please send both business and personal card referrals.

Thanks,

Garry

Business spg referral please

I am available to give out referrals as well. I have 8 left. Send me your email.

Greenwoodfam@gmail.com

Thanks Scott for letting me post in your comments.

What is the maximum number of referrals?

If you have a business card can you refer people for personal and visa versa?

Turns out only for the type you have

I’d like a referral please. Thanks for all the info you share on your blog.

Hi All,

I have 8 personal card referrals available if anybody is looking. Please reply with your first and last name and e-mail address. I’ll be happy to send it straight over.

Regards,

Paul

You can send me an e-mail directly at paulboardworks@gmail.com if that is preferable.

I’ve had both of them since last September but didn’t receive this offer. All I’ve found on my SPG profile reveals the following:

“Your friend will receive the following offer for the Starwood Preferred Guest® Business Credit Card from American Express : Get 10,000 Starpoints after your first purchase on the Card. † Earn an additional 15,000 Starpoints after you make $5,000 in eligible purchases on the Card in the first 6 months of Card Membership. †”

I also have quite a few SPG Business referrals. Please send me your email address if you’d like to have a referral link.

ihsin2@yahoo.com

Thanks Scott for letting me post in your comments.

Sorry for the confusion. I just realized that my links are only 25K, not 30K.

Would love a personal and business referral

e-mail me at paulboardworks@gmail for a personal referral

I would like the personal referral for a friend please.

Feel free to email me at rajeevvadgama@yahoo.com with the first name, last name and email address to send the referral for the personal card. Thanks!

Looking for a personal card only, referrAl only, one for me and knew for my wife. Thx

Feel free to email me at rajeevvadgama@yahoo.com with the first name, last name and email address to send the referral for the personal card. Thanks!

I can send referrals for the SPG Business Card. Just send me an email. I would greatly appreciate anybody who would like a referral from me. Thanks

scobro99@yahoo.com

Would you please send me a business referral? Thanks!

Scott, I would appreciate referrals for both personal and business SPG cards. Thanks so much.

I would love a referral for the business card. Thanks!

Hi Greg, I think Scott will send you my email address or vice versa. Thanks

I would like the refferela to personal offer. Thx

Feel free to email me at rajeevvadgama@yahoo.com with the first name, last name and email address to send the referral for the personal card. Thanks!

I have the biz. I can refer anyone who gives me their email adrress. yudigoldfein@gmail.com

Hi Samuel – I can send you and anyone else a personal spg referral if you send me your full name and email address to dj_luv123@hotmail.com. All referrals appreciated and thanks Scott for letting us post!

I have a few personal referrals available. You can email me at dangrozaATrocketmailDOTcom for referrals. Thanks

I would love to to send referrals for the personal card as I have 8 left! Just email me your first name, last name and email address to rajeevvadgama@yahoo.com. Thanks!

I can offer a referral to someone who would like to get a Biz card. Thanks!

Can you please send me the business card offer for 30k points?

rajeevvadgama@yahoo.com

Hi Email me a1anchang@yahoo.com, my wife and I both have Personal and Business. We’d love to refer you.

email me at honcamry@hotmail.com for a personal or business referral. please specific personal or business. Thanks.

I’ll be happy to provide both personal and business referrals.

Just send me a note: vike80@gmail

Pick me! Pick me! I can also provide business and personal referrals! b4f3a7fc@opayq.com

I could offer biz referal as well, feel free to contact me!

Please email me at rajeevvadgama@yahoo.com with the 30k business card referral link!

I have multiple referals available , contact me at lintinoelloco@yahoo.com, thanks

I have the personal already, but am looking for a Biz referral. Anyone willing to swap referrals – my personal for your biz? djbenjam at gmail

I’ve got plenty of referrals for the personal card. Feel free to contact me at adshap@gmail.com and I’d be happy to provide one.

Hi. I can give personal and business referrals as well! Feel free to email me your first and last name and email address for the referral. Also preference for personal or business card.

kevin.c.wung@gmail.com

Referrals still available for both Personal and Business, contact me at livinnj@yahoo.com with your full name and email address .

I can also refer personal and biz cards. Please email me ( raj49@hotmail.com) your First/Last name and email address. T

matt.kovner@gmail.com if you need either personal or biz referral. Thanks

I still have some personal and biz referrals available, feel free to email me at simon7821@gmail.com

Biz and personal available. Email mochada75@gmail.com.

I would love to send out referrals for the SPG Business or Personal Card 30k offer. Email me your first name, last name and email address to rajeevvadgama@yahoo.com

Offer expires at the end of June 2014. Thanks in advance!

I would like a business card. can someone refer me?