MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

This is the tenth post in a monthlong series that started here. Each post will take about two minutes to read and may include an action item that takes the reader another two minutes to complete. I am writing this for an audience of people who know nothing about frequent flyer miles, and my goal is that by the end, you know enough to fly for free anywhere you want to go.

The section of the beginners’ guide on earning miles is over, but before I turn to redeeming miles, I want to discuss something crucial that a lot of people muck up:

Don’t let your miles and points expire unused.

What’s the point of earning them if you don’t get to take that dream trip? Too many people have been turned off from the hobby because they let some miles expire and become too frustrated with the whole game to continue. Luckily it’s incredibly easy to keep all of your miles and points safe and ready for your next trip.

- When do miles and points expire?

- Will closing a credit card cost you the miles or points you earned?

- What is my set-it-and-forget-it trick to keep balances active?

- What service lets you know when your miles are about to expire?

Does Closing a Credit Card Cost Me the Miles I Earned?

Closing a credit card that is co-branded with an airline or hotel (such as The US Airways® Premier World MasterCard® or Citi® Hilton HHonors™ Reserve Card) will never, by itself, cause your miles or points to expire.

Co-branded credit cards deposit the miles you earn from signup bonuses and spending directly into the account you have with the airline or hotel, so they are no longer linked to the credit card.

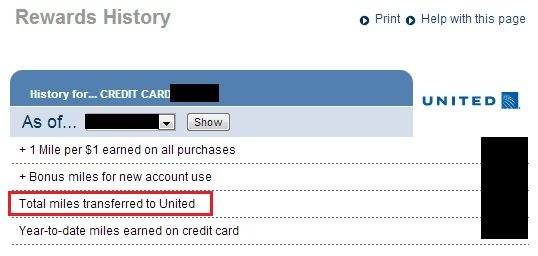

Chase.com even shows that miles earned with a Chase United MileagePlus Explorer card are “transferred to United.”

And you can confirm that by logging into my United account. When I cancelled that card, the miles were still safely in my United account.

What will cause my miles to expire?

What does cause miles to expire, however, is a lack of activity in the program account for a specified period of time.

- Delta miles do not expire.

- American Airlines, United Airlines, US Airways, and Hawaiian Airlines’ miles expire after 18 consecutive months of account inactivity

- British Airways Avios expire after 36 consecutive months of account inactivity.

The danger of mile expiration does often come when you cancel a credit card. If I cancel my Citi AAdvantage card, I am no longer earning American Airlines miles on purchases. I have to make sure that there is some sort of activity–either earning or redeeming–in my AAdvantage account within the next 18 months, or I will lose all my miles.

What about my bank points?

All that was about frequent flyer miles and hotel points. Bank points are quite different.

Closing a credit card that earns bank points can cost you all of the points in the account. These cards hold the points that you earn in the credit card account–for example, the Arrival miles that you earn using your Barclaycard Arrival PlusTM World Elite MasterCard® are held in your Barclaycard account. If you were to simply cancel this card, you would lose all the points you worked to accumulate. You would want to redeem your Arrival miles before canceling the card.

Luckily, transferable bank points are even easier to “redeem” before canceling a card. In order to avoid losing transferable points when you cancel a card, transfer them to an airline whose miles you’re likely to want in the near future.

For instance, if I were about to cancel my Citi ThankYou® Premier Rewards Card, I would transfer my ThankYou Points to Singapore miles beforehand. (ThankYou Points just became transferable this week, and the transfer to Singapore takes about 36 hours.)

For more information on expiration and other ways to keep your points and miles from expiring, see The Complete Guide to Miles and Points Expiration.

Dining Programs & Other Ways to Keep Miles Active

My favorite way to keep balances active is with dining programs.

Normally the miles I earn from dining programs are really small, like 30 miles from a single dine, but even earning 30 miles is enough to reset that clock on miles expiration.

For full details on dining programs, see “Why Dining Programs Can Be Worth Big Miles.”

A few other ways to keep miles active in a pinch.

- Purchase miles: Purchasing miles is normally a bad idea, as you end up paying more than the value of the mile. However, if you need to keep a big balance active, you can purchase a small number of miles in the program you need to keep active. Hawaiian Airlines charges $14.78 for 500 miles. United charges $35 + 7.5% tax for 1,000 miles. Google “purchase [airline] miles” to quickly be taken to any airline’s mile purchase page.

- Donate miles: All the major carriers allow you to donate miles to non-profits such as the Make-A-Wish Foundation, Operation Hero, UNICEF, and various other charities. While this is best done out of the goodness of your heart, a donation of miles will also keep your account active. Scott has a post on where you can donate miles here.

- Preservation fee: US Airways allows you to pay a $9 preservation fee after 15-17 months of account inactivity. This extends the life of your miles for another 18 months.

Award Wallet

Award Wallet tells me the expiration date for all my miles, allowing me to ensure some activity to keep them active when necessary. The free version of Award Wallet only gives the expiration date for three accounts. Here’s more information on Award Wallet.

Award Wallet Plus gives the expiration date for all accounts. Here are 10 free upgrade codes to Award Wallet Plus:

Invite-55486-PZPCL – use coupon

Invite-55486-NYOJV – use coupon

Invite-55486-FYWHV – use coupon

Invite-55486-QBPKJ – use coupon

Invite-55486-XFDWK – use coupon

Invite-55486-MBPOW – use coupon

Invite-55486-USHQB – use coupon

Invite-55486-YPYXK – use coupon

Invite-55486-JQEAZ – use coupon

Invite-55486-RNHVJ – use coupon

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

Used 1st one. Thanks!

[…] The miles will only eventually expire if there is 18 months of inactivity in the frequent flyer account. Generating activity to restart the 18 month clock is very easy. […]

[…] Other than bonuses, the best use of dining programs is to cheaply keep miles active, so they don’t expire. […]