MileValue is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or are no longer be available. You can view current offers here.

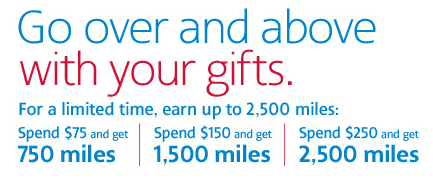

American Airlines is offering 2,500 bonus AAdvantage miles if you spend $250 or more in its online portal between now and December 2, 2013.

- Spend $75 to $149 and get 750 miles

- Spend $150 to $249 and get 1,500 miles

- Spend $250 or more and get 2,500 miles

All spending from all stores in the portal before December 2, 2013 will be added up to determine your bonus amount.

If you can spend just over $75, $150, or $250, you will earn at least 12x miles per dollar on every purchase because you’d get 10x through this bonus, at least 1x for the normal portal payout, and 1x on your card.

I would consider a 12 American-Airlines-mile-per-dollar to be a 21.2% rebate, so there should be a lot of things worth buying with that rebate.

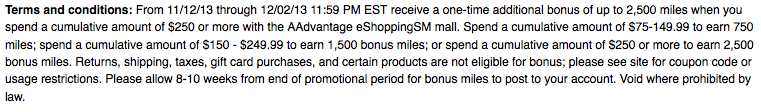

Terms and Conditions:

Just getting started in the world of points and miles? The Chase Sapphire Preferred is the best card for you to start with.

With a bonus of 60,000 points after $4,000 spend in the first 3 months, 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editorial Disclaimer: The editorial content is not provided or commissioned by the credit card issuers. Opinions expressed here are the author’s alone, not those of the credit card issuers, and have not been reviewed, approved or otherwise endorsed by the credit card issuers.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all questions are answered.

One-time additional bonus. Boo.

But I’ll take it.

Walgreens=15X in Aadvantage Portal. Wow!

[…] At Least 12x Miles Per Dollar on Every Store in the AAdvantage eShopping Mall until December 2, 2013 […]

Just FYI, mileage plus and Delta are also offering similar offers and they have higher purchase limits (as opposed to one time like AA).

Terms and Conditions says gift card purchases through the portal aren’t eligible. Any idea if they can accurately tell?

Very misleading title. Boo !

@Jordan: Not sure, hopefully not. I just purchased $ 300 in gift cards at Walgreens. Will update if the bonus post =D

@Jordan, I bought a $250 gift card from Best Buy with my AmEx that had an offer of $25 off $250 or more. Miles have posted to my aadvantage shopping account.

[…] with the ongoing promotion that is awarding up to 2,500 miles for $250 in purchases through the portal (and fewer bonus miles for smaller purchases), you can buy up to 17,500 American […]

Its been more than a month and my miles still has not posted for purchasing from Walgreens.com